The CME Comex is the Exchange where futures are traded for gold, silver, and other commodities. The CME also allows futures buyers to turn their contracts into physical metal through delivery. You can find more detail on the CME here (e.g., vault types, major/minor months, delivery explanation, historical data, etc.).

The data below looks at contract delivery where the ownership of physical metal changes hands within CME vaults. It also shows data that details the movement of metal in and out of CME vaults. It is very possible that if there is a run on the dollar, and a flight into gold, this is the data that will show early warning signs.

Gold

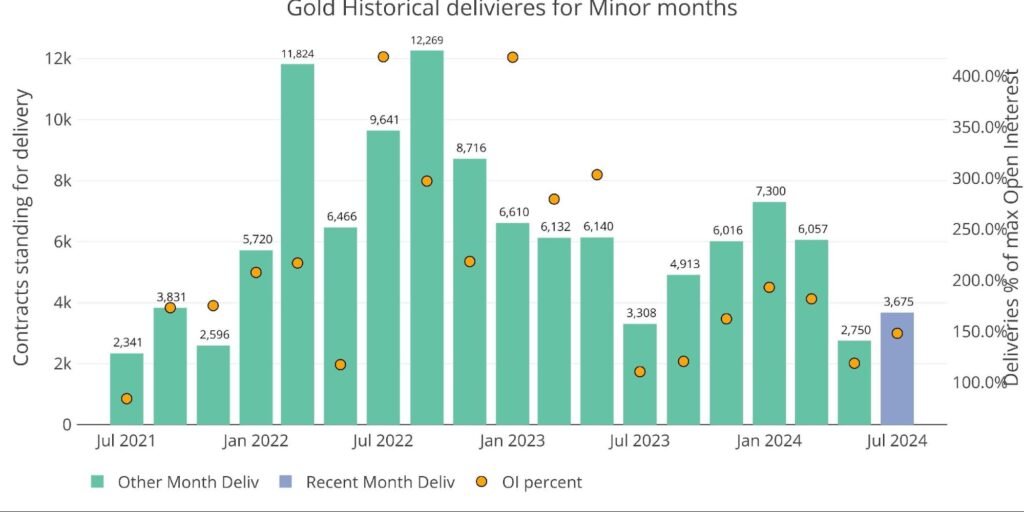

July is a minor delivery month for gold. This July saw stronger delivery volume than the last minor month in May, but was below trend when considering the last 12-18 months.

