Sponsored content

Matthew Boxall of Team Asset Management offers this week’s market review

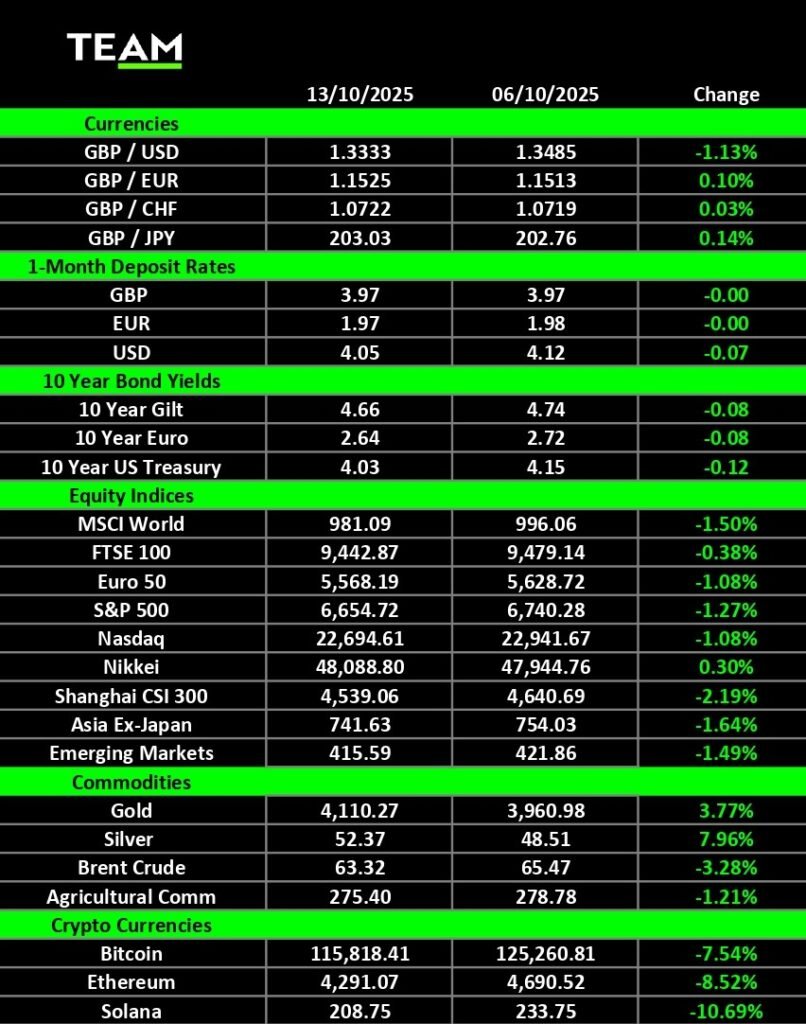

GLOBAL markets endured a turbulent week as political instability and trade tensions rattled investor sentiment. The S&P 500 fell sharply on Friday before a rebound on Monday, while the Nasdaq and Japan’s Nikkei also struggled to absorb the week’s events.

In Europe, French President Emmanuel Macron reappointed Sébastien Lecornu as Prime Minister, just days after accepting his resignation following the collapse of his short-lived government. The move capped a chaotic week in Paris marked by Lecornu’s controversial cabinet, internal revolt and a failed search for his successor.

Reappointed with a mandate to “end the political crisis”, Lecornu pledged to restore stability and allow greater parliamentary debate, marking a shift from Macron’s prior use of executive powers.

Lecornu’s first task is to present a draft budget to parliament before facing a no-confidence vote later in the week where he will need the support from the Socialist Party to survive.

The Socialists have demanded a new wealth tax, smaller spending cuts and a reversal of Macron’s 2023 law which raises the retirement age from 62 to 64. The political turmoil, and failure to agree a budget to reduce the government’s annual deficit, has pushed France’s borrowing costs above Greece and Italy in the bond markets.

Across Asia, Japan’s ruling coalition collapsed after junior partner Komeito withdrew from its 25-year alliance with the Liberal Democratic Party. The split derailed LDP leader Sanae Takaichi’s path to becoming Japan’s first female prime minister, stripping her of a parliamentary majority.

Komeito leader Tetsuo Saito said the decision followed the LDP’s mishandling of a long-running political slush fund scandal, calling further co-operation “utterly impossible”. The fallout comes just weeks ahead of key diplomatic meetings and a planned visit from US President Donald Trump, raising concerns over Japan’s stability.

Markets reacted swiftly with the Nikkei falling -1% and the yen strengthening as investors sought safety. Business leaders called the rupture “truly regrettable”, warning that political instability threatens Japan’s fragile economic recovery.

In the US, a steady week turned volatile on Friday after President Trump, infuriated by China’s decision to impose strict export controls on critical rare earth minerals, threatened 100% tariffs on Chinese imports in retaliation, starting on 1 November. The social-media post sparked a sharp sell-off, with the S&P 500 and Nasdaq posting their worst day since April, and the Dow seeing its steepest drop since May.

China responded swiftly, threatening countermeasures while insisting it “does not want a tariff war but is not afraid of one”. Over the weekend, Trump softened his tone, calling President Xi Jinping “a great leader” and assuring reporters “it will all be fine”.

The shift buoyed sentiment, and US markets rebounded on Monday as investors bet that the “TACO” (Trump Always Chickens Out) rhetoric would repeat before the November deadline.

Amid the turmoil, gold climbed to an all-time high of $4,075 per ounce, bolstered by political uncertainty and a US government shutdown that has frozen key economic data releases.

The metal’s rally reflects not only fear-driven flows but also expectations of continued US rate cuts, which weaken the dollar and reduce the opportunity cost of holding gold. Exchange Trade Fund inflows have surged as retail investors, institutions and central banks, particularly China, increase allocations, underscoring a broader de-dollarisation trend.

Silver also soared above $50 per ounce, marking its eighth consecutive weekly gain. Up more than 70% this year, silver’s rally has been fuelled by safe-haven demand, rising fiscal concerns and persistent supply shortages. With industrial demand high, the metal is set for a fifth straight annual deficit in 2025. The gold-silver ratio has fallen below 80, down from 104 in April, signalling silver’s relative strength, though still far above its historic 15:1 average, highlighting its long-term undervaluation.

While precious metals shone, digital gold suffered. The cryptocurrency market endured its largest-ever liquidation event, with around $19 billion in leveraged positions wiped out across futures and perpetual swaps. Nearly 90% of liquidations were long positions, led by Bitcoin ($5bn), Ethereum ($4bn), and Solana ($1.8bn).

The selloff was triggered in the wake of Friday’s tariff shock, as crypto became the only open market for risk repricing over the weekend.

Thin liquidity, automated margin calls and exchange outages magnified the volatility, with trading volumes soaring 140% to $180 billion. Funding rates flipped negative, signalling a sharp reset and exposing the fragility of crypto’s trading infrastructure under stress.

Looking ahead, the global data calendar remains light. In the UK, unemployment is expected to hold steady at 4.7%, while Federal Reserve chair Jerome Powell is set to speak on Tuesday, offering insight into policy direction ahead of the next FOMC meeting. On the corporate front, earnings season begins in earnest with results due from JPMorgan, Goldman Sachs, Bank of America, American Express and Johnson & Johnson, a timely test of market resilience after a week defined by politics, panic and precious metals.