Premium Bonds: Could You Be Sitting on an Unclaimed Prize?

Rip Off Britain’s Louise Minchin

At a glance

-

Over 24 million people in the UK hold Premium Bonds, with more than £132 billion invested and £106 million in prizes unclaimed.

-

Each £1 Bond is entered into a monthly prize draw, with tax-free winnings from £25 up to £1 million.

-

Pros include Treasury-backed security, tax-free prizes and quick access to savings, but there is no guaranteed return.

-

Savings accounts currently offer higher guaranteed returns than Premium Bonds, though only Premium Bonds give you the chance to win big.

BBC Morning Live

Monday 15th September 2025

BBC iPlayer

A new figure released by National Savings & Investments (NS&I) reveals over £100m in Premium Bonds prize money is going unclaimed. Rip Off Britain’s Louise Minchin joined BBC Morning Live to explain what Premium Bonds are, how they work, and how they compare to traditional savings accounts.

What are Premium Bonds?

Premium Bonds are a savings product offered by National Savings & Investments (NS&I), which is backed by the UK Government.

Instead of earning interest, each £1 bond you hold is entered into a monthly prize draw. Prizes range from £25 up to £1 million, and all winnings are tax free.

Today, Premium Bonds are the UK’s biggest savings product, with more than £132 billion invested by over 24 million people.

How the prize draw works

Each month, millions of prizes are awarded.

In the 2025 September 1st draw, two people became millionaires, one from County Durham and one from Cumbria. Around 1,500 Premium Bonds won £5,000 each, with millions more winning smaller £25 prizes.

The odds of winning with each £1 Bond currently stand at 22,000 to 1.

Pros and cons of Premium Bonds

Pros

-

Your investment is risk free. You can hold up to £50,000 in Premium Bonds, and your money is 100% backed by the Treasury.

-

All prizes are tax free, making them attractive if you’ve already used up your ISA allowance or pay higher rates of tax.

-

You can withdraw your money quickly, usually within three working days.

Cons

-

There’s no guaranteed return. You could hold Premium Bonds for years and win nothing, which means inflation eats away at the real value of your money.

-

You can’t hold them jointly with someone else. They are always owned in an individual’s name.

-

Some savers report decades of holding Bonds without winning a single prize.

Get independent advice on Premium Bonds

Premium Bonds vs savings accounts

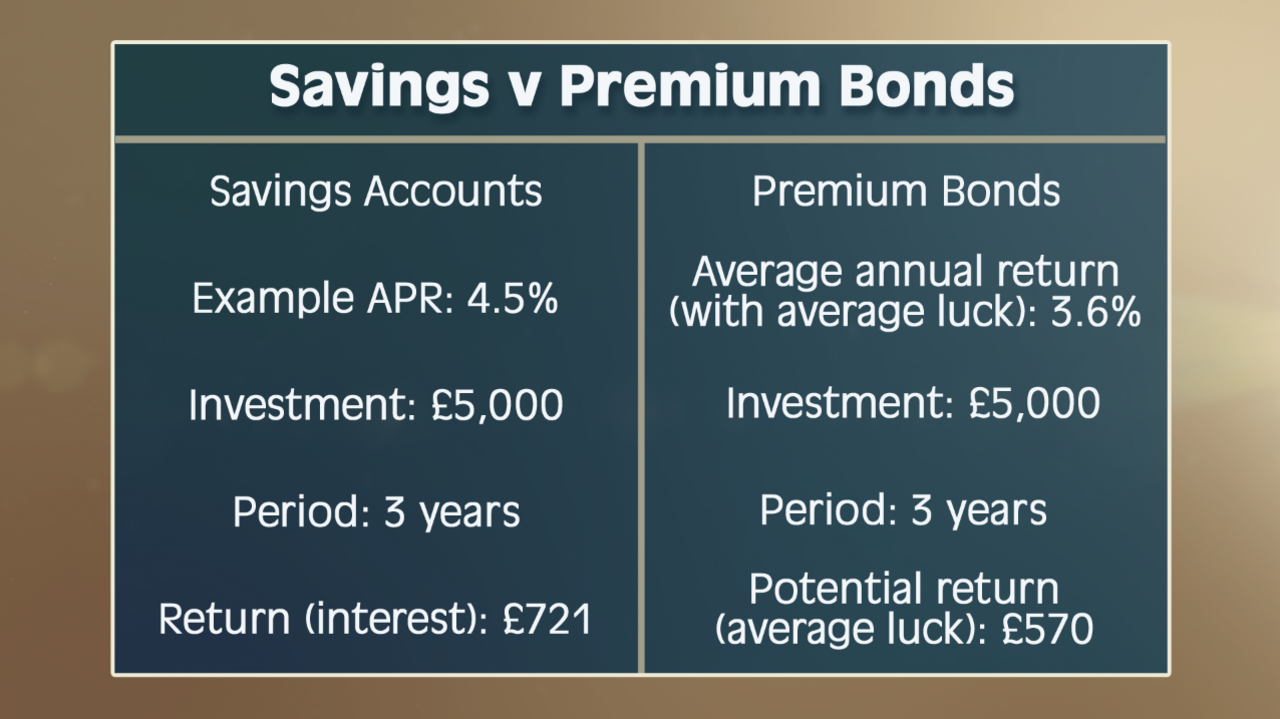

Savings accounts guarantee a fixed rate of return, which Premium Bonds do not. At the moment (Sept 2025), some of the best easy-access savings accounts are paying around 4.5% interest.

If you invested £5,000 in a savings account at 4.5% for three years, you’d earn around £721 in interest, bringing your balance to £5,721. By comparison, Premium Bonds are estimated to give an average annual return of 3.6%, which would mean around £570 over the same period.

The trade-off is potential. With Premium Bonds, you could end up with a life-changing million-pound prize.

Savings accounts guarantee a return on investments whereas Premium Bonds do not, however if luck is on your side, winning big on Premium Bonds could bring in life changing winnings.

Yes, NS&I contact all winners. For more recent Bonds, you can set up online accounts and receive winnings directly into your bank.

But if you or a relative hold older Bonds, you might not be notified if you’ve moved house and haven’t updated your details. Prizes never expire, so you can still check decades later using NS&I’s online prize checker or by post.

If you’re unsure whether you or a relative still hold Bonds, NS&I also run a tracing service. This can be done online or by sending a claim form in the post.

Track down lost Premium Bonds here, external

Get advice on unclaimed prizes here, external

A BBC Morning Live viewer’s old Premium Bond, purchased in 1963

What happens to Premium Bonds when someone dies?

Premium Bonds cannot be transferred to someone else after death. They form part of the person’s estate and must eventually be cashed in.

They can, however, remain in the monthly draw for up to a year after death. Any prizes won in that period are paid into the estate before the Bonds are closed.