Figure: 1 Recent like-month delivery volume

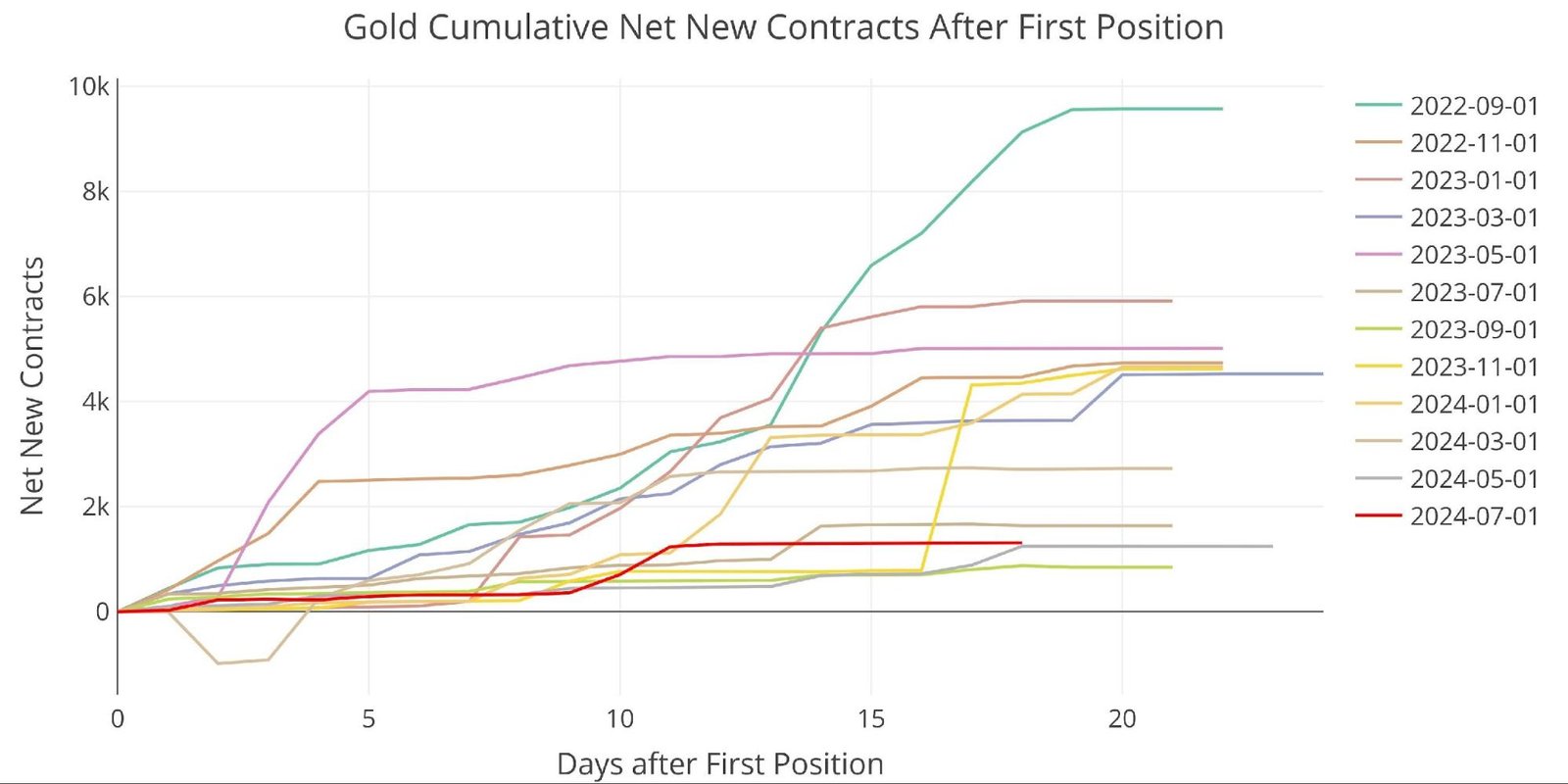

A big driver of the lower delivery volume is the lack of net new contracts standing for immediate delivery. This can be seen below. July has been one of the weakest months in recent history.

Figure: 2 Cumulative Net New Contracts

Looking at inventory levels shows a jump in Registered that showed up yesterday. This is possibly in anticipation of the August delivery that starts next week. August is a major month in gold and should see heightened delivery volume.

