Japanese government bonds (JGBs) rebounded on Wednesday after a rout that rippled across global markets, though trade remained skittish and volatile, and stocks slipped for a fifth straight session.

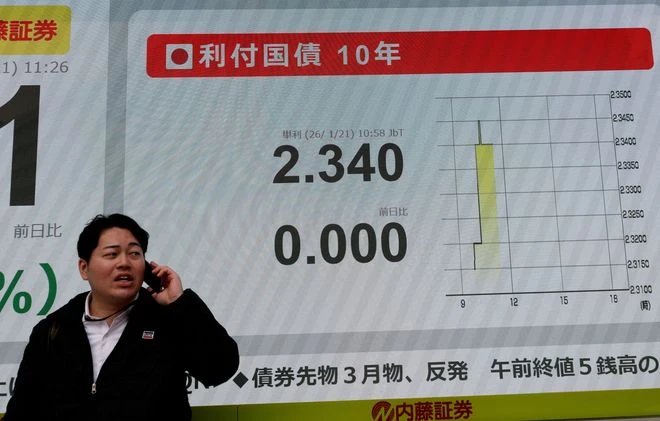

The 30-year JGB yield slipped 16.5 basis points to 3.71%, down from an unprecedented 3.88% in the previous session. The benchmark 10-year yield fell 6 bps to 2.280% after reaching a 27-year high on Tuesday. Yields move inversely to bond prices.

Japan’s markets are in a fragile state this week, with Prime Minister Sanae Takaichi set to dissolve parliament on Friday to trigger a snap election, while the central bank meets on policy the same day.

Yields on many JGB tenors surged to record highs on Tuesday after Takaichi pledged to eliminate sales taxes on groceries, fueling concerns about the country’s already precarious finances. Finance Minister Satsuki Katayama called for calm in the markets, telling Bloomberg News overnight that the government’s fiscal policy was not expansionary.

“Yields fell sharply after overnight comments from the Finance Minister Katayama eased market sentiment,” said Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management.

“But trading is thin. Only a small number of investors bought bonds and that pushed prices sharply higher,” he said.

The rout in JGBs was reminiscent of the 2022 collapse in British gilts and a warning for confidence in Japan’s balance sheet. A decline in yields on most Japanese tenors on Wednesday helped defuse some of those worries.

Yuichiro Tamaki, the head of an influential opposition party, told Reuters on Wednesday that policymakers could correct the “abnormal” moves in assets through actions including JGB buybacks or reductions in the issuance of super-long notes.

The benchmark Nikkei 225 Index fell 0.4% to close at 52,774.64, capping a five-day slide that was the gauge’s longest decline in a year. The broader Topix slid 1% to 3,589.70.

Sentiment was dampened by a mix of domestic political uncertainties and global trade frictions.

“Today, investors are probing the market with small buys after the sharp declines of the Nikkei. The market wanted to defend the psychological line of 52,000,” said Kazuaki Shimada, chief strategist at IwaiCosmo Securities.

U.S. equities, which ended weaker overnight, also hurt investor sentiment, with all three major Wall Street indexes closing with their biggest one-day drops in three months on concerns that fresh tariff threats from President Donald Trump against Europe could signal renewed market volatility.

Financial stocks fell, with a Topix sub-index of banks sliding 3.2% to lead decliners among 33 sectors.