Stock image.

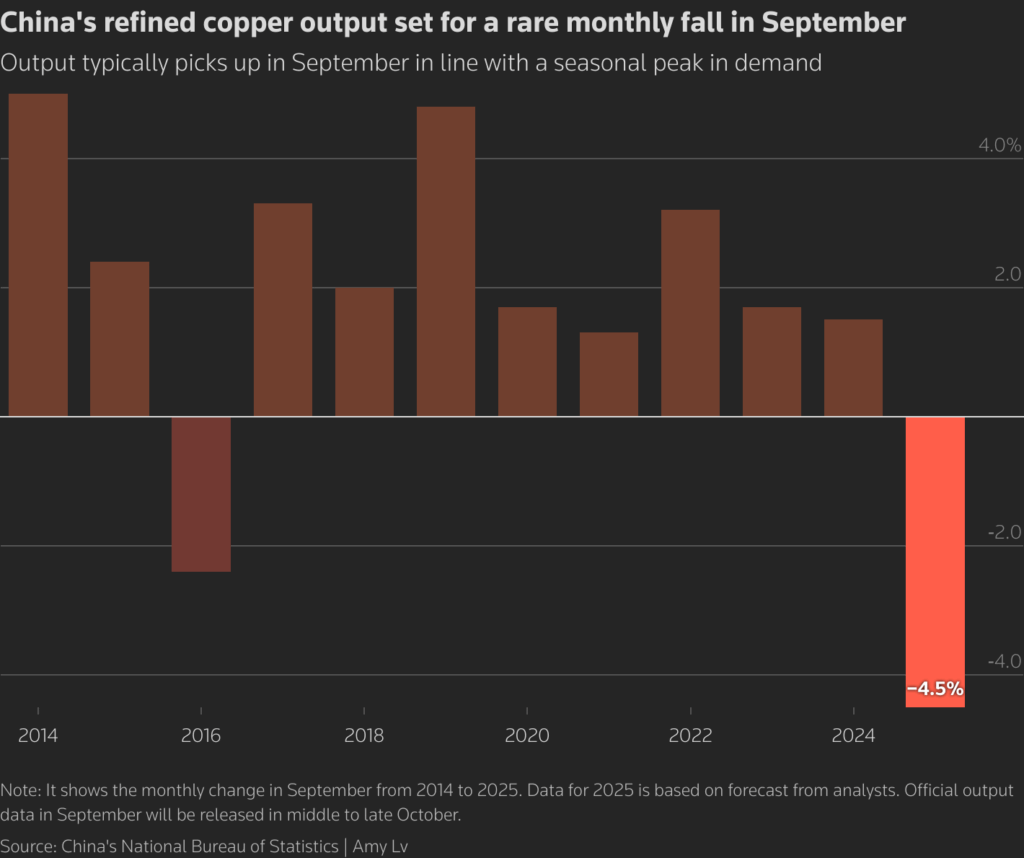

China’s refined copper production in September is forecast for a rare fall, the first for the period since 2016, analysts say, as newly introduced tax regulations constrain the supply of scrap copper.

September output from the world’s largest producer and consumer of refined copper is expected to drop by 4%-5% from August’s level, according to research agencies Shanghai Metals Market (SMM), Mysteel, and Benchmark Minerals Intelligence (BMI).

That, coupled with expectations for a U.S. Federal Reserve interest rate cut, could support copper prices, said analysts.

The decline comes during what is typically a seasonal peak in demand, as the new tax rules make smelting copper scrap into anodes less profitable, analysts noted. Anodes are a key input for processors producing refined copper, which is widely used in construction, power infrastructure, and manufacturing.

At the same time, the number of smelters, which produce anodes, shut for maintenance will grow to five in September from three a month earlier, SMM data showed, adding to the decline in output, they added.

“In the past, when smelters implemented maintenance, refiners could source some anode copper to sustain production. But right now, supply of anode copper is also tight, capping refined output,” said Yongcheng Zhao, a principal analyst at BMI.

The operating rate among smelters fed by scrap copper or anode copper is forecast to fall by 8.3 percentage points month-on-month to 59.9% in September, according to SMM.

To the degree equipment maintenance reduces consumption of copper concentrate, a key input for smelters, it could help stem spot processing fees from more dramatic falls, according to two analysts who spoke on condition of anonymity as they are not authorised to speak to media.

That could give Chinese smelters some leverage when they meet with miners in November to negotiate the contract prices for the following year, they added.

Processing fees, a vital source of revenue for smelters paid by miners to process concentrate into the metal form, have slipped into negative territory since last December due to a shortage of mined material.

New smelting capacity coming online worldwide and slower-than-expected mined supply growth have led to an acute and persistent concentrate shortage, forcing some smelters outside China to pause operations.

The dip in September output, which analysts expect to continue into October, is unlikely to derail annual output from hitting a record this year.

(Reporting by Amy Lv and Lewis Jackson, Editing by Louise Heavens)