Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Nvidia chief executive Jensen Huang reaffirmed his commitment to Taiwan as a global technology hub on Monday, announcing the construction of a new local base in Taipei and an artificial intelligence supercomputer that would use thousands of the company’s chips.

The move comes as President Donald Trump’s administration pressures technology companies to increase manufacturing on US soil, and as Huang seeks to navigate new tariffs and export controls that threaten Nvidia’s massive sales of AI chips, which are heavily dependent on Taiwan’s supply chain.

Speaking at Taipei’s Computex tech show, Huang also announced a range of new products aimed at embedding the company’s technology at the heart of an AI infrastructure industry he predicts will be worth multiple trillions of dollars over the coming years.

Huang paid tribute to Taiwan, “the largest electronics manufacturing region in the world”, saying that it was the “centre of the computer ecosystem”.

Foxconn subsidiary Big Innovation Company will work with Nvidia and the Taiwanese government to build an AI supercomputer using 10,000 of Nvidia’s latest Blackwell chips to be used by Taiwan’s tech ecosystem. The investment would be likely to run into hundreds of millions of dollars, based on estimates of the cost of an individual chip.

$500bn

Nvidia’s 4-year spending plan for US AI infrastructure

Its customers will include Taiwan Semiconductor Manufacturing Company, Nvidia’s key manufacturing partner, which will use it to research and develop new chip-building processes.

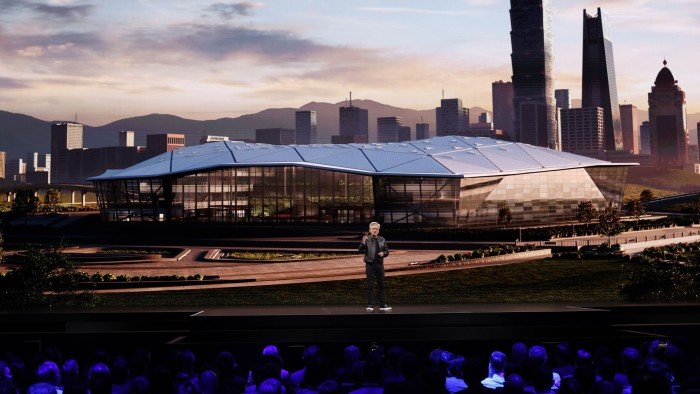

“We are growing beyond the limits of our current office [in Taiwan],” Huang said, as he revealed a video of a futuristic spacecraft landing and transforming into the design of its new “Constellation” building that will start construction soon in the capital’s Beitou district.

The plan reflects a broader spending trend by Nvidia, which has become a $3tn company in the space of just a couple of years. For example, Huang has pledged to spend up to $500bn over the next four years on AI infrastructure in the US with partners that include Taiwan’s TSMC, Foxconn and Wistron.

But moving high-tech manufacturing to the US will take years, and in a short demonstration video, Huang narrated how multiple high-tech companies manufacture Nvidia’s latest chips, many based in Taiwan.

The Nvidia chief also unveiled an “‘NVLink Fusion” initiative aimed at combining the company’s technology with the custom-designed products of competitors.

The move would both open up Nvidia’s ecosystem to new chip players while cementing its technology as the go-to solution for the underlying infrastructure on which they run. Big Tech companies such as Google and Amazon have worked on building their own AI chip technology, seeking to bring more of the technology in-house to reduce their reliance on the market leader.

Huang said the new feature would allow competing chips to plug into Nvidia’s graphics processing units and its NVLink networking technology, which connects the chips together across servers.

“Nothing gives me more joy than when you buy everything from Nvidia . . . but it gives me tremendous joy if you just buy something from Nvidia,” he quipped.

Huang is in Taiwan following a whistle-stop tour of the Gulf with President Trump last week, with Saudi Arabia and the United Arab Emirates both committing to multibillion-dollar AI infrastructure projects.

It follows the administration’s revocation of a Biden-era rule that would have restricted the export of Nvidia’s leading AI chips to dozens of countries. Trump has simultaneously cracked down on exports of Nvidia’s China-specific AI chip, the H20.

Arriving in Taiwan on Friday and mobbed by fans asking him to sign hats and baseballs, Huang told reporters that Trump’s involvement in the Gulf deals showed that he supported “the world having access to Nvidia technology to build AI infrastructure”.

Asked about the potential for Nvidia to build a new chip for China that would comply with the latest export controls, Huang said the company was “evaluating how best to address the China market”, but that no further modifications to the H20 were feasible.

The company has been considering how it might redesign its chips to continue to sell them in China while complying with US controls. The Financial Times reported last week that Nvidia is planning to build a new research facility in Shanghai in a sign of its commitment to the country.

Huang added that there was “no evidence of any AI chip diversion” to China, a concern that motivated US lawmakers to write to the company last month.