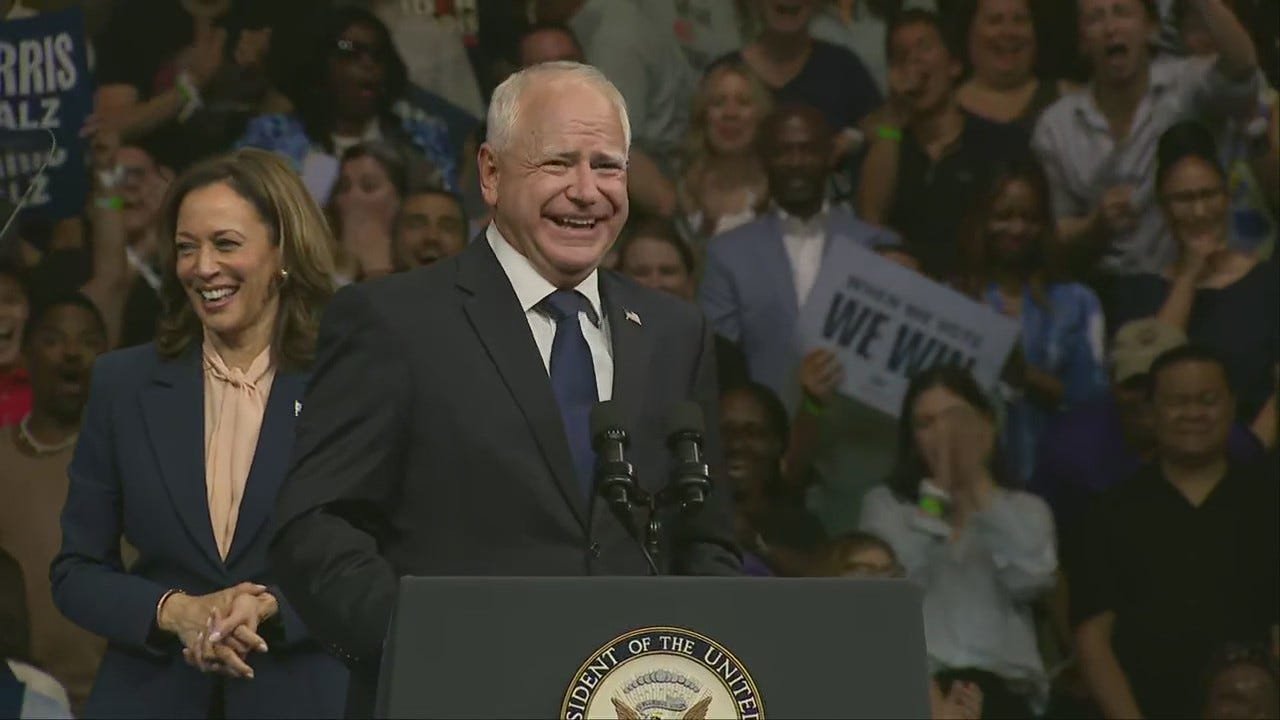

Tim Walz on JD Vance: ready to debate

Democratice Vice Presidential nominee Tim Walz campaigned with Kamala Harris on Tuesday — and said he’s looking forward to debating JD Vance.

Fox – 2 Detroit

A record 58% of Americans owned stocks in 2022, according to the Federal Reserve.

Democratic vice presidential nominee Tim Walz was not one of them, his financial disclosures show.

In fact, Walz didn’t own many investments, based on what has been released. No stock, no bonds, no home or any other real estate. Instead, the former teacher and congressman’s assets consisted mostly of pensions, whole life insurance and college savings, a 2019 filing showed. He and his wife, Gwen, earned $166,719 before taxes in 2022.

Meanwhile, his Republican rival for the vice presidency, J.D. Vance, has a portfolio that includes stocks, real estate and cryptocurrency.

So what do financial advisers think about the two men’s investment strategies?

“I think they (Vance and Walz) have different approaches, because they’re in different generations and they have different goals, most likely financially, at the stage of their life that they’re in now,” said Daniel Razvi, chief operating officer at retirement advisor Higher Ground Financial Group.

“J.D. Vance is still fairly early on in his career,” he said. “He’s still very young. He’s got a lot more trajectory upward as far as income and assets and so on. Tim Walz is getting close to a retirement-type age. It becomes very common to start thinking about, ‘How can I make sure I don’t run out of money?’ That’s usually the primary concern.”

Vance also has more money to invest, Razvi said. Vance is a bestselling author, a venture capitalist who runs Narya, an Ohio-based venture capital firm he founded and launched in 2020 for startups around the country and the junior senator from Ohio. Walz was a high school teacher before being elected to the House of Representatives and then as governor of Minnesota.

Why’s it surprising Walz doesn’t own stocks, bonds or a home

Some financial advisers were surprised by Walz’s choices.

“I’m shocked,” said Eric Bond, adviser at Bond Wealth Management in Long Beach, California. “There’s never been a book written that says create generational wealth without saving, don’t invest in stock, don’t buy houses.”

By not owning stocks and real estate, Walz is losing opportunities to grow his money and build generational wealth, financial advisers said.

- From the beginning of 1990 through May 2024, the S&P 500 stock index has returned more than 1,300%, and the S&P CoreLogic Case-Shiller U.S. National Home Price Index, which measures residential real estate values, has risen more than 320%, or more than quadrupled.

