Property investments, when done right, can be highly rewarding.

While it might sound intimidating, property investment is pretty straightforward—purchasing properties to generate profit by either reselling or renting them out and managing them accordingly. This avenue has thus become increasingly popular globally among investors, as real estate offers abundant opportunities for growth and additional incomes.

READ: Moving out and moving on: How investing in property was my act of self-love

Here are five individuals who’ve taken this approach and turned their property investments into impressive, profitable ventures.

Donald Bren

Now known as America’s wealthiest real estate baron, Donald Bren, who currently holds a net worth of almost $19 billion, got an early start in this industry because of his father who was also a property investor.

In his youth, Bren worked as a carpenter on his father’s buildings, helping ensure their overall quality. While there, he gained valuable insights about real estate investing. Today, he owns a massive real estate empire. With over 590 office buildings and 125 apartment complexes to his name, Bren has used the lessons he learned early on to build a legacy that stands as one of the most significant in real estate history.

His Irvine Company currently owns over 129 million sq ft of real estate, mostly in Southern California, as well as all of Manhattan’s MetLife Building, having bought out a minority 2.7 percent stake in July 2024. He also owns several hotels, golf courses, marinas, retail shopping centers, and a coastal resort.

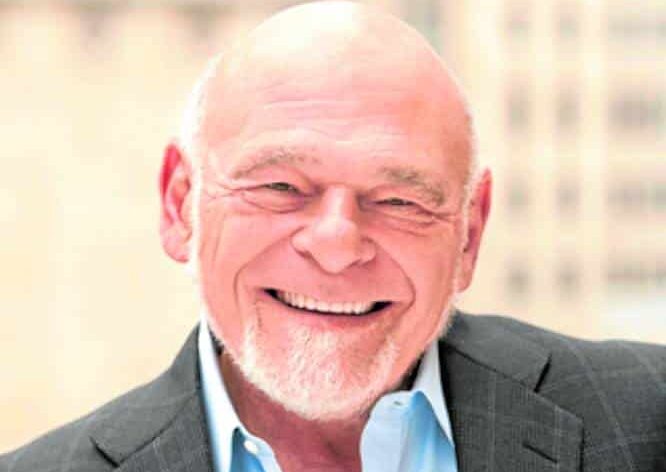

Sam Zell

Known as the forefather of real estate investment trust (REIT), Sam Zell was considered one of the most successful real investors in the world. He was valued at $5.2 billion by the time of his death in 2023.

Zell began his real estate career in the 1960s by purchasing and leasing properties to other students at the University of Michigan where he studied. Zell managed a 15-unit student apartment building in exchange for a free room. By the time he graduated, his enterprise was netting over $150,000.

In 1968, he launched Equity Group Investments, which included real estate investment as one of its primary focuses. Over the following decades, he expanded his real estate empire across America.

His $39 billion sale of REIT Equity Office to Blackstone before the 2007 market crash was known as one of the largest real estate deals ever.

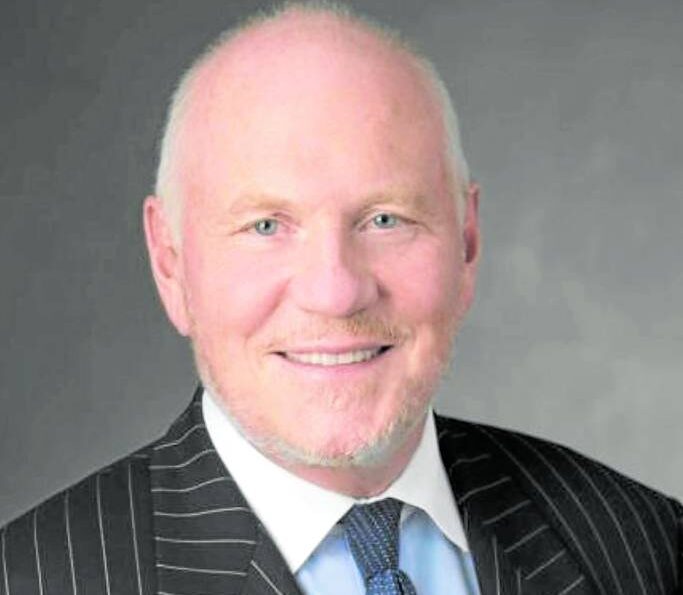

John Grayken

John Grayken is the founder and owner of Lone Star Funds, a Texas-based private equity firm which has focus on real estate investments.

After graduating from Harvard Business School, he launched a career in real estate by buying distressed property and busted real estate loans. Since starting his company in 1995, the now billionaire has raised 21 funds and drawn over $85 billion committed capital. Today, Grayken’s net worth is valued at over $7.3 billion.

Lone Star’s purchased assets are also managed by Hudson Advisors, another Dallas-based firm owned by Grayken that owns more than $250 billion in assets under management.

In June 2016, it was reported that Grayken purchased the most expensive apartment, shelling out over $30 million for a 13,000-sq ft unit atop the 60-story Millennium Tower.

David Lichtenstein

Now valued at over $2 billion, real estate mogul David Lichtenstein is an accomplished investor and founder of real estate company Lightstone Group.

Prior to this, Lichtenstein began his career in real estate investment in 1986 when he racked up an investment of $89,000 to purchase a two-story, multi-family home in New Jersey. He later added several apartment buildings to his portfolio, and within two years, his ventures in real estate led him to start his own real estate company.

In 1988, Lichtenstein founded the New York-based Lightstone Group, which oversees some 23,000 rental units across 120 properties in 28 states in the US.

John Whittaker

With a net worth of over $1.5 billion as of 2019, John Whittaker is known as a real estate visionary with a penchant for regeneration projects.

Whittaker got his start in the 1970s, when he began buying and acquiring cotton mills for their land. He later acquired the Square Works Mill in Ramsbottom. From there, he learned that selling scrap from the mill could lead him to make more than the amount that he had put into the building, with more still left to have it developed further.

Today, the Lancashire native chairs The Peel Group, a large British conglomerate he also founded that holds stakes in property, media, and infrastructure businesses. The group has developed several well-known buildings, such as Manchester’s MediaCityUK and Trafford Centre mall.

Sources: salboy.com, forbes.com, bluelake-capital.com, bostonglobe.com, Bloomberg.com, david-lichtenstein.lightstonegroup.com, insidepropertyinvesting.com, peelgroupfoundation.org, peel.co.uk