By David Williams

InvestIntellect.co.uk

There is a moment in every emerging market cycle when noise gives way to pattern. When repetition sharpens into signal. In the art world, those moments are rarely loud when they arrive. They tend to surface quietly, almost reluctantly, before becoming obvious in hindsight.

Mr. Phantom belongs to that early stage.

Over the past five years, his work has circulated steadily through private collections, selective exhibitions, and closed conversations. There has been no public campaign demanding attention, no manufactured mythology introduced prematurely. Instead, the recognition has moved laterally, carried by collectors, curators, and industry insiders who recognised something forming before it could be named.

What first distinguishes Mr. Phantom is not anonymity alone. The art world has long been comfortable with artists who recede from view. What sets him apart is how anonymity functions not as concealment, but as structure. It is not absence. It is discipline.

Sarah Freeman, Mr. Phantom’s manager, noticed this early.

“I’ve worked with many great artists,” she explains. “What stood out immediately was his insistence on finding the right people for the right roles. He wasn’t interested in speed. He was interested in alignment.”

Her first encounter with his work was not framed as opportunity. It was repetition. His name kept resurfacing. Conversations circled back. Early exhibitions drew attention that felt unforced. The interest was organic, but persistent.

“I was watching from the background,” Freeman says. “And eventually, I made the first move.”

That decision coincided with Mr. Phantom’s introduction to London Art Exchange, a gallery known less for spectacle and more for systems. Under the leadership of CEO Kylie James, the platform operates with an understanding that modern artistic relevance is shaped as much by infrastructure as by imagery.

Technology, Mr. Phantom understood, was not a replacement for craft. It was a multiplier.

The first exhibition confirmed what early observers had sensed. Attendance exceeded expectation. Conversation lingered beyond the event itself. The work did not rely on explanation. It invited interpretation.

In a market that increasingly rewards visibility, Mr. Phantom chose withdrawal. His anonymity was not a provocation. It was a refusal to let identity outrun output.

“When you’re a rebel,” Freeman notes, “the most effective ones don’t shout. They move through whispers. Those whispers turn into noise over time.”

Early commentary often misunderstood the work. His first series, followed closely by the second, were dismissed by some as stencil-based, derivative, or mechanically produced. Comparisons to Banksy surfaced quickly. Speculative reports circulated.

Mr. Phantom anticipated this.

Rather than respond, he waited. When the time was right, he released documentation showing the reality of his process. Every line was freehand. Every composition executed manually. Even the works that visually suggested stencil methods were produced without them.

It was not a rebuttal. It was clarification.

