Venture capital has fueled some of the most transformative companies in history, often with eye-watering investments. From billion-dollar funding rounds in AI and fintech to late-stage bets on emerging markets, VCs are writing larger checks than ever before. These high-stakes investments not only shape industries but also define the future of innovation. In this article, we explore the most expensive VC deals, the firms behind them, and what these mega-rounds reveal about the direction of global capital.

Key Takeaways

- 1$1.5 billion: The largest single VC investment round to date went to ByteDance, the parent company of TikTok.

- 2The biggest funding rounds are concentrated in sectors like AI, fintech, biotech, and clean energy.

- 3While the U.S. and China lead in mega-round activity, India and Europe are emerging as strong late-stage markets.

- 4AI and climate tech are attracting larger VC rounds than ever before. While billion-dollar deals remain rare, they’re expected to continue for standout companies in these sectors.

What Makes a Venture Investment “Expensive”?

Expensive venture capital deals are defined not just by size, but by their influence, stage, and risk profile. These investments often represent high-stakes bets on companies poised to dominate their industries or go public.

- Not all big checks are equal – The sheer size of the investment doesn’t make it expensive; valuation, risk, and strategic timing matter just as much.

- $500 million+ benchmark – Typically, rounds over this amount, especially from Series C onward, are considered part of the elite funding class.

- Late-stage capital – These are not seed or early-stage rounds; they’re growth accelerators aimed at scaling teams, tech, and market reach.

- Market-shaping impact – Mega-deals often set new valuation records and inspire follow-on rounds in similar startups or sectors.

- Unicorn and decacorn fuel – Many of these investments push startups across the $1B+ (unicorn) or even $10B+ (decacorn) valuation threshold.

- Strategic dominance – These rounds signal investor confidence in the startup’s ability to own a category or disrupt incumbents.

