Three years on from the disastrous ‘mini budget’ which resulted in a sharp increase in interest rates, pressure still remains on UK public finances.

This is evidenced by current bond markets, claims Richard Carter, head of fixed interest research at Quilter Cheviot.

He said: “As we reach the three-year anniversary of the ill-fated ‘mini budget’, delivered by Liz Truss’ shortlived government, there remains pressure on the UK public finances, particularly from the bond markets that resulted in the downfall of that Conservative government.

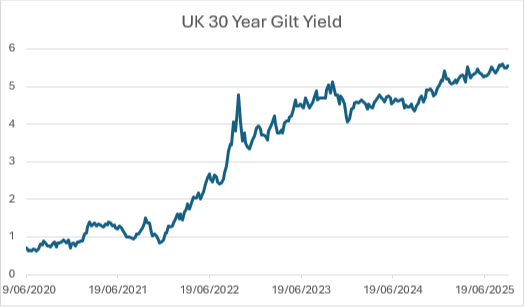

“The yields on UK government debt have been reaching levels of late not seen since 1998, with long-term borrowing costs increasing due to economic outlook concerns, both domestically and overseas.”

Despite the Bank of England lowering interest rates five times since August 2024 the 30-year gilt yield has risen.

It got as high as 5.7 per cent but has now settled to around 5.5 per cent.

Carter added: “The UK has two main factors that is causing the concerns around the bond market just now.

“Firstly, inflation remains persistently higher than the 2 per cent target, currently sitting at 3.8 per cent and expected to climb higher this year yet due to increases to national insurance and the minimum wage, as well as higher energy and food costs.

“Meanwhile, economic growth remains anaemic and borrowing is increasingly having to be relied upon for day to day spending by the government.”

Despite rising yields, Carter said we are not yet at a point where “confidence has been well and truly lost by investors”.

Eyes are on next month’s Budget to see whether chancellor Rachel Reeves will relax her fiscal rules.

“While gilt markets have calmed in recent weeks, as we approach the budget in November, tensions will begin to rise once again,” said Carter.

“It is a delicate act that Reeves needs to produce, and markets may just start pressuring for results sooner rather than later.”

tara.o’connor@ft.com

What’s your view?

Have your say in the comments section below or email us: ftadviser.newsdesk@ft.com