Stanislaw Pytel

Co-authored by Treading Softly.

There is an old idiom I have oft heard repeated:

“Health is wealth.”

For many, being wildly successful and wealthy means little if you have no health left to enjoy them. As I got older, I can remember one of my first bosses saying that many traded their health to accumulate wealth and then spent all their wealth in old age to recover whatever health was left. Instead of this constant back-and-forth, I recommend maintaining your health through your pursuits for monetary wealth. Once you give away your health, you’re unlikely to ever recover much of it again.

There is a lot of money moving through the financial markets, and I like to tap into it to fulfill my income goals. By strategically investing in dividend-paying sectors, I direct a flow of money from the markets directly into my account. This is why I invest to own a piece of utilities, fuel distribution, and natural gas pipelines.

Today, I want to look at how you can earn a great income from those trading their wealth in to try to get some of their health back. We will look at how to tap into another income stream as old as time itself—real estate.

Let’s dive in!

Pick #1: THQ – Yield 10.1%

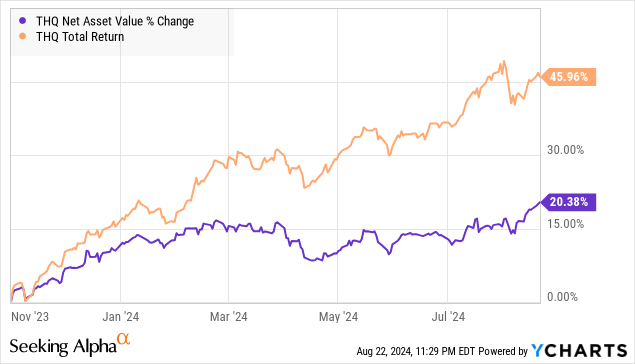

Since the completion of the sale of Tekla Capital Management to Abrdn Inc., its CEFs (Closed-End Funds) have demonstrated terrific results. abrdn Healthcare Opportunities Fund (THQ), in particular, has been the strongest performer of the pack, delivering +45% total returns and +20% NAV (Net Asset Value) gain since the closing of the transaction.

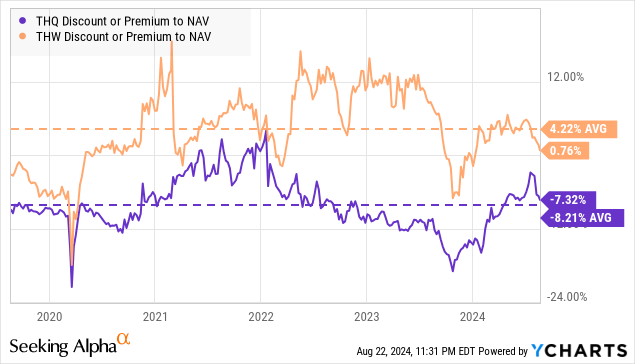

For years, THQ has traded at deep discounts to NAV, while its international cousin, the higher-yielding abrdn World Healthcare Fund (THW), sported healthy premiums.

While Tekla management consists of highly qualified medical professionals capable of assessing the markets and companies to make prudent investments in promising drugs and treatments, Abrdn brings its influence and reputation as a world-class fund manager. The combination of these has resulted in the shrinkage of THQ’s discounted valuation and a market-beating performance, and we expect this to continue in the years ahead.

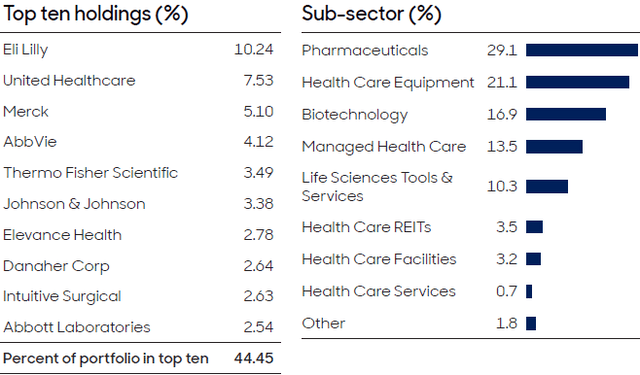

THQ’s top holdings are leading U.S.-based biopharma companies, with Eli Lilly (LLY) representing its largest position. Source.

