These smart strategies will help make your retirement years secure and stress-free.

Just because you’ve retired doesn’t mean your income is tax-free. (Epicstock/Dreamstime/TNS)

By Rachel Brown Kirkland – For The Atlanta Journal-Constitution

1 hour ago

Rob and Kathleen Sable know the value of careful planning. After nearly four decades running their dental practice in metro Atlanta, the couple sold the business in 2024 and stepped into retirement with confidence.

Their preparation began decades earlier when Rob opened his solo cosmetic and general dentistry practice in 1985 with Kathleen doing accounts payable and external marketing. The Sables opened a profit-sharing plan in the early years, committed to bimonthly contributions, maxing them out every year without fail. And they hired a team of professionals to ensure their success — an asset manager, an accountant and an estate attorney.

“This was our early plan: save, save, save,” Rob said.

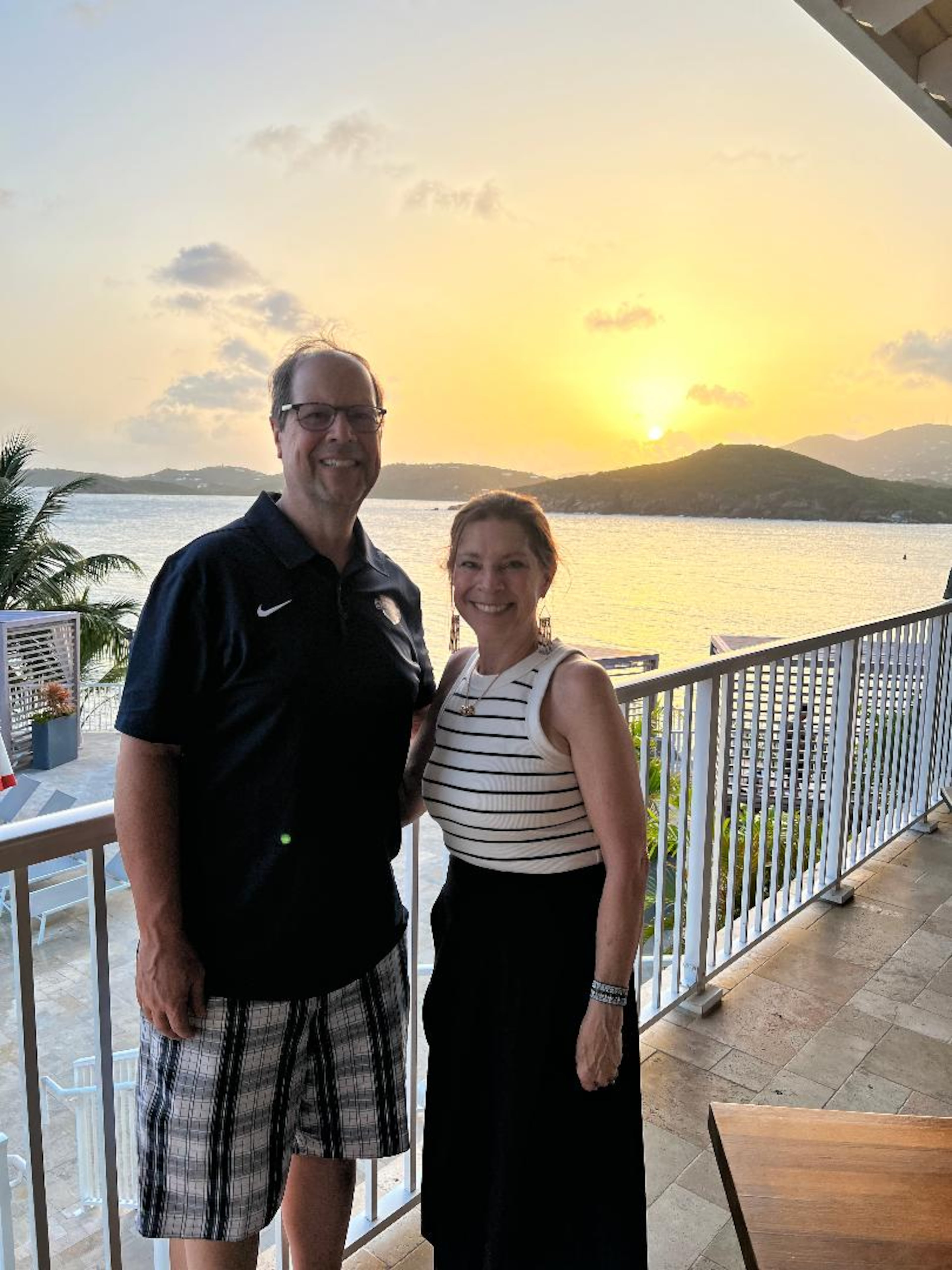

Rob and Kathleen Sable enjoy traveling during retirement. They recently visited the United States Virgin Islands.

It’s paid off as the couple now enjoys traveling where they want when they want — whether to Maine or the Virgin Islands.

“We honestly cannot think of anything (we would go back and do differently),” she said. “How amazing is that?”

Their story underscores a reality many approaching retirement face: preparing for life after work requires more than savings alone. Health care costs, tax implications and the emotional roller coaster of spending patterns all play into whether retirement will be smooth or stressful.

