-

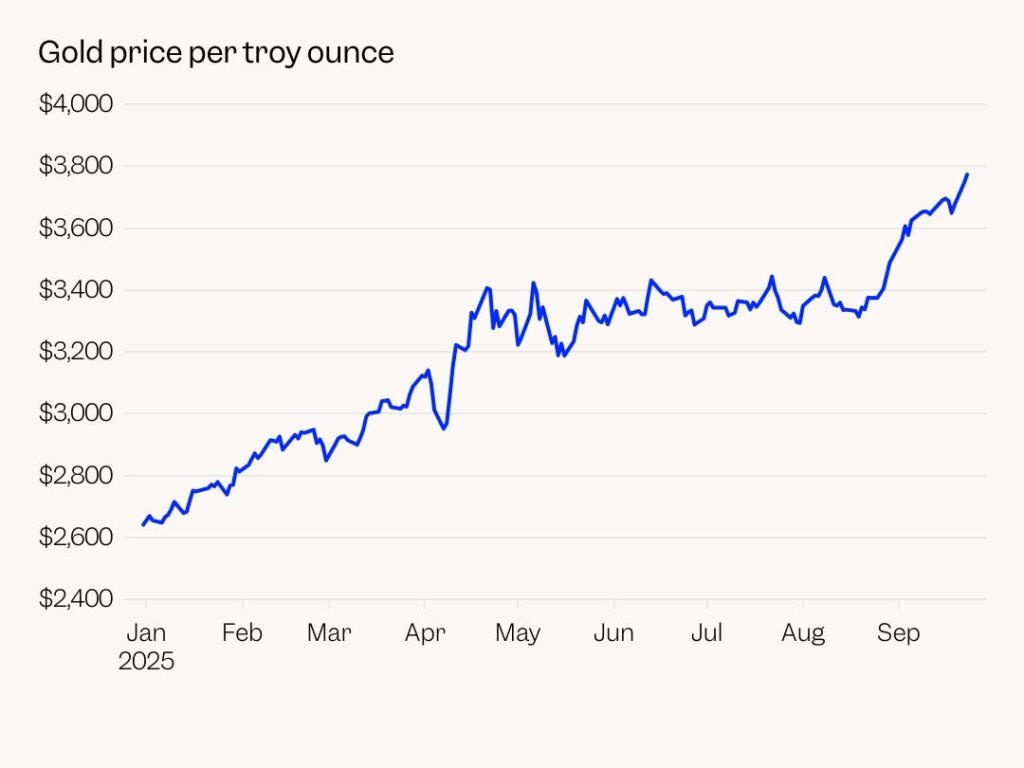

Record-setting gold is having its best year since the 1970s.

-

Returns have ramped up in recent weeks as the Fed has started a new rate-cutting cycle.

-

A new catalyst entered the fray on Tuesday, with China reportedly interested in being a gold custodian.

In case you’ve missed it, there’s been a bit of a gold rush going on.

The price of the precious metal is on a seemingly unstoppable ascent to record after record, including its latest on Tuesday.

There’s interest from the Wall Street elite, such as billionaire Ray Dalio, who thinks 15% of your portfolio should be in the precious metal. But the rally has also captured the attention of everyday shoppers. Just ask Costco, which currently counts gold bars as a top-selling item online.

No matter how you slice it, gold is having a moment, but it didn’t happen overnight.

It’s been propelled higher by a mix of three main macro drivers, two of which have been simmering for months, and one that just presented itself this week.

These are detailed below, in reverse chronological order:

A new report from Bloomberg on Tuesday said that China is trying to become a custodian of foreign sovereign gold reserves. In other words, it wants to store the bullion bought by other countries. The report said that the plan had attracted interest from at least one Southeast Asian country.

The move is bullish for the price of gold in two ways. First, it incentivizes more people — in this case, governments — to buy the metal. Second, by making it a national financial priority, China is establishing itself as yet another major player in a system designed to do one thing: keep buying and holding gold.

Given the Federal Reserve’s decision to lower interest rates by 25 basis points at its September meeting, this can be considered the second-most-recent bullish driver for gold.

It’s also important to note that the mere prospect of rate cuts was also responsible for gains throughout 2025, before Jerome Powell finally pulled the trigger.

The technical reason for this is straightforward: if the Fed is going to cut rates and keep doing so, bond yields will fall alongside them, making bonds less attractive compared to non-interest-beating assets like gold.

In addition, lower rates boost the outlook for higher inflation, which gold is meant to hedge against in investor portfolios.

This catalyst points to gold’s core function throughout history: a haven asset that investors turn to for safety and stability.