THQ’s top positions represent ~45% of the CEF’s assets and continue to deliver robust earnings. Here are a few notable mentions:

-

Eli Lilly (LLY) recently reported a monster second quarter fueled by robust sales of its new weight-loss drug, Zepbound. The company raised its revenue guidance, demonstrating the commercial promise of GLP-1 drugs.

-

While the sales of its blockbuster drug Humira continue to slow, Abbvie (ABBV) is lifting investor concerns by demonstrating that it is in the process of having a new golden goose. The pharma giant reported a strong quarter with sales powered by immunology drugs Skyrizi and Rinvoq. This combo is used to treat forms of arthritis and inflammatory bowel disease, among other conditions.

-

Intuitive Surgical (ISRG) reported double-digit revenue growth driven by strong demand for its da Vinci robotic surgical device.

THQ operates with a ~20% leverage (at a cost of 1.48% of net assets) to boost returns from its holdings. Earlier this year, the CEF delivered a 60% distribution increase, and its current $0.18/share monthly payment calculates to a 10.1% annualized yield. THQ has 9/30 as its fiscal year-end. In its Fiscal Year to date, the CEF estimates that 54% of the distributions were sourced from capital gains and 46% from Return of Capital.

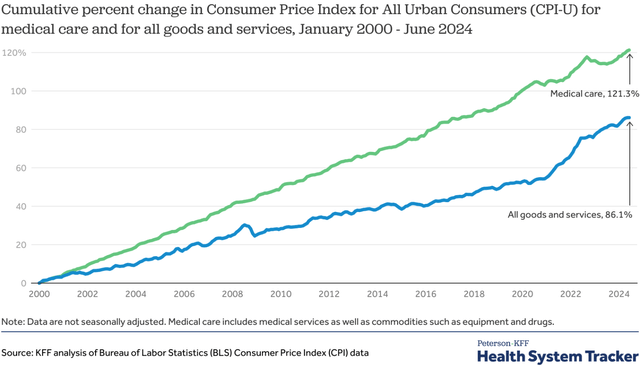

Healthcare prices and overall health spending have historically outpaced the rest of the economy. As the American population continues to age, health costs form a growing share of the gross domestic product, and families are seeing the cost of services, drugs, and insurance premiums grow much faster than household income.

Healthcare is an essential sector with tremendous demand potential given America’s aging population. Despite solid price and NAV performance since its takeover by new management, THQ continues to trade at a ~7% discount to NAV, making its 10.1% yield an excellent buying opportunity.

Pick #2: RNP – Yield 7.2%

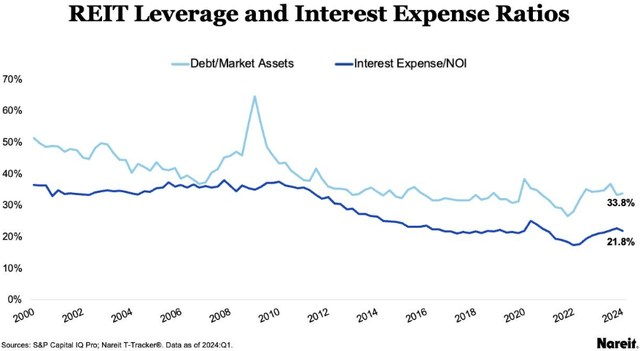

During 1H 2024, the operational performance of REITs has been solid with high occupancy rates in the face of supply demand imbalances due to the high interest rate-induced weakness in construction activity. Well-managed REITs also maintain disciplined balance sheets with ample liquidity to be property acquirers.

Data from the Q2 earnings shows that REITs continue to have well-structured debt – 79% of REITs’ total debt was unsecured, while 91% of public REITs’ total debt carried fixed rates.

Active fund managers are increasingly allocating new and emerging property sectors with more credit-worthy tenants, better demand dynamics, and promising growth prospects. Cohen & Steers started off in 1986 as the first-ever manager of a REIT-focused mutual fund and currently manages over $80 billion in Assets Under Management.

