Comex copper price paused on the losses recorded late last week as the bulls successfully defend the crucial resistance-turned-support level of $5.85. At the time of writing, the asset was trading at $5.90.

A weaker US dollar and supply concerns continue to support the red metal. However, the short-term demand outlook remains foggy as China grapples with the years-long property market crisis.

Copper price bounces off crucial support level

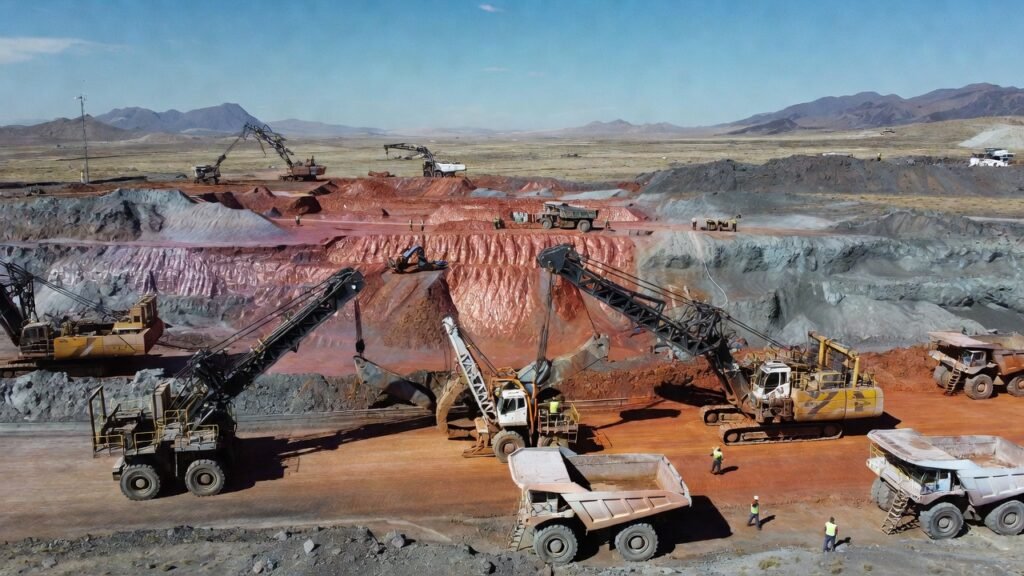

Copper is used in almost every electrified item. From electric vehicles to mobile phones and power grids, the red metal is one of the crucial metals. Notably, the world has heightened its efforts on decarbonization, urbanization, and modernization. These goals, coupled with the artificial intelligence boom, have strengthened copper’s long-term demand outlook.

For instance, Goldman Sachs has raised its copper price forecast for 2026 from an average of $10,650 a tonne to $11,400. This revision is founded on the ongoing supply tightness amid uncertainties over copper tariffs and subsequent stockpiling. Besides, the Bank of America cites the bullish long-term demand outlook and supply squeeze as the factors that have informed its prediction of $11,313 a tonne in 2026 and $13,501 in 2027.

Nonetheless, copper’s near-term outlook remains clouded by some uncertainties on the demand front. In fact, Goldman Sachs has indicated that the recent rallying may have played out and a significant decline lies ahead.

To begin with, China is the leading importer and consumer of the red metal. As such, the economic weakness in the Asian country continues to weigh on the asset. Its property market, which is one of China’s largest consumers of copper, continues to struggle. Official data released on Monday showed that home prices in the Asian country dropped in December.

With these persistent struggles, market participants are increasingly calling for major stimulus from the government. Before that, the real estate crisis will likely continue to weigh on the copper demand outlook. However, these woes have been eased by the latest data that shows China’s economic growth met the government’s target as its GDP rose by 5% in 2025.

In the ensuing sessions, a weaker US dollar and concerns over Trump’s tariffs on Greenland. Besides, copper price is set to move in tandem with precious metals, which continue to record stellar performance.

Comex copper technical analysis

After a weekly loss in the just-concluded week, the bulls are keen on defending the crucial support level of $5.85 per pound. Last week, it pulled back from the record high hit on 14th January at $6.15. Nonetheless, it continues to trade above the short-term 25-day EMA; an indication of further gains in the ensuing sessions.

A look at its daily chart highlights possible horizontal trading at an RSI of 57. More specifically, the Comex copper price may successfully bounce off the current support level of $5.85 with the possible gains being curbed along the resistance level of $6.10.

On the flip side, the asset may hold steady above the 25-day EMA at $5.75. This is as the months-long trendline that has shaped its price movements since July 2025 remains in place. Indeed, it has supported copper price since late December when it rose above it. A move below that trendline and past the short-term MA will invalidate this thesis.