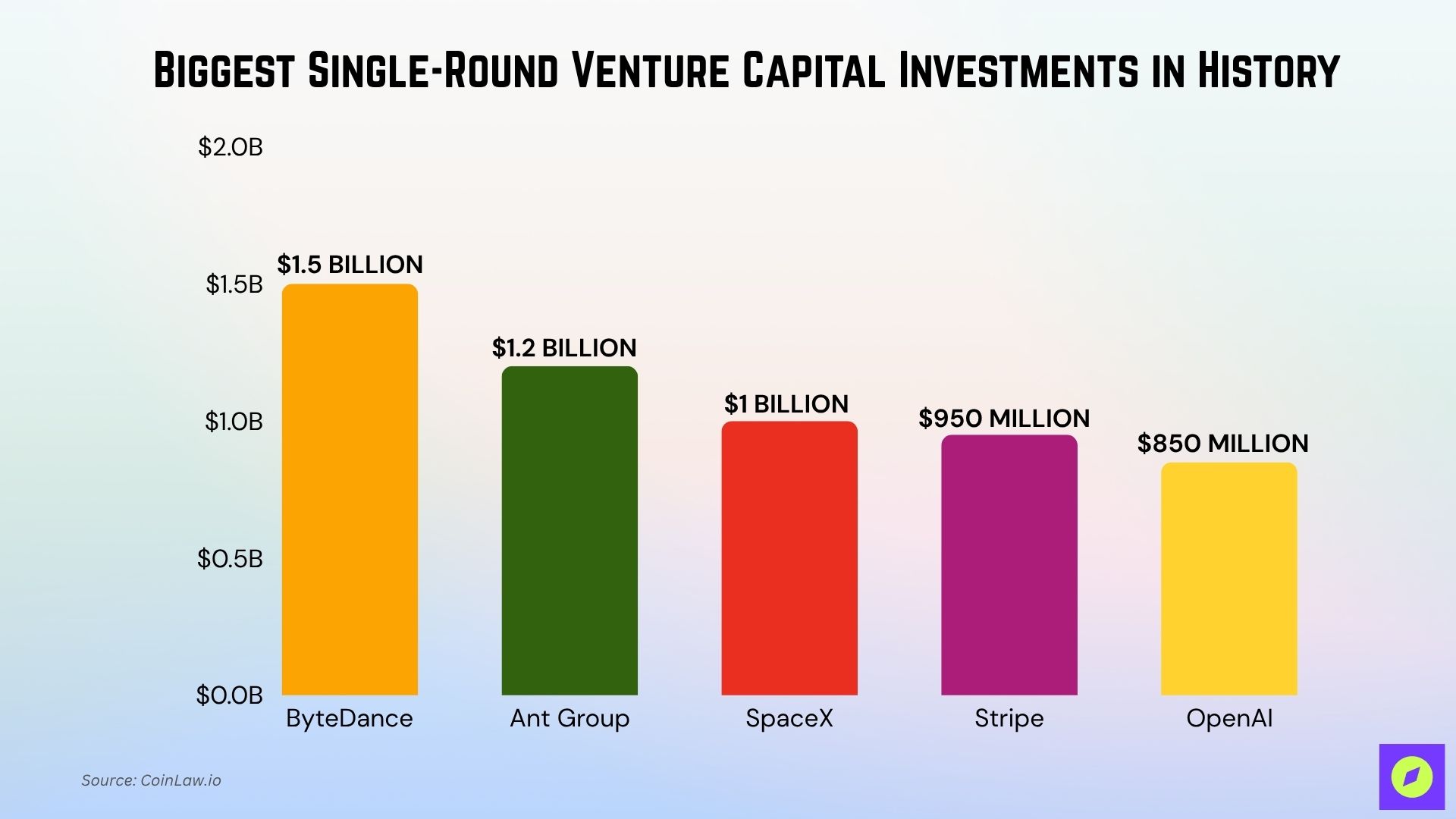

The Top 5 Most Expensive VC Rounds of All Time

| Rank | Company | Round Size | Year | Lead Investor(s) | Sector |

| 1 | ByteDance | $1.5 billion | 2018 | SoftBank Vision Fund | Social Media / AI |

| 2 | Ant Group | $1.2 billion | 2018 | Temasek, Warburg Pincus | Fintech |

| 3 | SpaceX | $1 billion | 2022 | Andreessen Horowitz, Sequoia | SpaceTech |

| 4 | Stripe | $950 million | 2021 | Fidelity, Allianz, Baillie Gifford | Payments |

| 5 | OpenAI | $850 million | 2023 | Thrive Capital, Khosla Ventures | Artificial Intelligence |

1. ByteDance – $1.5 Billion

Founded in China, ByteDance is a global internet technology company best known for creating TikTok and its Chinese counterpart, Douyin. It has become one of the most influential platforms in short-form video and algorithm-driven content discovery.

- Lead Investor(s): SoftBank Vision Fund

- Sector: Social Media / AI

- Why It Matters: ByteDance’s massive $1.5B round in 2018 was a turning point, not just for the company, but for the entire venture capital world. This funding gave TikTok the fuel to aggressively expand globally, disrupting Western giants like Facebook and YouTube. SoftBank’s bet on ByteDance was also part of its broader strategy to dominate mobile-first tech in Asia.

Impact:

- Elevated ByteDance into “decacorn” status (valuation $10B+)

- Enabled the company to acquire and scale Musical.ly into TikTok

- Cemented SoftBank’s Vision Fund as a force capable of moving global tech markets

2. Ant Group – $1.2 Billion

Ant Group is a financial technology powerhouse affiliated with Alibaba Group, operating the widely used mobile payments platform Alipay. It plays a central role in China’s digital finance ecosystem, offering services in wealth management, lending, insurance, and blockchain.

- Lead Investor(s): GIC, Temasek, Warburg Pincus, Carlyle Group

- Sector: Fintech

- Why It Matters: Ant Group (an affiliate of Alibaba) raised $1.2B in what was supposed to be a prelude to the world’s largest IPO, until Chinese regulators intervened. This funding round underscored China’s dominance in fintech and the growing importance of super apps.

Impact:

- Established Ant as the world’s most valuable fintech

- Highlighted the rise of Asia-based VC mega-rounds

- Its IPO freeze became a case study in geopolitical risk for investors

3. SpaceX – $1 Billion

Founded by Elon Musk, SpaceX designs, manufactures, and launches advanced rockets and spacecraft with the goal of reducing space transportation costs. The company has pioneered reusable rocket technology and leads private efforts in space exploration and satellite internet.

- Lead Investor(s): Sequoia Capital, Andreessen Horowitz

- Sector: Aerospace / SpaceTech

- Why It Matters: SpaceX is one of the few non-software companies to consistently secure multi-billion-dollar venture funding. This round, focused on expanding Starlink and space exploration missions, reinforced Elon Musk’s private space monopoly and redefined venture capital’s comfort zone.

