Retirement is a once-in-a-lifetime moment. After decades of saving, the last few years before retirement carry some of the most important decisions you’ll ever make. Too much risk, and a sudden crash can take away years of progress. Too little risk, and you miss the rally that could have added millions to your retirement nest egg.

At Jenwil BlueStar, we understand this conundrum. That’s why we created the Jenwil BlueStar Real Savings Wrap Fund — designed specifically to protect your retirement wealth when it matters most.

ADVERTISEMENT

CONTINUE READING BELOW

- Confidence: Over the past three years, our fund delivered the same return as the average balanced fund but at almost half the volatility. Imagine enjoying growth without sleepless nights.

- Integrity: This fund is Regulation 28 compliant and structured to put your financial safety first. You remain in control while we protect against the extremes of market uncertainty.

- Pride: Clients who chose the Real Savings Wrap have seen steady, reliable outcomes — avoiding big crashes while still taking part in rallies. It’s a solution you can be proud of when looking back on your financial journey.

- Passion: We care deeply about helping you retire with peace of mind. This fund is more than numbers — it’s about giving you the freedom to live your next chapter confidently.

Your retirement is too important to leave to chance. With Jenwil BlueStar Real Savings Wrap Fund, you don’t have to choose between safety and growth — you can have both.

The Jenwil Real Savings Wrap (Jenwil BlueStar)

Asset allocation in one’s pre-retirement products becomes a headache the closer one gets to retirement, partly due to the fear of losing capital in a market crash just before retirement date, and partly due to the fear of missing out on a bull run during the last year.

During the early years, it makes sense for most clients to place their contributions in as aggressive a portfolio as possible, as they have various factors on their side:

- The term to retirement is normally 30 years plus.

- Market volatility could work to an investor’s advantage, as units (in investment funds) become cheaper, allowing the investor to purchase more units for a given amount.

- Rand-cost averaging reduces volatility over time.

At this stage, it is important to differentiate between risk and volatility. Volatility is the up and down movement of a portfolio during the investment term due to unit price movements which are linked to market movements and should as a rule be disregarded if the portfolio is well-constructed and if the chosen investment term considers the risk profile of the investment portfolio.

Risk, on the other hand, is the possibility of capital loss at the end of the investment term and is mainly determined by the asset allocation of the portfolio and the resulting volatility of the portfolio. Risk is therefore highly dependent on how far the investor is from retirement. If retirement is close, most clients prefer to tone down on volatility and some even move into cash up to three years before retirement.

What are the choices for most investors?

The reality is that investors usually have one of the following experiences:

Stayed in the market and experienced a sharp fall just before retirement, resulting in a sharp loss in retirement capital.

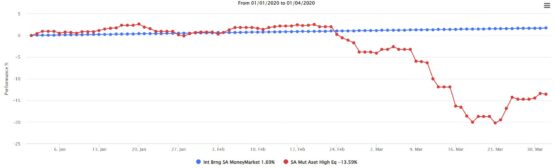

The months before Covid can be used as an example. The graph below shows the correction in the average balanced fund vs the average money market. For an investor with retirement capital of R5 million, the correction of more than 20% would have meant a loss of R1 000 000. Quite substantial.

Switched to more conservative investments, like a money market fund, and when markets corrected, capital was protected. The graph above still is relevant.

These clients would not have had a loss of 20%, but small growth of 1.69%.

The variance between these two outcomes was about 22%, which constitutes the risk factor hinging on the client’s decision during the last three months of their term to retirement.

Stayed in the market and experienced a bull run just before retirement, resulting in a sharp increase in the value of their retirement lump sum.

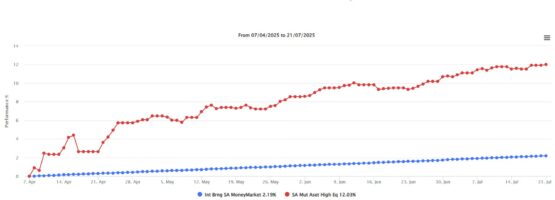

The three months after the announcement of US tariffs can be used as an example of where the average balanced fund gave a return of 12% over three months. For an investor with retirement capital of R5 million, this implies R600 000 more, resulting in a better situation from which to purchase an income.

Switched to more conservative investments, like a money market fund, and when markets rallied, lost out on growth. Again, the previous graph for illustration.

In the money market they still had 2.19% return for the period, but they could have had an extra return of 12%.

The variance between these two returns is around 10%, which could have significantly affected the value of the client’s retirement capital.

Life stage portfolios

Many pension funds try to mitigate these experiences by introducing life stage solutions, where the portfolio is managed from moderately aggressive to conservative based on a specific algorithm during the last three years. However, this solution will gradually take on less risk and will also miss out on growth opportunities that may occur.

Income funds

The ideal solution would therefore reduce volatility during sudden downturns in the market, but does not forfeit the opportunity to still take part in a rally. Some investors switch to income funds to try and get more than money market returns, but when there is a strong rally like during the period April to July 2025, the investor would still miss out. Downside is, however, protected due to the nature of income funds. At the time of writing, the JSE is on an all-time high of more than 103 000 points.

The following graph illustrates that income funds have done better than money market funds over the above-mentioned period but still dramatically lagged the average balanced fund. For a client with R5 million, this would have meant R450 000 less return over three months.

