HEAVYWEIGHT boxer, fashion icon, and now property magnate.

We are used to seeing Anthony Joshua, 34 dominate in the ring.

While since he became a sporting legend, glam magazines have put AJ on their front covers modelling designer clobber and looking dapper in a fine cut suit.

But, it’s as a real estate investor the two-time unified WBO, IBF, and WBA champion is using as his retirement plan.

Playing real-life Monopoly, Joshua has bought commercial buildings in Mayfair and Bond Street – the latter for a whopping £25million.

Through his company 258 Investments he has also acquired two residential homes in North London, and is said to own three homes in his native Watford worth £1.5million.

Back in October, The Sun exclusively reported Joshua dropped £30million on a 301,000 square foot property in Hertfordshire, which was previously the HQ for oil giant BP.

73 New Bond Street, £25million

Before the dust had settled following his April demolition of Jermaine Franklin at the Greenwich O2, we revealed AJ had splashed the cash on a property on one of London’s poshest streets.

While he may have earned around £20million for that pay day, that didn’t cover the cost of 73 New Bond St.

AJ spent £25million on that exclusive address.

A source close to the boxer told SunSport: “He has always had his eye on the bigger picture when it comes to business and wealth.

“He eclipses most other stars when it comes to how to handle great wealth.”

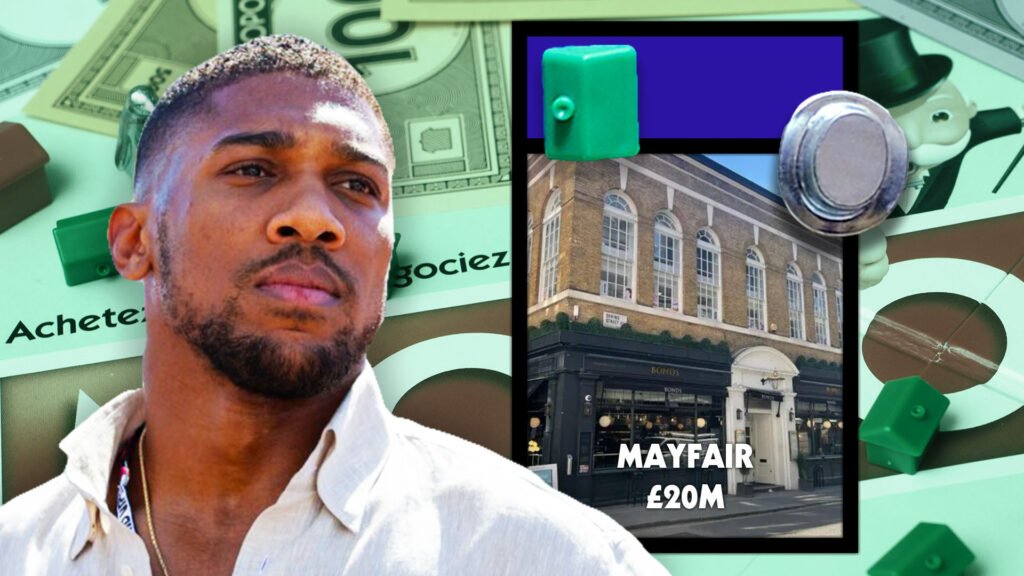

12-16 Dering Street, £20million

Home to the local Mayfair gastropub Bonds, AJ also acquired 12-16 Derring Street, estimated to be worth around £20million.

The 6,300 square foot building boasts office space too.

It is just 100 metres from Hanover Square’s Elizabeth line entrance, so it’s prime Central London.

Gives AJ more scope in plush West London.

North London, £2million

AJ has a deep affinity to North London.

He bought his mum her home there, while he honed his skills as a youngster at Finchley Boxing Club.

So it was no surprise he would invest in property nearby.

This stunning family home will be netting him a fortune from a potential renter.

AJ has another home, not far from there, that is also worth around £2million mark.

Hertfordshire, £30million

The biggest commercial space AJ has ever bought is this 301,000 square foot monster in Hertfordshire, another part of the world he should know well having grown up in Watford.

It used to be the the HQ for oil giant BP. That’s right, AJ’s coining in enough dough to buy out an oil company.

The estate includes more than 1,300 parking spaces and contains several blue chip firms.

But the fighter has not yet revealed what his plans are for it.

A close pal of the 2012 Olympic gold medalist told The Sun: “AJ has seen so many athletes build vast wealth and then squander it all.

“He is smarter than that. He has been working to build a huge empire that spans multiple large investments in different industries and will continue to grow way after he hangs up his gloves. He and his partners have really big plans for the complex he has bought.”

Retail, £750,000

Not much is known about AJ’s purchase of a retail spot in another spot in North London, close to Alexandra Palace.

But their Instagram suggests it was an impulse buy – which is great if you have the money.

Sharing a picture of Origin Massage Therapy, a caption on 258 Investments read: “We met a friend for a coffee to discuss our property requirements and ended up securing a lease for the premises that we sat down in. Sourced off market for @originmassagetherapy.”

The property is worth around £750,000, according to estimates online.