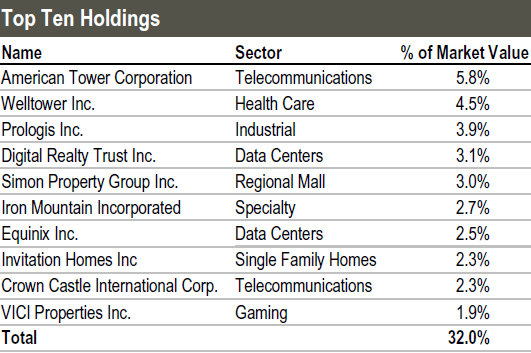

Cohen & Steers REIT & Preferred Income Fund (RNP) is a CEF with a highly diversified portfolio, 310 holdings, and a unique asset composition. The fund maintains a 51% allocation to REITs and a 49% allocation to non-REIT preferred securities, mainly from the banking, insurance, utility, and pipeline sectors. High-quality REITs across property types form the fund’s top holdings, representing 32% of the invested assets. We note increased allocation to data center names like Digital Realty Trust (DLR), Equinix (EQIX), and Iron Mountain (IRM) that are well-positioned to see rising demand fueled by heavy innovation from chip manufacturers and billions in investment from Big Tech. RNP’s top holdings also include leading names in telecom towers, healthcare, and single-family homes. Source.

RNP Fact Sheet

RNP maintains a largely investment-grade portfolio, with +68% of its holdings carrying ratings of BBB or higher. Moreover, RNP is actively managed, so we can expect the fund managers to make regular portfolio changes based on the financial standing and performance of the companies.

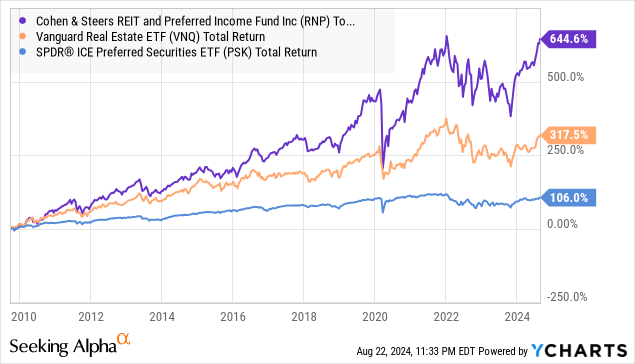

Born in 2003, RNP has experienced the brunt of the Global Financial Crisis and the COVID-19 pandemic, both of which unleashed devastating effects on the real estate market. Despite this, the fund has outperformed its passively managed index ETFs while delivering on its objective of current income. There are two reasons for this — active management and prudent use of leverage.

RNP has maintained growing distributions since its inception, and its $0.136/share distribution calculates to a 7.2% annualized yield. According to internal estimates, for the seven months of FY 2024, 100% of RNP’s distributions are sourced from NII (Net Investment Income). The CEF’s portfolio operates with a 31% leverage, which carries a weighted average interest rate of 2.4%, with 81% of the borrowing fixed for a weighted average term of ~2 years. With interest rate cuts upon us, we expect RNP’s NAV to rise materially, providing the fund an opportunity to deleverage naturally and refinance at more favorable terms.

RNP’s unique blend of REITs and preferred shares presents a packaged opportunity to directly benefit from rate cuts. We like both asset classes for their predictable income and lower correlation to the broader markets. RNP is priced at par with NAV, and its high-quality portfolio presents a defensive investment in this euphoric market.

Conclusion

With THQ and RNP, we can benefit from the aging population and impending rate cuts. Due to Medicare, even in a recession, healthcare spending is highly likely to rise or at least be maintained. This means THQ’s bundle of investments will see financial strength with revenue flowing in, allowing the CEF to continue to pay us. RNP’s bundle of holdings will benefit when rates fall, and REITs thrive. Both these investments provide us with strong, recurring income that flows from various companies directly into our accounts.

When it comes to retirement, it’s important to have the cash flow you need to meet your expenses head-on. I don’t want you to have to defer bills, miss opportunities, or skimp on your dreams because your finances are holding you back. I also don’t want you to fall into a pit of debt and have your life governed by your creditors. Instead, using our unique Income Method, you can tap into the trillions flowing through the market and enjoy strong income, letting the economy tackle your bills in retirement. That’s the beauty of my Income Method. That’s the beauty of income investing.