Yes, even after retirement, you are still required to pay income tax.

Many new retirees are surprised to learn that they must continue submitting annual tax returns and may still be liable for income tax. A common question is: “I contributed my entire working life – why do I still need to pay income tax?”

ADVERTISEMENT

CONTINUE READING BELOW

During retirement, income is typically derived from annuities, such as living annuities, life annuities or a combination of both. These annuities are funded by the retirement savings you built up before retirement from retirement annuities, preservation funds or pension and provident funds.

While you were working, contributions to these retirement savings vehicles were tax-deductible. This means you received a tax benefit at the time by paying less tax.

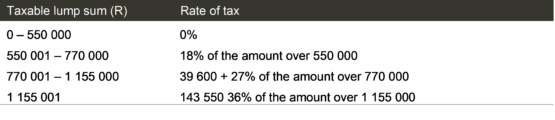

At retirement, funds are transferred tax-free from pre-retirement investments into annuities. However, any cash lump sums withdrawn from pre-retirement funds are taxed in accordance with the retirement lump-sum tax tables.

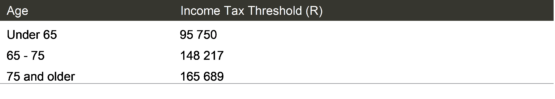

Although the transfer into retirement income vehicles is tax-free, the income subsequently paid from these annuities is subject to income tax, to the extent that it exceeds the applicable tax threshold.

Product providers administering these annuities are required to deduct income tax monthly using standard income tax tables and pay this over to the South African Revenue Service (Sars). Retirees receive an IRP5 for this income, similar to the IRP5 they received while employed.

It is important to note that most service providers deduct income tax on the assumption that the annuity income is your sole source of income. Sars, however, calculates tax based on your total taxable income received during the tax year.

ADVERTISEMENT:

CONTINUE READING BELOW

This is where many retirees encounter difficulties. Lump-sum cash withdrawals are often invested in bank deposits or other discretionary investments.

Any interest earned and capital gains realised during the tax year are also taxable and must be declared to Sars, subject to the applicable exemptions.

These investments generate IT3(b) and IT3(c) certificates, and the additional income can result in a higher tax bracket and an unexpected tax liability upon assessment.

Bank deposits, in particular, can generate significant interest income, which is fully taxable. As no tax is deducted at source during the year, this often comes as a surprise to retirees when a substantial amount becomes payable to Sars upon submission of their tax return.

For this reason, the role of a qualified financial advisor remains critical even after retirement. A financial advisor can assist in structuring retirement income and investments appropriately, ensure that all sources of income are considered, and proactively manage your tax position. This helps to avoid unexpected tax liabilities and ensures that your retirement strategy remains sustainable over the long term.