The move is aimed at encouraging large cities to tap capital markets rather than relying largely on grants or bank borrowings, while sustaining momentum among smaller urban local bodies.

For municipal bond issuances above Rs.1,000 crore, the Rs.100 crore incentive acts as a quasi-grant, lowering the effective cost of capital and making large infrastructure projects financially viable.

Fledgling market

Municipal bonds are debt instruments issued by local bodies such as municipal corporations to raise funds for public infrastructure projects, including roads, water supply, sanitation, and urban development. They offer investors relatively stable returns backed by the revenue streams of the issuing city.

India’s municipal bond market is finally showing signs of life after years of remaining on the fringes of the country’s debt ecosystem. In the 2026 financial year, urban local bodies (ULBs) have come to the bond market with increased frequency.

According to data from the Securities and Exchange Board of India (Sebi), nine municipal bond issuances were completed by December, a sharp rise from three in the previous year and just two the year before.

“India’s bond markets saw broadening demand in 2025 beyond institutions to retail investors. While private placements and AAA-rated issuances continue to reflect institutional strength, retail participation in municipal bonds is meaningfully accelerating,” said Priyashis Das, Chief Executive Officer, Altifi by Northern Arc.

However, experts cautioned that retail participation, while improving, remains modest.

Also read: Come clean or face the heat: 5 Budget 2026 signals for taxpayers

Attractive yields

Returns have been a major draw. Municipal bonds typically offer yields comparable to high-quality corporate bonds and slightly higher than state development loans (SDLs). Das said certain AA-rated municipal bonds offer additional spread, compensating investors for liquidity and credit considerations.

Aditi Mittal, Co-founder of IndiaBonds. com and Director at AK Group, estimates that municipal bonds currently offer a 75–100 basis-point yield premium over AAA-rated public-sector or corporate bonds. “Even at yields of around 8-8.5%, demand remains robust,” she says, noting that issues tend to get fully subscribed quickly.

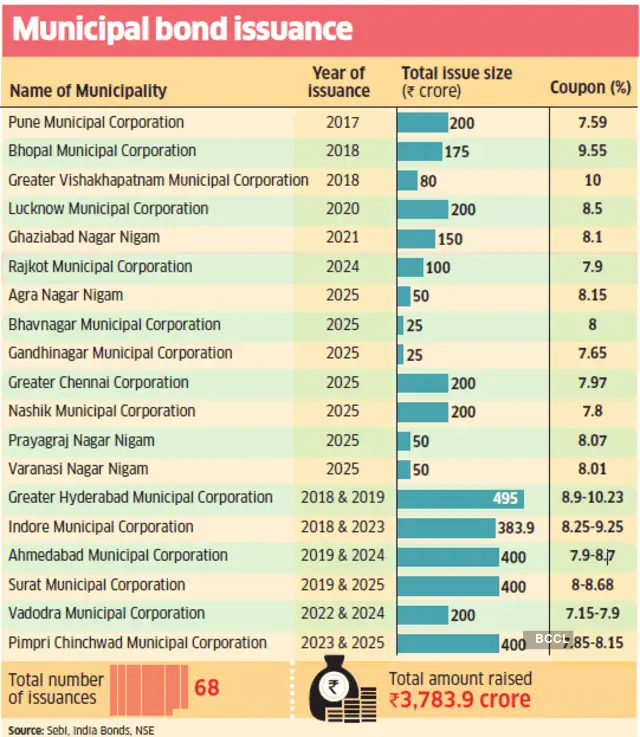

Municipal bond issuance

Structural challenges

One key constraint has been the way bonds are issued. Most municipal bonds have been raised through private placements, which largely exclude retail investors. “Surat Municipal Corporation was issued through a public issue, and the retail participation was oversubscribed by more than three times,” says Deepak Panjwani, Vice President at GEPL Capital, underscoring the latent demand that can surface when bonds are openly offered.

High face values have also been a deterrent. Many municipal bonds are issued with denominations of Rs.1 lakh or even Rs.10 lakh, far above what most retail investors are comfortable deploying in a single instrument.

Industry participants argue that the next phase of growth depends on rethinking issuance structures. Panjwani says issuances need to be routed through public offers, with more attractive coupons or incentives for retail and high-net-worth investors. “The nature of the bonds should be secured, as it keeps the interest high,” he points out.

Investors can access municipal bonds by subscribing through registered brokers during primary issuances or by purchasing listed bonds on stock exchanges such as BSE and NSE. Investors can also invest in bonds of other corporations besides their area of residence.

Also read: From tax relief to easier property sales: 5 NRI rule changes

Still a niche play

Despite higher issuance, secondary market liquidity remains the market’s weak link. The total trading value of municipal bonds in calendar year 2025 stood at a mere Rs.175 crore.

Panjwani describes liquidity as a “major issue”, pointing out that price discovery depends heavily on demand and supply. “Retail investors always look after the return, safety and exit route,” he says, adding that AAA-rated PSU bonds remain far more tradable and familiar for investors.

Mittal notes that most municipal bonds are effectively buy-and-hold instruments. Issue sizes have been small, often between Rs.25 crore and Rs.200 crore, which restricts free float and trading activity. “Some trading may occur shortly after listing, but liquidity tends to dry up within two to three weeks,” she says. With total municipal bond issuance of about Rs.1,000 crore in 2025 compared with over Rs.1 lakh crore of annual corporate bond issuance, municipal bonds remain a niche segment within fixed income.

Role in a portfolio

Municipal bonds can complement corporate bonds and government securities within a retail fixed-income portfolio by offering exposure to urban infrastructure backed by specific revenue streams and government support. “They provide competitive yields with moderate risk, enhancing diversification and steady income potential,” says Das.

At present, municipal bonds are neither large nor liquid enough to serve as a tactical allocation in portfolios. “Instead, investments are largely driven by local body familiarity and comfort, particularly among investors who live in or understand the issuing city,” Mittal says.

Mittal adds, “However, all this is set to change with the budget announcement of Rs.100 crore incentives for bond issuances of Rs.1,000 crore. This is a welcome step that will encourage large municipal corporations to come to market and would be a step towards enhancing secondary trading liquidity going forward.”

In a broader context, Das says, “The Rs.100 crore incentive for mega municipal issuances is equally bold; it essentially puts a premium on urban governance. By incentivising cities to tap capital markets rather than rely solely on grants, we are seeing a fundamental shift toward fiscal discipline at the grassroots.”

For now, most advisers see municipal bonds as a satellite allocation rather than a core holding. As a standalone asset class, municipal bonds still have some way to go before they can be considered a core allocation.