The ideal solution would therefore be a portfolio that has the asset allocation to deliver similar returns to an average balanced fund, but which reduces the volatility dramatically, should a cataclysmic event occur.

The solution

ADVERTISEMENT:

CONTINUE READING BELOW

The Jenwil BlueStar Real Savings Wrap Fund (which is Regulation 28 compliant) was developed for this very reason and is available exclusively on retirement savings products at Glacier. This solution makes use of alternative structures to reduce downside without losing out on market upswings. By incorporating various strategies to produce returns that are not directly correlated with market movements, this portfolio has managed to almost halve the volatility experienced by the average balanced fund.

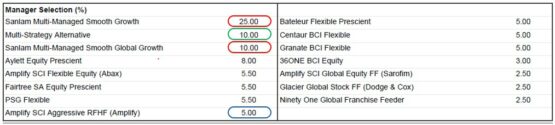

At the time of writing, the exposure to smoothed portfolios was 35% (indicated by the red circles in the table below). These portfolios offer some guarantees and will only take part in market downside once the underlying assets have dropped more than 15%.

As indicated by the green circle in the table above, 10% is allocated to a multi-strategy fund which incorporates concepts that are not daily priced, such as private equity and certain debt structures approved by Sanlam. This fund has almost no volatility, yet its historical returns have exceeded those of the average balanced fund (see below):

Including the 5% exposure to hedge funds (indicated by the blue circle in the table), a total of 50% of the portfolio is therefore not invested in traditional unit trusts that are influenced by market-related volatility.

Return

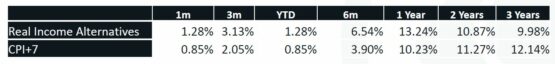

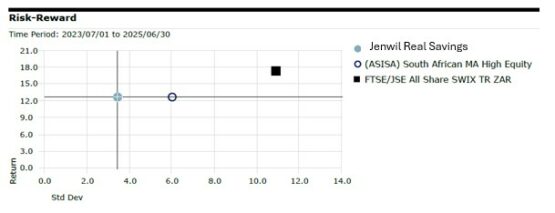

It is evident from the graph below that the three-year return of the Jenwil BlueStar Real Savings wrap fund was the same as that of the average multi-asset high-equity fund.

Source: Glacier Invest Fund fact Sheet

Reduced volatility

However, This three-year return was achieved at a lower rate of volatility, meaning risk was markedly reduced for an investor over the last three years of investment. The average balanced fund (multi-asset high equity) had a standard deviation of just above 6, while the Glacier Invest Real Savings Wrap Fund had a standard deviation of around 3.5. The maximum drawdown over this period was 1.85%, compared to the FTSE/JSE All Share SWIX’s of 10%, and it recovered within one month.

Source: Glacier Invest Fund fact Sheet

A strategy for confident investing before retirement

This highly diversified portfolio, therefore, ticks all the boxes. It reduces volatility and risk of capital loss while maintaining enough exposure to growth assets to deliver the targeted inflation-plus-5% return. For clients nearing retirement age (five years and less) this portfolio eradicates the need to make an asset allocation decision which might lead to either a capital loss during a market crash, or reduced participation during a bull run. This is the ideal solution for clients who need to protect and grow their capital in retirement annuities and preservation funds.

About Jenwil BlueStar

Jenwil BlueStar authorised by Sanlam, is a prominent leader in the investment environment, known for its exceptional ability to tailor investment strategies to meet the needs of each client. Through its bespoke wrap funds, Jenwil ensures that portfolios are designed according to individual risk profiles, providing a personalised and strategic approach to wealth management. These wrap funds are offered on the reputable Glacier by Sanlam platform, adding a layer of trust and reliability to the investment process.

The success of these portfolios is enhanced by a dedicated investment committee, which meets quarterly to ensure that all decisions are made with precision and up-to-date market insights. Furthermore, the in-depth research provided by Glacier Research plays a crucial role in maintaining the strong performance of Jenwil BlueStar’s portfolios, ensuring that clients’ investments are managed with the utmost care and expertise.

About Glacier by Sanlam

Glacier by Sanlam is your trusted partner in unlocking infinite investment opportunities. As the largest linked-investment service provider, we have led the way in meeting the diverse needs of South Africans for over 27 years. Our extensive range of local and international solutions empowers investors to create, grow, and preserve their wealth. Through innovative products and expert advice, we offer infinite opportunity to achieve financial success.

Glacier Financial Solutions (Pty) Ltd is a licensed financial services provider.

About Glacier Invest

As an independent discretionary fund manager, Glacier Invest draws on the full expertise and capabilities within the Sanlam Group to deliver a world-class portfolio management and consulting value proposition. Our highly experienced investment professionals work with financial intermediaries to create and manage bespoke portfolios to meet the specific needs of investors.

Glacier Financial Solutions (Pty) Ltd is a licensed discretionary financial services provider, trading as Glacier Invest FSP 770.

Sanlam Multi Manager International (Pty) Ltd FSP 845 is a licensed discretionary financial services provider, acting as a Juristic Representative under Glacier Invest.

As Juristic Representative of Glacier Invest, Sanlam Multi Manager International (Pty) Ltd manages the retail investment solutions offered by Glacier Invest.