- Government bonds usually yield less, but they’re also less risky because they’re backed by the federal government. Investors holdings bonds lock in a certain yield for a specified amount of time and get all their principal back at maturity.

- Financial advisers often recommend the “classic” 60/40 portfolio, or 60% stocks for growth and 40% bonds for income.

What are the positives in Walz’s financials?

Walz’s net worth is estimated between $112,003 to $330,000. Here’s a summary of what advisers said Walz did right, based on what has been released:

- Two whole life insurance policies valued at $15,000 to $50,000 each. He made regular payments into their value until at least 2013, but payments stopped later, CNBC reported.

“If you put money into life insurance, that’s not a horrible idea,” said Dan Casey, investment adviser and founder of Bridgeriver Advisors. “It’s growing tax-free and you can take it out tax-free and leave something to your wife and kids.”

-

A tax-deferred 529 education plan containing $1,000 to $15,000, likely for his two children, Hope, 23, and Gus, 17.

“It’s great they took time and invested,” Bond said, noting that 529s can also be passed on to another child or rolled into a Roth IRA.

Diversify to reduce risk: Why investing in multiple stocks isn’t enough to keep your money safe

Diversify to save on taxes: Tax diversification can help you save. Here’s what to consider with your retirement funds.

What do advisers see as possible negatives?

Walz’s plan also had possible drawbacks, advisers said, including:

- A sale of his family home in 2019 for just over $300,000, more than double what he paid in 1997 and before he moved into the governor’s mansion.

If Walz had kept his home and rented it, he could have collected rental income and taken yearly depreciation as tax deductions for 27 years, Bond said. And then when he died, he could have passed the home to his heirs who could have sold it without paying any capital gains tax, since the property’s value automatically resets at market value, he said.

Bond acknowledged not everyone wants to be a landlord, especially if you’re running a state. So maybe Walz sold his home and took the tax break (IRS allows joint filers to exclude up to $500,000 of the gain from their income), he said.

“But what did he do with the money?” he said. “OK, trade it if you don’t like real estate but then go to stocks, bonds or whatever.”

Pensions, which are becoming increasingly rare, offer a guaranteed monthly payment for life and so offer a certain amount of financial stability. However, there are some financial considerations.

“Taxes would be my primary concern,” Razvi said. “When he receives (the payout), it will be taxable, and he’s not going to have a lot of choice at that time, because government pensions cannot be converted to Roths.”

Pension money is taxed as income, which is usually a higher rate than the capital gains tax on money from a brokerage account, he said.

Roth accounts are funded with after-tax money and withdrawals are tax=free. Other retirement accounts like 401(k)s or pensions are funded with pre-tax money and taxed when distributed.

Additional concerns include liquidity and heirs. Pensions guarantee fixed monthly payments, but if a large expense emerges, like long-term health care or help for a child’s down payment on a home, you can’t get an advance on monthly payments, Bond said. But you can withdraw money as needed from 401(k), brokerage or IRA accounts.

Pensions, unlike individual stocks and other retirement accounts, also aren’t generally passed on to heirs, unless specifically offered and elected and even then, it is usually a reduced benefit, Bond said.

- In 2009, Walz sold investments valued at between $1,001 and $15,000 in two Roth individual retirement accounts (IRA). He and his wife, Gwen, also executed sales in the same value range for two Roth IRAs she owned. Those IRAs don’t appear later on Walz’s House disclosures, suggesting they were liquidated, CNBC said.

This move stumped some financial advisers. Typically, cashing out a Roth IRA is “the absolute last resort,” Casey said. “You give blood before you cash in your retirement plan. A Roth is gold” because your money grows tax-free and is withdrawn at retirement tax-free.

How do Walz’s financials compare with Republican VP candidate Vance’s?

Republican vice president candidate JD Vance’s financials are starkly different, showing a diverse investment strategy and net worth at up to $10 million, according to Forbes Magazine. Here are some items Vance lists:

- Stock ownership in more than 100 companies, according to financial disclosures he submitted as a U.S. senator. In 2022, they included shares of Walmart and other private companies.

- Book royalties of $121,376 in 2022 from his book “Hillbilly Elegy.”

- Cryptocurrency valued between $100,001 and $250,000.

- Rental income between $15,001 and $50,000 in 2022 from a Washington, D.C., rowhouse.

- Various other investments including several bank accounts, CDs and exchange traded funds tracking everything from the S&P 500 and Dow to Treasuries, gold and oil.

- Multiple homes, retirement accounts and three college savings accounts, the Wall Street Journal said.

- Annual salary of $174,000 as a U.S. senator, according to the National Taxpayers Union Foundation.

If you have money to make investments, advisers said, Vance’s actions are a good example of diversification.

Though Vance’s holdings with a cryptocurrency stake may lean risky, “he has enough assets that crypto’s not a huge portion overall,” Casey said.

Plus, Vance’s risk tolerance is typical for his age, advisers said. Vance is 40; Walz is 60.

Vance is “still trying to build and accumulate, and he’s spending a lot of time doing different investment strategies to try to generate and accumulate wealth,” Razvi said. “But as he gets closer to retirement, then he may want more certainty as well.”

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at mjlee@usatoday.com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday morning.