Experts say there are several major considerations everyone should weigh.

Know your spending

It goes without saying that retirement planning includes knowing where every dollar goes. If you haven’t tracked spending, now is the time to start, experts say.

One of the most pressing spending questions for would-be retirees is how much health care will cost before age 65, the age when Medicare eligibility begins.

Jeff Purdon is a financial planner with Raymond James Financial Services. (Photo provided by Jeff Purdon)

Jeff Purdon, a financial planner with Raymond James Financial Services, emphasized that understanding those costs is critical. He pointed to his own experience — in his 60s, living with Type 2 diabetes and nine months away from Medicare — as an example of how health considerations can change the equation.

Purdon said people often underestimate not only the medical expenses themselves but also the broader impact on retirement budgets.

Be intentional about the spending roller coaster

Purdon describes spending in retirement as a roller coaster.

“What I find is that in retirement, people spend more money in the first five years than they do going forward,” he said. “Why? We live in a place where when you have the money, you don’t have the time. When you have the time, you don’t have the money. And then you get to the stage that I’m in, and if you have the money and the time, you may or may not have your health.”

He warns against assuming the traditional model that retirees can live on 70% of their pretax income. “I find that people are still spending close to a hundred. Why? Because they’re now taking that trip that they didn’t take.”

That early splurge period can skew financial projections.

The math matters. For example, he said, someone earning $200,000 annually may be living paycheck to paycheck. In retirement, they might have $80,000 or $90,000 a year — “which is not a bad number, but it isn’t $200 (thousand).”

Plan with family in mind

Purdon emphasizes that retirement planning isn’t just about the individual — it’s about family.

“The goal at retirement is to be able to live your life, financially independent, for the rest of your life at the standard of living you would like to live at,” Purdon said. “The best gift to your children is to have your estate squared away so it’s easy for them to take care of that and/or take care of you.”

That preparation matters in both directions.

“One out of three adults is supporting their parents,” Purdon said. On the other side, parents sometimes undermine their own retirement by paying too much for grown children. “Spoiling their children,” he said, can derail carefully laid plans.

He recommends reading “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko for insights on building wealth and security. And his message is clear: “You want to own your lifestyle, not rent it. There are far too many people renting their lifestyle.”

Choose advisors wisely

With 32 years of experience, Purdon said he’s more interested in giving clients the truth than in drumming up business. He warns that many in the industry do not necessarily have a client’s best interests in mind.

“You have to educate yourself so you can make good decisions,” Purdon said. “There are a lot of people in my business who are pretty sketchy. … Understand who you’re sitting across the table from because a lot of these folks may not be very good financial advisors, but they’re very good salespeople. And they’re very good at convincing you to do those things.”

His advice echoes a timeless lesson: “It goes back to what your mama taught you, and my mama taught me: If it sounds too good to be true, it probably is. Step away. And don’t get greedy,” he said.

Understand how retirement has changed

Shawn Maloney, who has been in the industry for more than 20 years, adds another perspective. The author of “The Priority of Retirement” and host of the “Retire Wise” show on XTRA 106.3 on Sunday mornings, his Retire Wise firm operates from Lawrenceville. His firm, launched independently five years ago, focuses exclusively on retirement planning — both saving for retirement and managing money wisely in retirement.

Shawn Maloney is an independent financial planner, author of “The Priority of Retirement” and owner of Retire Wise. (Courtesy)

“A lot of people get to retirement and don’t know how to make their money last,” Maloney said. A key question he seeks to help with is: “What do you do on the downside of retirement once you get there?

There is no one-size-fits-all answer to that question. But careful planning and bringing in professionals for advice is a good start. And it reflects how different retirement planning is now from the world his grandparents knew.

“Back in the day, you had a pension, you had Social Security and then you may have had a little bit of personal savings,” Maloney said. “So you had your retirement party and you turned on your pension, you turned on your Social Security and away you’d go. There wasn’t a lot of planning involved.”

Adjust your strategy as you age

Two shifts are particularly important, Maloney said: moving from accumulation years to preservation years, and rethinking investment style.

“You can’t build it the same way you did in your accumulation years,” he said. “We have to shift from an all-out growth mode to a ‘preserve plus grow.’”

Health care and taxes loom especially large. “Our money acts differently in retirement than it does in our working years,” Maloney said.

He strongly cautions against the so-called 4% rule, which suggests withdrawing 4% of retirement savings each year. But this method fails to account for inflation, market risk or personalized needs.

“It’s very misleading and it gets people in trouble,” he said. Instead, he recommends starting with a full income analysis, followed by a detailed risk analysis. Personalized planning beats online advice every time, he added.

Write out a plan

Waiting too long to start planning is a common mistake, but Maloney urges people not to give up if they’ve fallen behind.

“No matter how long you wait, even if you kick it down the road, just bite the bullet,” he said. “You’ve got to start somewhere.”

Maloney’s bottom line is clear: Have a written, analyzed plan. Many people, he said, do not have an analyzed, written-out retirement plan.

“It’s like going on a trip,” he said. “Why would you go on a trip from Georgia to California without having it plotted out on a map or using your GPS? You’re going to get lost.”