After decades of building a successful career, you’ve reached the starting line of retirement with a substantial nest egg. Your very first decision is a big one, and you only get one chance to make it: How much of your retirement fund should you take as a cash lump sum?

This is the “commutation” decision. You can take up to one-third of your retirement fund in cash. The rest must be used to buy an annuity that provides your monthly retirement “salary”.

ADVERTISEMENT

CONTINUE READING BELOW

Many retirees get fixated on finding the single “tax-optimal” number for this decision. This is the wrong way to look at it. Focusing on tax-efficiency alone can lead you to ignore the single most important factor: liquidity.

Subscribe for free to receive new weekly posts focused on retirement income.

Your two retirement “pots” and how they’re taxed

When you retire, your commutation decision splits your money into two distinct capital pots, which are taxed differently

- Pot 1: The Annuity (your “retirement salary”) This is the two-thirds (or more) that you don’t commute. It’s invested and pays you a regular income. Every rand you draw from this annuity is taxed just like a salary, at your personal marginal income tax rate, which can be as high as 45%.

- Pot 2: The Discretionary Pot (your “flexibility fund”) This is the lump sum you do take in cash. This amount is taxed once, according to the retirement lump sum tax tables. (The first R550 000 is tax-free, with progressive rates from 18% to 36% on amounts above that, assuming no prior withdrawals).After this one-off tax, this money is yours to invest in a “discretionary” portfolio (like a unit trust). The returns and income from this pot are taxed far more favourably:

- Interest: Taxed at your normal rate, but with a R34 500 annual exemption (if you’re over 65).

- Dividends: Taxed at a flat 20%.

- Capital gains: Only 40% of your gain is taxed, and you have a R40 000 annual exclusion.This mix of tax-free capital withdrawal, interest, dividends, and capital gains means your effective tax rate on withdrawals from this pot can be low, often between 5% and 10%.

The “optimal” tax myth

This tax difference leads to a tempting calculation: is there a “perfect” commutation percentage that minimises tax and maximises your total after-tax income?

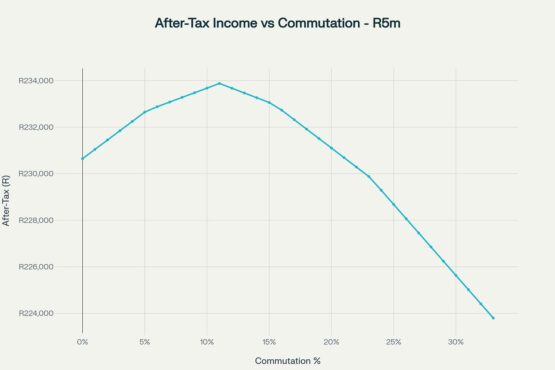

In theory, yes. The chart below, for example, shows that for a R5 million retirement fund, the “optimal” after-tax income is achieved with an 11% commutation (R550 000).

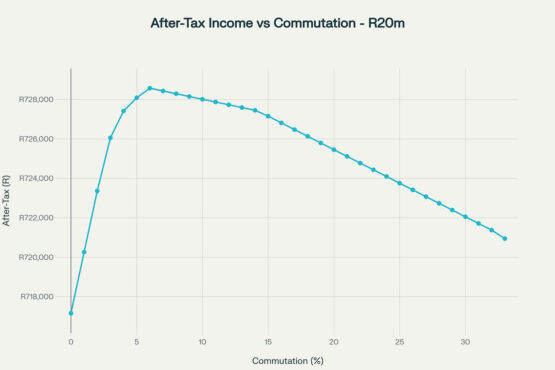

For a larger R20 million fund, our models show the optimal point is a 6% commutation (R1.2 million). On paper, this seems like the “smart” move. But this analysis misses the real world.

ADVERTISEMENT:

CONTINUE READING BELOW

Why liquidity is king in retirement

A spreadsheet can’t model life. Liquidity, the ability to access significant cash when you need it, is arguably the most valuable asset in retirement.

Your annuity income is inflexible. You can’t call your annuity provider and ask for extra income for an emergency medical procedure, a new car, or a sudden opportunity to take your grandchildren on a dream holiday.

Your discretionary pot is your freedom. It’s your emergency fund. It’s your buffer against uncertainty. It gives you the power to adapt and react much more easily than the annuity.

The real price of flexibility (it’s less than you think)

“But,” you might ask, “am I not losing thousands by not choosing that ‘optimal’ number?”

Let’s look at that R20 million fund example again. Assuming no prior lump sums were taken, the after tax discretionary capital you have available is shown below:

“Optimal” 6% commutation:

- Gross lump sum: R1 200 000

- Lump sum tax: R159 750

- Net discretionary capital: R1 040 250

Maximum 33.3% commutation:

- Gross lump sum: R6 666 667

- Lump sum tax (approx.): R2 127 750

- Net discretionary capital: R4 538 917

The “peak” optimal income (at the 6% mark) is only a few hundred rand a month more than the income you’d get by taking the full one-third.

By choosing the full one-third commutation, you potentially lose a few hundred rand a month in income, but you are gaining over R3.5 million in extra, liquid, after-tax capital. That’s a massive amount of flexibility and peace of mind you would be giving up. This is a tradeoff that needs to be carefully considered.

A note on estate planning

Some may argue that keeping more money in the annuity is better for estate planning. It’s true that a living annuity doesn’t form part of your estate for executor’s fees, and it can pass to beneficiaries efficiently.

However, as the saying goes, “life is for the living”. Your retirement plan should first and foremost serve you and your needs while you are alive. Prioritising a potential tax benefit for your heirs over your own financial flexibility and liquidity for the next 30 years can be a mistake.

Every family’s situation is unique and requires a tailored plan. But as a general principle, we should not let post-death tax planning dictate the crucial decisions we need to make for our own lives. Liquidity should generally be prioritised.

The takeaway: optimise for liquidity first

Your retirement plan should be tailored to you. Too many retirees focus on tax optimisation first.

Rather secure your liquidity first, then optimise for tax. We need to focus on your real-world needs for the next 30 years. Future tax laws are uncertain, but the value of having access to your own capital is permanent.

Ultimately, the commutation decision is less about finding the perfect calculation and more about having the right conversation.

We specialise in building retirement income portfolios, including dedicated bond ladders – please get in touch to discuss: jonathan@rexsolom.co.za

A solid retirement income plan starts with getting organised. A great way to do this is to create a free, one page visual summary of all your finances.

Subscribe for weekly updates on optimisting retirement income.