Matt Prince

Matt PrinceWhen Max Prince turned 18 he got the Child Trust Fund his parents opened when he was born – only to discover surprise fees had left him with just £12.39.

He was one of about six million babies, born between September 2002 and January 2011, who all received at least £250 from the government to kick start their savings.

The idea was the long-term tax free savings pot would go up in value by their 18th birthdays.

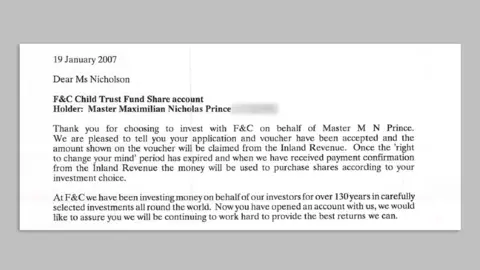

When Max’s fund matured, investment firm Columbia Threadneedle was in charge of it. It said it had written to his parents about a £30 annual charge but the letters were returned unopened. The family had moved house and over the years the fee ate almost all of the savings.

Child Trust Funds were set up by the then Chancellor Gordon Brown with strict rules on how much could be charged in fees.

The first of those funds started maturing four years ago when those babies began turning 18 and, like Max, were notified that they could finally access their savings.

“We’d been expecting this letter for a while, I mean we’d been waiting for it for 18 years basically,” said Max.

“So when me and the family one morning opened this letter, expecting to find at the very least £300 or so, we instead saw the number £12.39. Not £120, not anything… just £12.39.

“It was certainly shocking, to say the least, and it’s kind of outrageous as well.”

Matt Prince

Matt Prince‘It’s unexplainable’

Statements seen by the BBC show the fund was worth just over £300 by 2012.

But as of 2013, a £30 annual administration charge began on the account which Max’s parents said they knew nothing about.

The maximum fee allowed to be charged on Child Trust Funds was set at 1.5% but the BBC has calculated Max was effectively charged 10% and more each year.

The fund was originally administered by F&C Investments but after a series of industry takeovers ended up with multi-billion pound investment firm Columbia Threadneedle by the time it matured.

It told the BBC the type of account chosen by Max’s parents was a CTF Shares account, which has a different fee model. Subsequently the £25 plus VAT charge was for administering the account, not the underlying investment.

The company told the BBC it had tried to contact Max’s parents when it put in place “the current charging structure” but that its letters were returned unopened.

Max’s parents said they had moved house and did not receive the letters despite setting up a forwarding system. They said they knew the details of Max’s fund and knew when it was due to mature but had not expected to be contacted before then.

Columbia Threadneedle said its Child Trusts Funds “require customers to actively make their own investment decisions and without authorisation and communication from customers, we are unable to take action on their behalf”.

Matt Prince

Matt PrinceMax’s parents told the BBC they were unhappy with this explanation and would contact the firm to complain.

Max said: “The money was originally intended by Gordon Brown to be something that would help future adults just get off the ground a bit, get ahead in life.

“In the grand scheme of things it can’t be a lot of money for the company, right? It’s only around £300, so it is unfair in my opinion.

“You could say cruel. It’s unexplainable I think would be the best way of putting it.”

Money sitting unclaimed

The average amount in Child Trust Funds is estimated to be around £2,000 because of growth over the years and extra money put in by family and friends.

But many funds are sitting unclaimed because people simply don’t know about them.

Gavin Oldham is an investment expert with decades of experience in the industry who now runs a government-backed organisation that helps locate lost Child Trust Funds. He is campaigning to help hundreds of thousands of young adults from low-income households access an estimated £800m of money held in lost funds.

He said Max’s was “a fairly shocking story”.

“The investment company… certainly did have discretion to get rid of that £25 plus VAT charge per year, and they do have the discretion now to reimburse the whole lot [of charges] together with a compensation award as well,” he said.

“The next step for that family is to go and talk to the [Financial Ombudsman Service] and they’d take a fairly dim view of this I’d imagine.”

Columbia Threadneedle told the BBC: “As we assess our Child Trust Funds, we will place a specific focus on identifying other similar situations to assess, as appropriate, what action we can take.

“Our ongoing duty to the consumer is important to us and thank Money Box for raising this case with us.”