Impact:

- Pushed SpaceX closer to IPO speculation

- Strengthened Starlink’s global satellite rollout

- Positioned VCs as key backers in infrastructure-heavy sectors

4. Stripe – $950 Million

Stripe is a US-based financial infrastructure company that provides payment processing software and APIs for internet businesses. Its technology powers transactions for millions of companies worldwide, from startups to Fortune 500 enterprises.

- Lead Investor(s): Fidelity, Allianz X, Baillie Gifford

- Sector: Payments / Fintech

- Why It Matters: Stripe’s late-stage mega round turned the payments giant into one of the most valuable private companies in the US. Unlike many unicorns that burn cash, Stripe’s model impressed investors for its scalability and reach into e-commerce, subscriptions, and SaaS infrastructure.

Impact:

- Sparked widespread VC attention on B2B fintech

- Reinforced Stripe as a modern backbone of online payments

- Signaled confidence in Stripe’s IPO potential, though it’s still pending

5. OpenAI – $850 Million

OpenAI is an artificial intelligence research and deployment company focused on creating safe and broadly beneficial AI systems. Known for innovations like GPT-4 and ChatGPT, it bridges cutting-edge AI development with practical, commercial applications.

- Lead Investor(s): Thrive Capital, Khosla Ventures, Sequoia

- Sector: Artificial Intelligence

- Why It Matters: OpenAI’s $850M round was more than a funding event; it was a strategic arms race trigger in AI. While Microsoft’s multi-billion-dollar investment remains separate, this round signaled that traditional VCs also wanted skin in the AI game beyond Big Tech partnerships.

Impact:

- Boosted OpenAI’s infrastructure and R&D capabilities

- Helped scale ChatGPT and other commercial products

- Marked the start of generative AI as a key VC battleground

Sectors Dominating Billion-Dollar VC Rounds

Certain industries consistently attract the biggest VC checks, often because of their disruptive potential, scalability, and massive addressable markets. These sectors aren’t just hot, they’re reshaping the global economy.

- Artificial Intelligence (AI): AI has become venture capital’s crown jewel. From language models to autonomous systems, startups in this space are raising hundreds of millions, often before reaching profitability.

- Fintech: Fintech remains one of the most capitalized sectors, with companies like Stripe, Klarna, and Revolut raising late-stage rounds nearing or exceeding $1 billion. Investors love the sector’s blend of scale, recurring revenue, and regulatory tailwinds in emerging markets.

- Biotech & Healthtech: Venture capital in biotech has surged, especially post-pandemic, as breakthroughs in genomics, mRNA, and AI-driven drug discovery have opened new doors. These deals often involve deep-tech science, longer timelines, and higher risk, but also higher returns.

- CleanTech and Energy: With global climate targets driving demand, energy startups are now securing some of the largest funding rounds in VC history. Companies working on battery tech, hydrogen, carbon capture, and renewables are attracting both traditional VCs and sovereign wealth funds.

- Aerospace / SpaceTech: Once dominated by governments, space is now a private VC frontier. SpaceX’s massive raises show investor appetite for long-horizon infrastructure plays, from launch systems to satellite internet.

The High-Risk, High-Reward Nature of Mega-Deals

While mega-deals can generate outsized returns, they also come with outsized risks. As funding sizes balloon, so do expectations, and the pressure to deliver results under public and investor scrutiny.

- WeWork raised more than $10B before collapsing in value, showcasing how weak fundamentals can sink even well-capitalized firms.

- Theranos, once valued at $9B, unraveled under regulatory and legal scrutiny despite backing from major investors.

- Katerra, a SoftBank-backed construction tech startup, burned through over $2B before shutting down operations in 2021.

These cautionary tales highlight that capital alone doesn’t guarantee success. Governance, product-market fit, and execution remain critical at any stage.

Conclusion: Mega-Rounds Define the Future

The most expensive venture capital investments aren’t just a reflection of capital abundance; they’re a signal of confidence in the ideas, markets, and founders that will shape the next decade. While the risks are high, so are the rewards, and the ripple effects of these deals extend far beyond the companies themselves. As global capital pools deepen and innovation cycles accelerate, the next wave of billion-dollar rounds is already in motion.