Stock image.

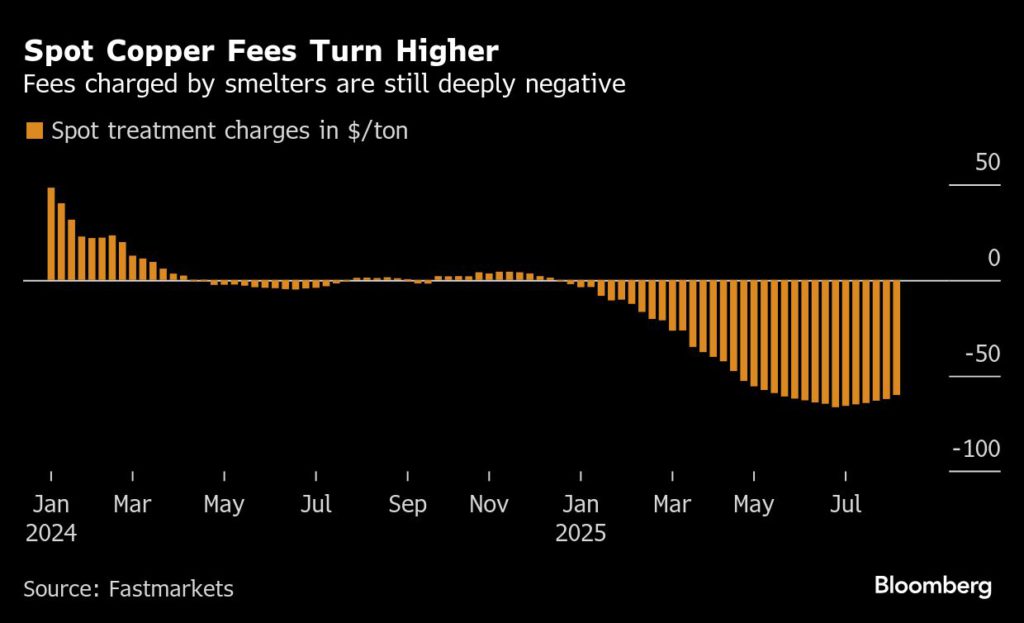

Chinese copper smelters are getting short-term relief from higher fees, although the improvement in profitability may not be enough to entice them into lifting production.

While spot treatment charges to turn concentrate into refined metal are still deeply negative, they’ve ticked higher over the past six weeks. That’s largely due to a surge in discounted Indonesian supplies, freeing up more cargoes for delivery to China, where over half the world’s smelting capacity is located.

Freeport-McMoRan Inc. is selling unexpectedly large volumes of ore following an outage at its Indonesian smelter. The company is looking to ship cargoes quickly under a short-term export license that expires in mid-September. That’s helped to loosen supply and make processing in China more profitable.

Treatment charges account for about one-third of a smelter’s income. Margins at Chinese plants are also getting a fillip from the price of sulfuric acid, a smelting byproduct sold to the chemicals industry, which has risen to a three-year high. In sum, smelters could now be turning a small profit, said Li Chengbin, an analyst with Mysteel Global.

China’s monthly output of refined copper has set a succession of records this year, topping 1.3 million tons for the first time in June. But that level is viewed by many as unsustainable given all the margin pressures faced by smelters and the government’s campaign against overcapacity across industries.

Moreover, the increased availability of Freeport’s ore comes with a time limit. The problem remains that Chinese smelters still aren’t making enough money to plan on boosting production, said Li.

Ultimately, there’s still too much capacity and insufficient concentrate to go around, and seasonal maintenance schedules should still reduce output in September and October, he said.

Read More: Chinese copper maker an unlikely winner from Trump’s tariffs