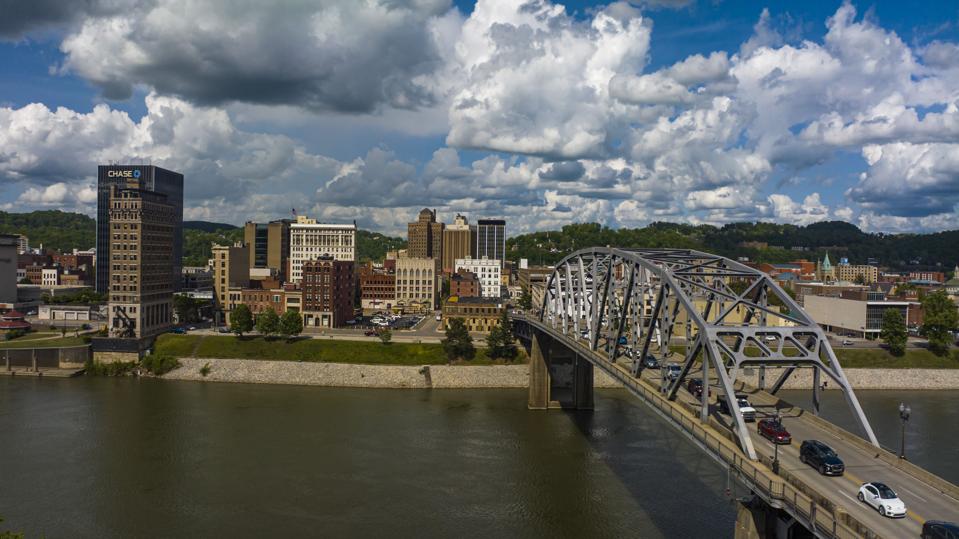

Aerial view of Charleston Skyline, West Virginia. (Photo by: Visions of America/Joseph Sohm/Universal Images Group via Getty Images)

Visions of America/Universal Images Group via Getty Images

In commercial real estate, the term “off-market deal” might come up as an option. For clarification, an off-market deal is one where the seller does not exclusively retain a broker to run a sales process. This can mean the owner is handling the sale process themselves, or perhaps a broker brings a buyer to the table unsolicited. Unlike a traditional listing, these transactions unfold quietly and without broad exposure.

If you’re selling a property, taking this approach can present advantages and disadvantages, which we’ll look at next. (Read the first of this two-part series here, “The Pros And Cons of Buying Investment Property Off-Market.”)

Advantages of Off-Market Deals for Sellers

Speed in Special Circumstances

There are rare occasions when an off-market transaction could be useful, such as if you’re facing foreclosure and need to move quickly. If there is a partnership dispute or a specific tenant situation, keeping a sale out of the public eye may be the only viable path. In such cases, moving quietly can help you act quickly while minimizing risk of disruption.

Privacy and Discretion

Not every seller wants the market to know their property is for sale. An off-market deal allows you to maintain privacy, which can protect tenant relationships or prevent speculation about your financial standing. This discretion may be especially important if your property houses high-profile tenants or if word of a sale could negatively impact business operations.

The Chance to Find More Opportunities

A seller may not want to pick a single broker for the deal, with the intent of keeping better relationships with other brokers. They might be reaching out to find more properties. Deals can be like currency, and having a potential sale could help them increase their buying opportunities.

Potential for a Premium Buyer

There is a chance that an off-market buyer may be willing to pay more simply because they don’t have competitors at the table. While this scenario is uncommon, it could work in the seller’s favor.

Disadvantages of Off-Market Deals for Sellers

Risk of Leaving Money on the Table

The greatest drawback of selling off-market is the loss of competition. In real estate, you only have one chance to sell your property. Without broad exposure and a competitive process, you’re far more likely to miss out on higher offers and better terms. When you list on-market, multiple buyers competing against each other typically drives up value.

Lack of Representation

If a broker approaches you with an off-market buyer, keep in mind that the broker represents the buyer, not you. Without someone advocating for your best interests, you risk entering negotiations at a disadvantage. Even if you can’t publicize your listing, having a broker in your corner ensures someone is working to maximize your outcome.

Limited Market Feedback

A formal sales process naturally generates feedback from the market, helping establish true value. Without it, you may struggle to gauge whether your property is underpriced or overpriced. If you’re aware of the value, you’ll be in a better position to make informed decisions.

Difficulty Finding a Buyer

If a seller opts to transact on their own, they may not be aware of investors who are willing and interested in buying the property. A broker who is in the mix selling constantly as their fulltime job will be able to identify the active buyers on the market.

Concluding Thoughts for Sellers

There is one additional consideration for sellers, and that is the brokerage commission. If a seller doesn’t hire a broker, they may think they are saving a fee on the transaction. While that is true, the reality is that if there’s a broker involved, that fee is coming off the transaction, and you have more control, like setting the commission rate. You may save a seller’s broker fee of 2%, but there could be a buyer broker fee of 3%. You may not realize it but you’re paying a higher commission than you thought. Regardless, when a broker is involved, the fee will get factored out of the deal. If you’re paying for it anyway, it makes sense to pay to the broker who’s in your corner advocating for you.

For these reasons, in most cases, an on-market sale is the better choice for sellers. It creates a competitive environment, maximizes exposure, and ensures you receive the highest price and best terms. Off-market deals can make sense only in very specific circumstances, such as urgent timelines or sensitive situations. Even then, it’s wise to have professional representation to advocate for you. Remember, in commercial real estate, competition is your ally when you’re selling.