Figure: 3 Inventory Data

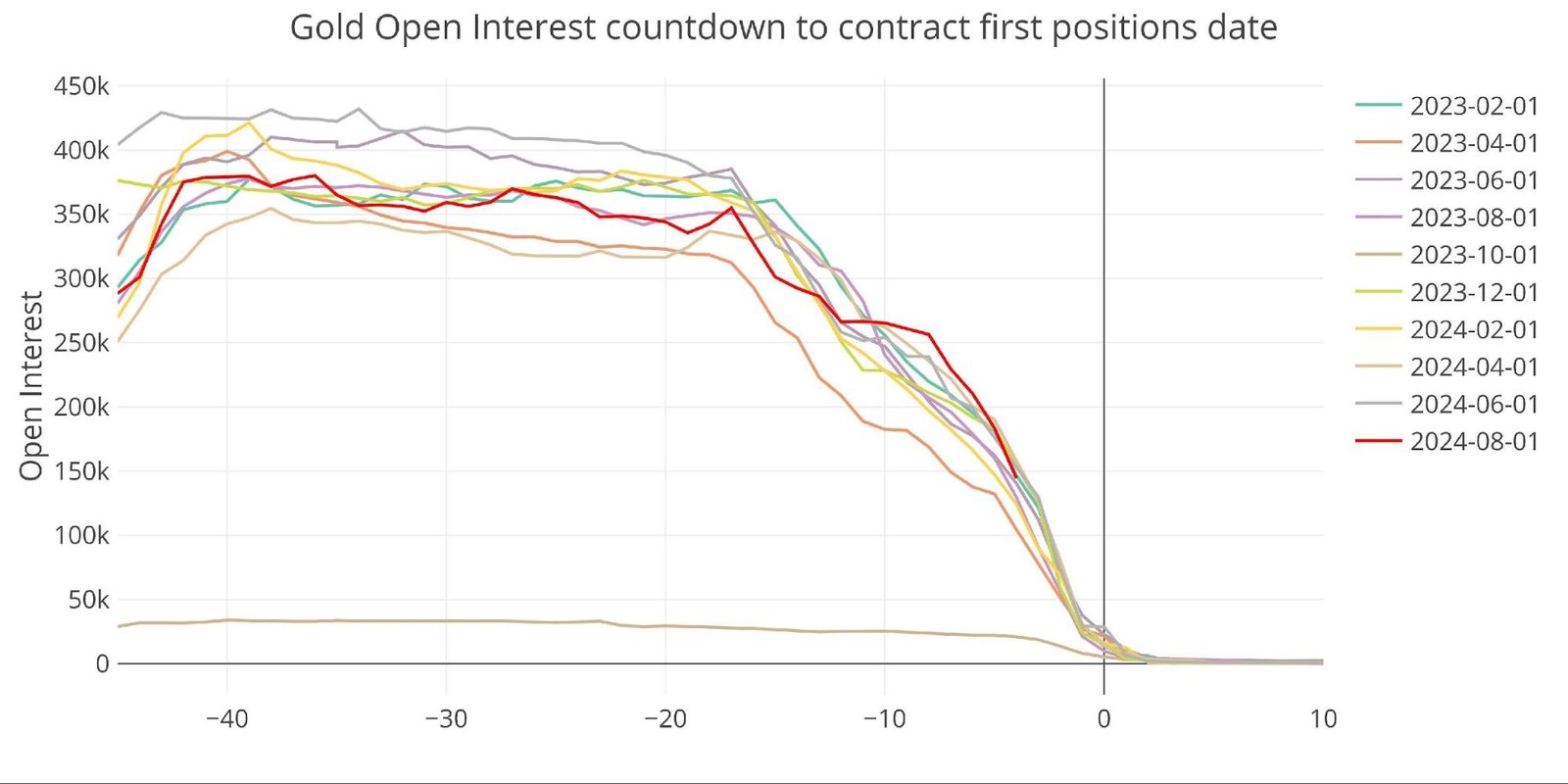

Heading into the delivery period, open interest has started to dip and took a big move down yesterday in the broader market sell-off.

