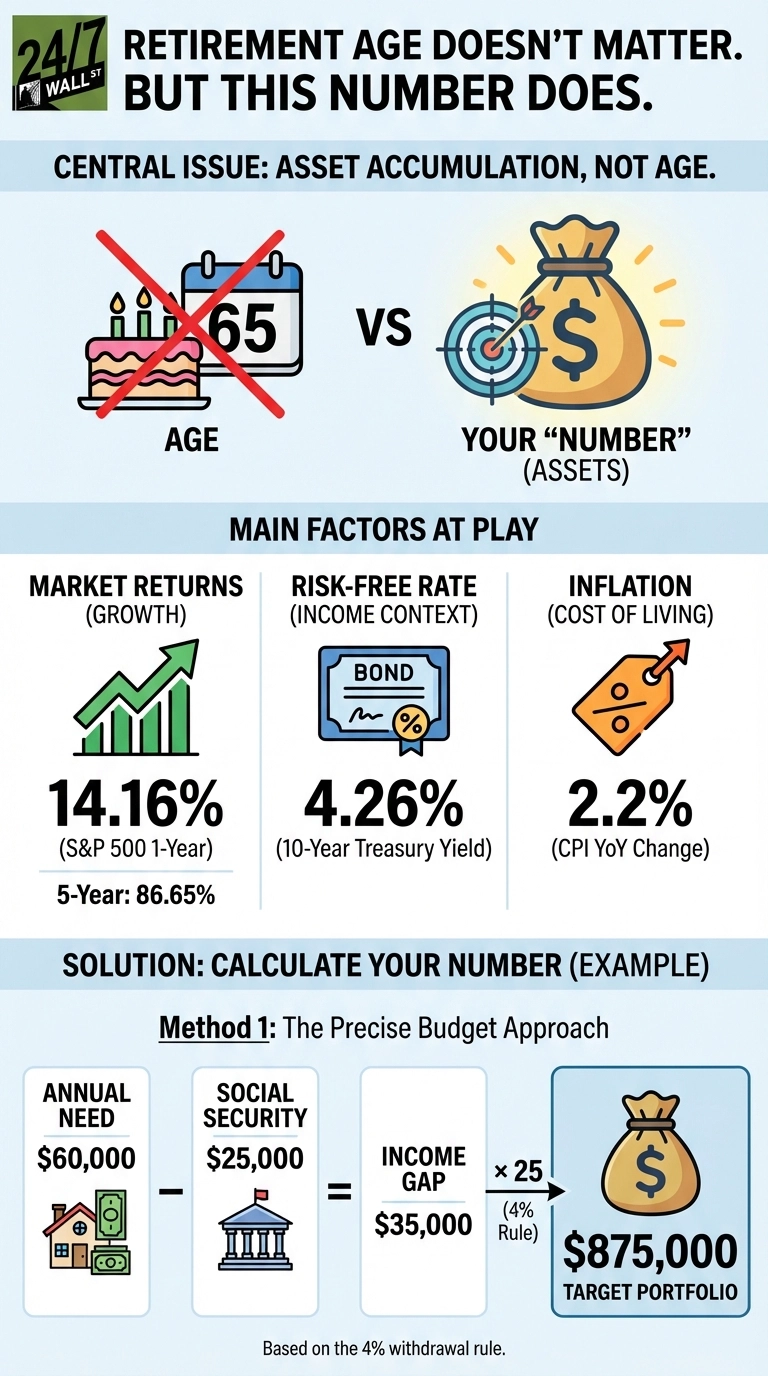

If you have a target retirement age circled on your calendar, you might be planning around the wrong metric. According to finance expert Dave Ramsey, retirement readiness isn’t determined by hitting 60, 65, or any other birthday milestone. What matters is whether you have accumulated enough invested assets to generate the income you need for the rest of your life.

The critical question isn’t “Am I old enough to retire?” but rather “Do I have enough money to retire?” Your investment account balance, not your age, determines when you can afford to stop working. Here’s how to calculate your personal financial number.

Three Methods to Calculate Your Retirement Number

Method 1: The Precise Budget Approach

This method delivers the most accurate result but requires detailed planning. Start by estimating your annual retirement spending. Then subtract guaranteed income sources like Social Security.

For example, if you need $60,000 annually and expect $25,000 from Social Security, your portfolio must generate $35,000 per year. Using the 4% rule (a widely accepted guideline suggesting you can withdraw 4% of your portfolio in year one, then adjust for inflation annually), multiply your income gap by 25. In this case: $35,000 × 25 = $875,000 needed.

The 4% rule exists because historical market data shows this withdrawal rate has historically sustained portfolios through 30-year retirement periods. With the S&P 500 returning 14.16% over the past year and 86.65% over five years, equity exposure remains crucial for long-term growth, even as 10-year Treasury yields at 4.26% provide meaningful income from bonds.

Method 2: Income Replacement Ratio

If you’re years away from retirement and can’t predict exact expenses, assume you’ll need 70% to 90% of your pre-retirement income. Someone earning $50,000 who wants to replace 90% would need $45,000 annually. After subtracting Social Security, multiply the remaining gap by 25 to find your target nest egg.

Method 3: The 10x Rule

The simplest approach: multiply your final working salary by 10. Earning $100,000 when you retire means targeting a $1 million portfolio. While less precise than budget-based calculations, this rule of thumb provides a quick benchmark for younger savers.

Which Method Should You Use?

Your life stage determines the best approach. Those within five years of retirement should use Method 1 for precision. Mid-career professionals can rely on the income replacement ratio, while younger workers might start with the 10x rule and refine their target as retirement approaches.

Ramsey’s core insight stands: age is irrelevant if you lack sufficient assets. A 55-year-old with $1.5 million invested is more retirement-ready than a 67-year-old with $200,000. The number in your investment accounts, not the number of candles on your birthday cake, determines when you can afford to stop working. If you haven’t hit your target, the answer isn’t to retire anyway but to keep building your nest egg until the math works in your favor.