The World Bank, through its leading arm, International Bank for Reconstruction and Development (IBRD), has issued a 9-year bond worth USD 225 million. This bond supports carbon removal by funding reforestation in Brazil’s Amazon rainforest.

Unlocking the World Bank’s Carbon Removal Bond

Jorge Familiar, Vice President and Treasurer, World Bank, noted,

“A variety of partners and financing tools are needed to support the Amazon and help the people there pursue better livelihoods, protect its incredible biodiversity, and safeguard its global role in mitigating climate change.”

Notably, this is the largest bond issued by the World Bank to date, directly linked to reforestation efforts in the Amazon and promising fantastic returns. As mentioned in the press release, investors will earn a return through a fixed coupon and a variable component tied to Carbon Removal Units (CRUs). Additionally, the reforestation projects in Brazil will generate these credits.

Furthermore, investors hail this bond as unique. This means it connects their financial returns to actual carbon removal, unlike previous bonds tied to carbon credit sales from emission avoidance.

The key feature of this bond is that ~ USD 36 million will support Mombak, a Brazilian company. Mombak will use the funds to reforest land in the Amazon with native trees, boosting biodiversity and supporting local communities. This bond introduces an innovative approach to mobilizing private capital for reforestation finance.

Their Carbon Credits Boost Global Markets

Last year, the World Bank unveiled its plans to expand high-integrity global carbon markets, helping 15 countries generate income by preserving their forests. To name a few, Chile, Costa Rica, Ghana, and Indonesia were the participating countries. The bank expects these nations to generate over 24 million carbon credits in a year, potentially earning up to $2.5 billion by 2028.

The initiative is led by the World Bank’s Forest Carbon Partnership Facility (FCPF), focusing on environmental and social integrity. Since 2018, the FCPF has pioneered carbon-crediting systems, ensuring credits are unique, measurable, and permanent. Third parties rigorously monitor and verify these credits based on World Bank standard.

Can this Bond Bring High Returns and Save the Amazon Rainforest?

Jorge Familiar has been assertive of this historic transaction. He believes it demonstrates eagerness of private investors to link their financial returns to positive outcomes in the Amazon. Additionally, the promising returns signal rising interest in this structure and the growth of supported sectors.

Essentially, the bond is 100% protected, ensuring investors’ money is safe. The USD 225 million raised will fund the World Bank’s global sustainable development efforts. Instead of receiving full regular interest payments, investors will allow a portion to support Mombak’s reforestation projects through a deal with its hedge partner HSBC. Moreover, these projects align with the World Bank’s goals in the Amazon but are not funded by IBRD loans.

The Carbon Removal Units (CRUs) generated by these projects will be sold, and a share of the revenue will be paid to bondholders as CRU Linked Interest. In addition, investors will receive a guaranteed minimum interest payment. If the projects succeed as expected, bondholders could earn more compared to similar World Bank bonds.

Greg Guyett, CEO of Global Banking & Markets, HSBC commented,

“We are pleased to work alongside the World Bank on this innovative bond which aims to support the reforestation of thousands of hectares of the Brazilian Amazon rainforest. We are committed to helping our clients fund sustainable development projects that make a difference in the climate challenge. It was a privilege for HSBC to structure the transaction and act as sole lead manager on the World Bank’s largest-ever outcome bond issuance to date.”

Bolstering Investors’ Confidence

Prominent investment partners include Mackenzie Investments. T Rowe Price, Nuveen, Rathbone Ethical Bond Fund, and Velliv.

Investors consider this bond to have the potential for attractive financial returns with measurable positive impacts. They expect significant benefits through carbon removal, biodiversity enhancement, and job creation.

Hadiza Djataou, Vice President, Portfolio Manager, Fixed Income, Mackenzie Investments has significantly remarked,

“This transaction, in partnership with Mombak, offers a landmark opportunity in nature positive investment while supporting land stewardship principles. We believe the bond’s unique structure will prove to be both a strong investment and a catalyst for further innovation in the sustainable fixed-income market.“

Decoding World Bank’s Interest in Brazil

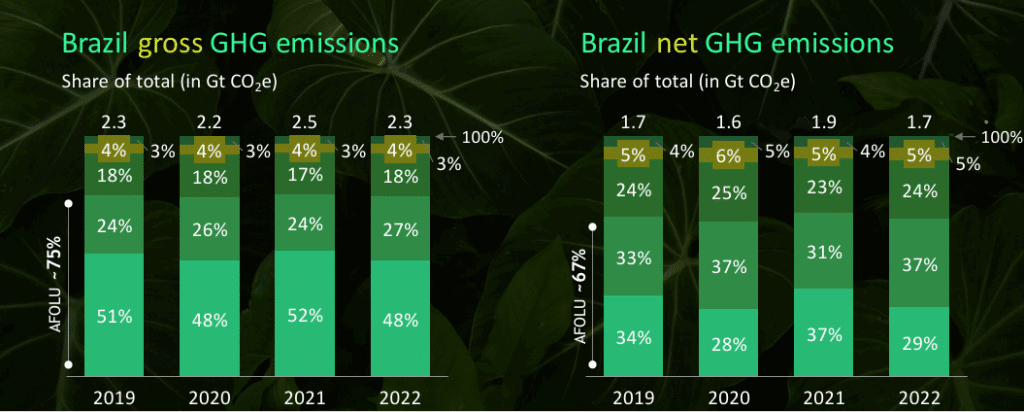

GHG emissions in Brazil surpassed 2.3 billion MtCO₂e in 2022, a decline of over 8% in comparison to the previous year. The country’s climate-aligned investments are expected to total $2-3 trillion by 2050. Brazil’s latest climate report predicted this.

Source: Brazil 2024 Climate Report

Source: Brazil 2024 Climate Report

Interestingly, AP news revealed that in 2022, Amazon trees held 56.8 billion MtCO₂e, making the Amazon a huge carbon sink. However, climate experts have shown a red flag over the ongoing deforestation that could shift the Amazon from a carbon sink to a carbon source. This is one of the reasons why Brazil has become a hot spot for environment preservation activities, particularly the Amazon rainforest.

Speaking of Brazil, the World Bank’s connection with the country is not something new. In 2022, it analyzed how Brazil could meet its climate goals and backed innovative projects. It included a whopping US$ 500 million Climate Finance Solution. This initiative aimed to expand sustainability-linked finance and help the private sector access the carbon credit market.

The World Bank announced the Amazon reforestation bond on June 14. They initially left the exact principal value undecided but have now confirmed it.