Figure: 4 Open Interest Countdown

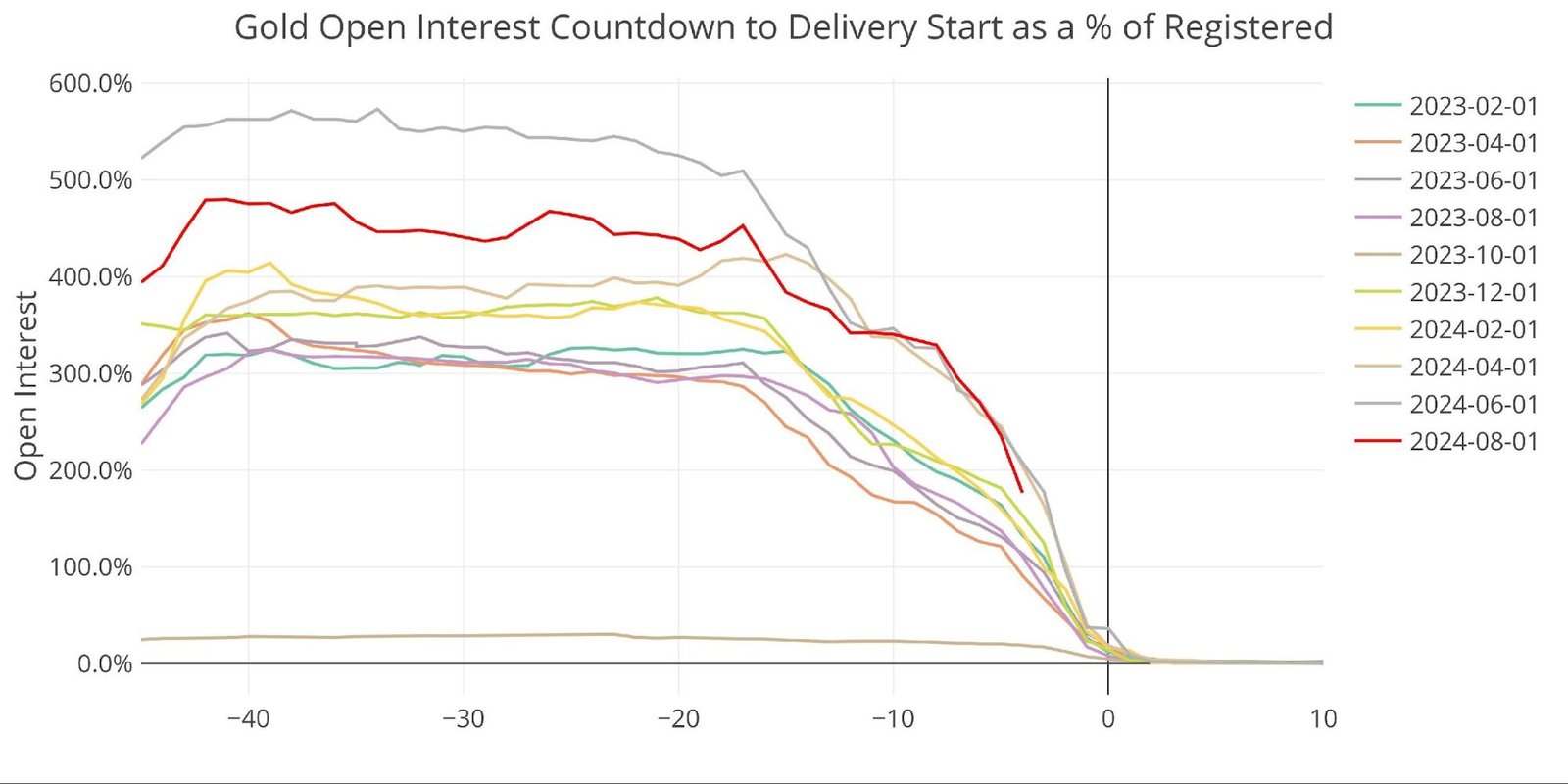

Regardless, on a relative basis, open interest is above trend representing 176% of available Registered inventory with 4 days to go until the delivery cycle starts.

