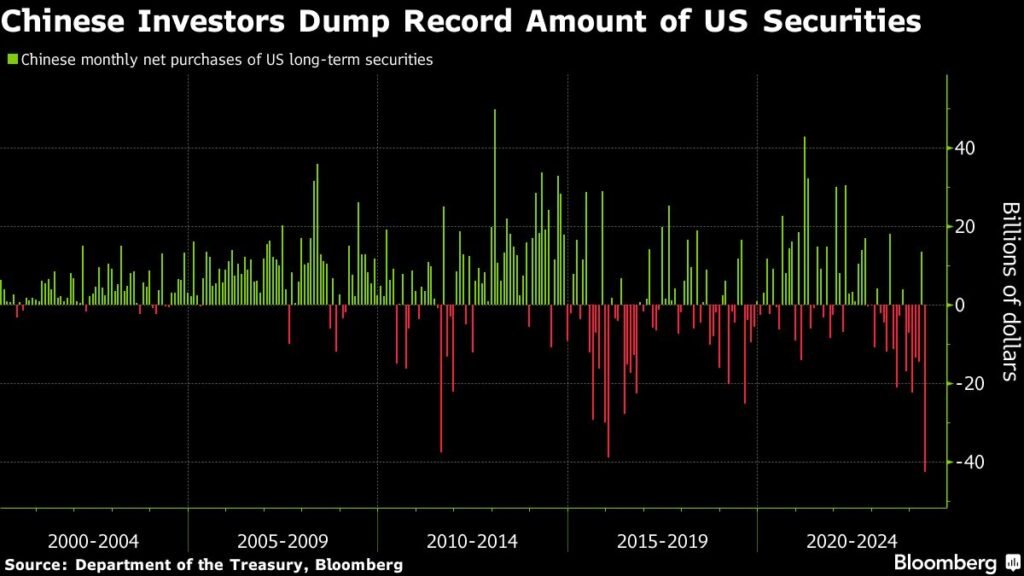

(Bloomberg) — Chinese investors sold a record amount of US stocks and bonds in May as diplomatic tensions remained elevated between the world’s largest economies.

Most Read from Bloomberg

Funds in the Asian nation offloaded a net $42.6 billion worth of long-term securities consisting of Treasury, agency, corporate and other bonds as well as equities, according to the latest data from the US Department of the Treasury released Thursday. Sales in the first five months of this year totaled $79.7 billion, an all-time high for the January-May period.

Chinese investors might have sold American securities for a risk reduction due to uncertainty around the US presidential election, said Billy Leung, an investment strategist at Global X Management Co. in Sydney. There’s also “possible political influence to reduce US dollar holdings,” he said.

More than half of the sales were of Treasuries, followed by agency debt and stocks. The yield on the benchmark Treasury 10-year note climbed to the highest since November on April 25.

China is one of the largest foreign holders of Treasuries, and its flows are closely watched by bond investors and geopolitical strategists alike. A rise in Sino-American tensions has often fueled speculation that Beijing may shift its foreign reserves out of US assets — a move that would likely add upward pressure to yields.

“Chinese investors have good reasons to be diversifying away from US assets given an over-valued US dollar, expensive US equity valuations relative to Chinese equities, and an increased need for liquidity given deleveraging,” said Wei Liang Chang, macro strategist at DBS Bank Ltd. “The divestment trend could continue based on economic fundamentals, as well as political uncertainty into US elections.”

The US government data have their own shortcomings: US securities held in a custodial account in a third country don’t show up as China’s.

China’s holdings of Treasury notes and bonds have dropped $440 billion since the end of 2017. During this period, the balance of the securities held in Belgium, widely seen as a home to custodial accounts for the Asian nation, increased $159 billion. China’s holdings of US stocks, agency bonds and other debt also rose, suggesting that the nation might have shuffled its dollar assets rather cutting them.

Still, the prospects for Federal Reserve policy easing and any ensuing weakness in the greenback might discourage Chinese investors from holding too much in the way of dollar assets, said Ken Wong, an Asian equity portfolio specialist at Eastspring Investments Hong Kong Ltd.

A weaker dollar could make investment in local securities “more enticing,” he said.

(Adds strategist comment)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.