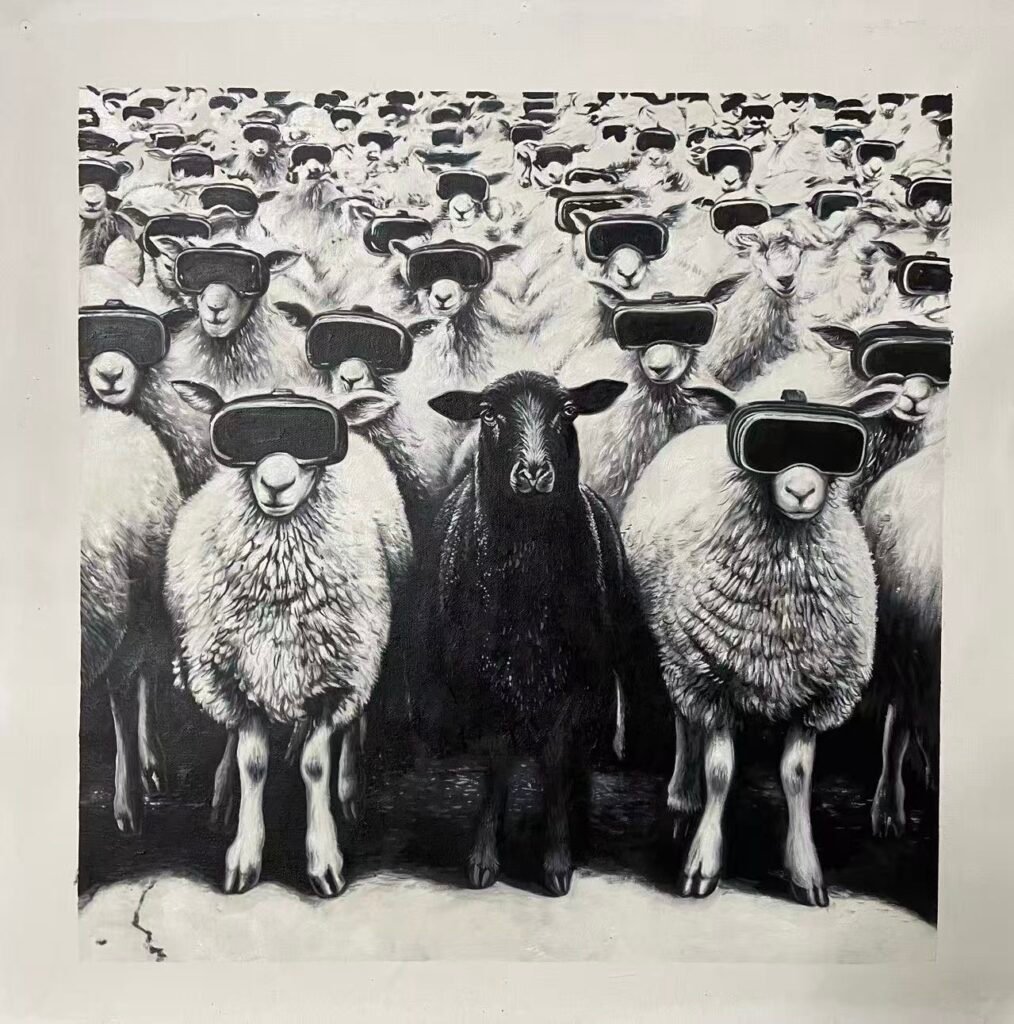

The comparison to Banksy remains inevitable. Both operate within visual languages that draw from street culture, political symbolism, and mass recognition. Yet where Banksy’s complexity often resides in message dissemination, media amplification, and public provocation, Mr. Phantom’s complexity is internal.

Banksy perfected the art of reach. Mr. Phantom is refining the art of execution.

His works appear deceptively simple. Direct imagery. Familiar references. Bold forms. But simplicity here is not reduction. It is compression.

“Every line matters,” Freeman explains. “Every space has intention. The time involved is extraordinary.”

This becomes most apparent in his Masterworks series, a body of ten pieces that openly engages with art history. Basquiat. Picasso. Warhol. Haring. Lichtenstein. These names are not hidden influences. They are acknowledged sources.

Picasso’s famous remark, “Good artists copy, great artists steal,” serves less as justification than as framework. Mr. Phantom does not imitate. He extracts. He studies what made those artists singular, then reconstructs those principles within his own visual language.

The result is not homage. It is dialogue.

What emerges is an artist who is less interested in style than in lineage. His work situates itself not among contemporaries, but within a longer argument about authorship, originality, and reinterpretation.

London Art Exchange’s role in this trajectory has been deliberate. Rather than accelerate output, the gallery emphasised pacing. Systems were put in place not to maximise short-term exposure, but to protect long-term positioning.

“They work like a record label,” Freeman says. “They understand marketing, but they also understand restraint.”

Algorithms, audience analytics, and trigger-based release strategies are employed not to manufacture demand, but to monitor it. This allows the work to surface naturally while maintaining scarcity.

Behind the scenes, Freeman’s management approach has been equally structured. Boundaries were established early. Parameters defined. Not to limit creativity, but to preserve it.

“When you’re signed,” she explains, “there are responsibilities. There’s structure. That doesn’t suppress genius. It protects it.”

Despite this framework, Mr. Phantom remains resolutely independent in thought. In conversation, he is measured. Precise. He listens more than he speaks. There is no performance to his anonymity. No theatrical withdrawal.

What surprises most is his clarity around what he does not want.

That clarity extends to collectors.

Those following his work closely describe a subtle shift. Early acquisitions involved discussion. Evaluation. Comparison. Recently, the questions have changed.

“How many are available?” replaces “Why this piece?”

“Can I secure one?” replaces “What’s the price?”

This shift signals something critical. When collectors sense inevitability, behaviour changes. Negotiation fades. Timing becomes central.

From a market perspective, the indicators are consistent. Demand curves steepen. Secondary interest emerges before secondary platforms exist. Acquisition patterns repeat across unrelated buyers.

The projection toward seven-figure valuations is not speculative optimism. It is pattern recognition.

Freeman is candid about this trajectory. “We already know where this is heading,” she says. “Seven figures is not the ceiling. It’s the next marker.”

The greater challenge now is not growth, but velocity.

Time, in this phase, becomes the final ingredient. Rushing risks dilution. Overexposure risks flattening.

Mr. Phantom’s work requires space to settle into culture rather than cycle through trend.

What he is building is not a brand. It is a position.

A position that acknowledges influence without dependence.

That values process as much as presence.

That allows anonymity to function as focus.

In five years, this period will likely be described as inevitable. The early signs will appear obvious. The ascent will seem pre-written.

What will be forgotten is how quiet it was at the beginning.

How controlled.

How deliberate.

That is often how the most serious trajectories begin.