Figure: 5 Open Interest Countdown Percent

Silver

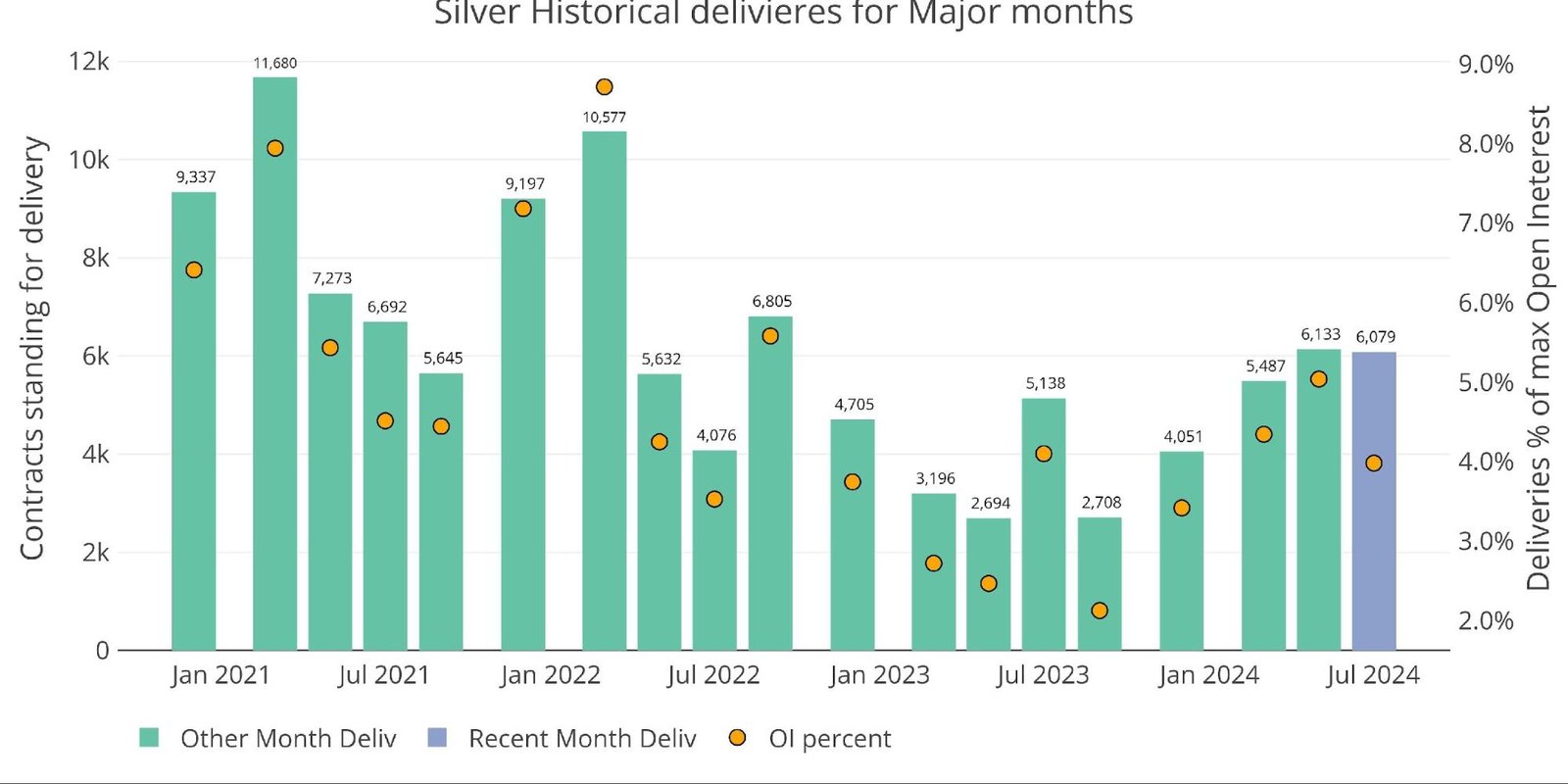

July is a major delivery month for silver. May was the strongest delivery month since September 2022 and July seems to be coming in just under the total delivery for May.

Figure: 6 Recent like-month delivery volume

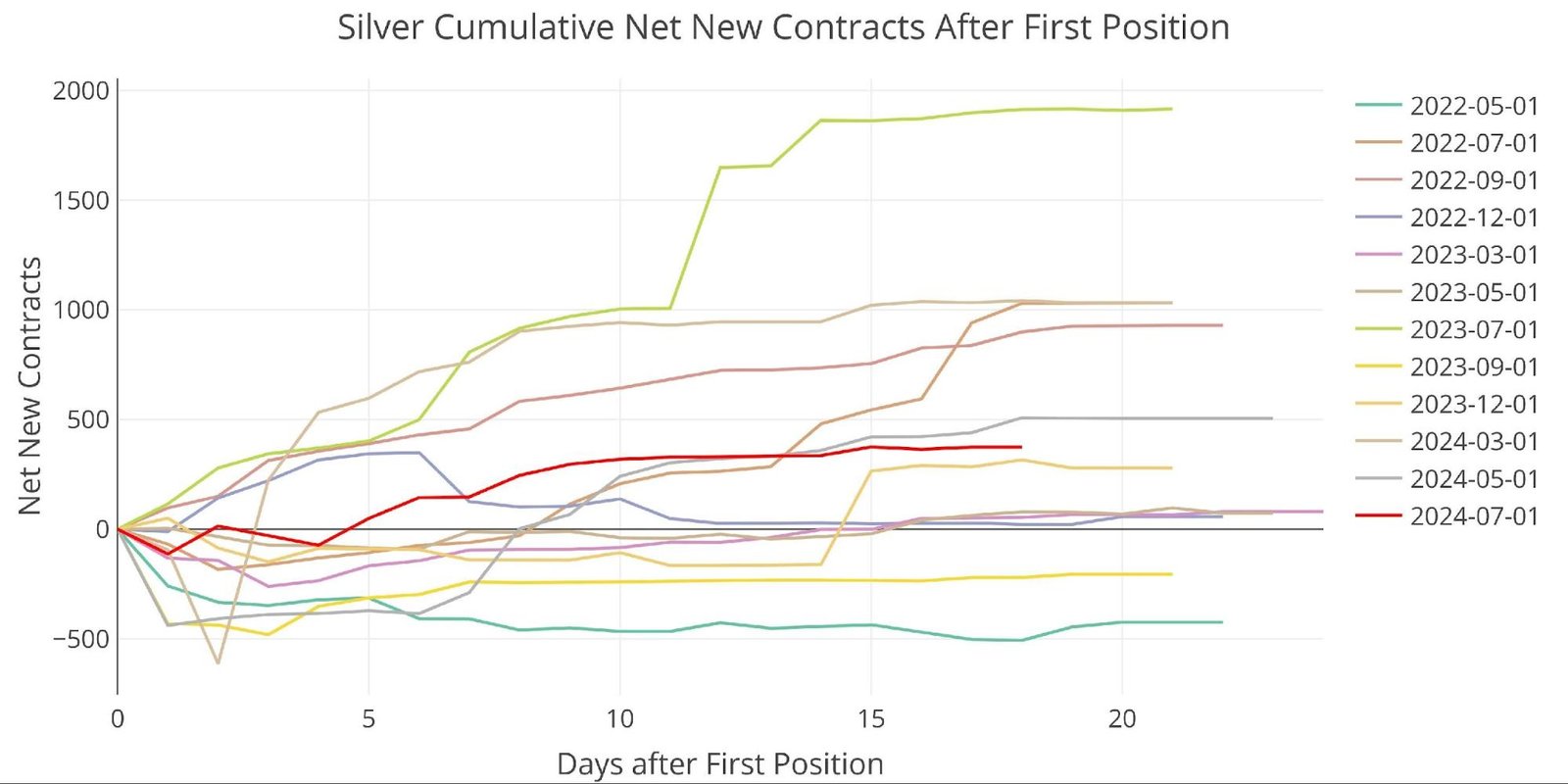

Similar to gold, silver was not helped much by net new contracts opening for delivery.

Figure: 7 Cumulative Net New Contracts

Registered and Eligible have been plotted separately to make the charts more readable. Eligible took a dive in June followed by a quick recovery. This was most likely a move to provide sufficient inventory for the July delivery and the metal was consequently moved back into Eligible after the initial deliveries were completed.

Figure: 8 Inventory Data

Registered shows the inverse. Seeing a large inflow followed by outflows. The amount of silver in Registered has moved up since bottoming last year. Most likely, actual silver supply available for delivery had reached near zero and so the CME brought metal in to backstop the market.

Figure: 9 Inventory Data

As we approach the delivery period for August, you can see that the silver contract is drifting lower as we close out the month. This is most likely part of the massive fall in the silver price after it breached the $32 level and saw a severe correction.

Figure: 10 Open Interest Countdown

On a relative basis, open interest is below the recent trend. This is due to both the drop in open interest as well as the increase in Registered metal.

Figure: 11 Open Interest Countdown Percent

Conclusion

The physical market had been stressed last month and that likely helped drive prices higher. The CME has had time to back-fill physical metal inventories and also encourage lower delivery volume. The August gold contract will be a good one to follow to see if there is waning demand in physical or if the futures traders are really after something more than just paper gains.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!