Richard Drury

By Eric Liu

China’s two-speed economy and the internationalization of the renminbi suggest long-term opportunities may be found amid near-term challenges.

Global investors see little cause for cheer in China’s short- to medium-term economic prospects, as the stresses in the country’s property sector continue to weigh on growth. But the likelihood of further policy easing – combined with the steady internationalization of the currency and some lively pockets of economic activity – points, in our view, to opportunities in Chinese corporate bonds.

China recently cut rates sooner than expected, but the move was downplayed by many commentators as unlikely to help the country’s ailing property sector. They missed the point, in our view. The significance of the cut was that it underlined China’s commitment to supporting broader economic growth, which is trailing the government’s target of 5% this year.

We believe this commitment, and China’s record of meeting its growth targets (it has missed only once, in 2022, as a consequence of its zero-COVID policy), has important implications for fixed-income investors – as does the country’s benign inflation outlook (Display).

China’s Inflation Outlook Is Relatively Benign

2024 Consensus Inflation Forecast (Percent)

Current forecasts do not guarantee future results. As of July 8, 2024 Source: Bloomberg and AllianceBernstein (AB)

The growth target and low-inflation environment suggest, in our analysis, that China has both the incentive and the room for another rate cut this year. Beyond that, we see no pressure on the People’s Bank of China (PBOC) to hike or even consider hiking for the foreseeable future.

China’s relatively benign inflation and policy conditions help explain why Chinese government bonds have steadily outperformed their US and European counterparts over the last three and a half years, and why foreign capital has been returning to China’s bond market since September 2023.

They also underpin our positive outlook for Chinese corporate bonds. History has shown, for example, that policy easings (such as the Fed’s use of quantitative easing between 2008 and 2020) can cause credit spreads to compress significantly. We expect Chinese credit spreads to narrow too, as rates fall further.

The chances of this happening are further boosted, in our view, by recent developments in the status of the renminbi (RMB) as a global currency.

RMB Deposits Climb as Currency Internationalizes

When investors think about the RMB, many do so in terms of its traditional pairing with the US dollar. Given its 5.5% decline against the US dollar during the last five years, and the yield differential between the two currencies (10-year US Treasury yields are significantly higher than their Chinese counterparts), the comparison isn’t flattering for the RMB.

Against other currencies, however, the RMB has performed well during the same period, holding steady against the Australian dollar and gaining against the euro, yen and New Zealand dollar. This performance reflects the continuing internationalization of the RMB and its increasing use in cross-border trade settlements, as well as for investment.

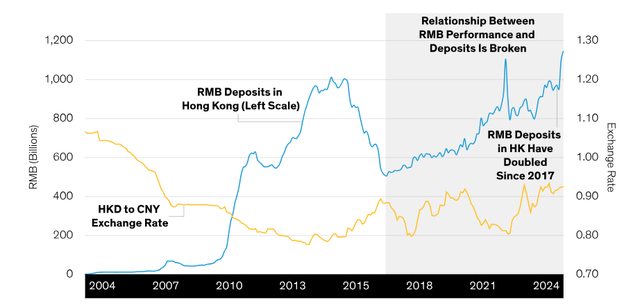

The broadening of the currency’s role has been dramatically evident in the doubling of RMB deposits in Hong Kong since 2017 – a trend that has progressed steadily, regardless of the RMB–HK dollar exchange rate (Display).

Demand for Renminbi Widens Beyond Investors

Historical analysis does not guarantee future results. Through May 31, 2024 Source: Bloomberg and AB

This is potentially relevant to Chinese credit spreads because holders of these RMB deposits have few opportunities to improve their returns. RMB money-market rates are below 2%, and Chinese equity markets are volatile. But China’s favorable policy and inflation outlooks may lead, in our view, to some of these funds being channeled into credit, adding to spread compression pressure.

Two-Speed Economy Creates a Double Advantage

These factors aside, investors may regard investing in Chinese credit as counterintuitive, given the headwinds to the country’s economic growth. But the headline growth figures largely reflect the outsize impact of the property slump. They obscure a more encouraging story, which is that China is effectively a two-speed economy, in which some sectors are growing faster than others (Display).

China Has a Two-Speed Economy

Historical analysis does not guarantee future results. GDP through June 30, 2024; PMI through May 31, 2024 Source: Bloomberg, Caixin and AB

While real estate has contracted sharply in 2024, other sectors – including technology, green economy–related businesses and the financial sector – have done well. Credit investors potentially gain a double advantage: overall conditions point to further rate cuts, and these could boost growth prospects in sectors that are already performing well.

Sectors we view most positively from a credit perspective include consumer cyclicals, banks, state-owned enterprises, technology, and utilities.

China’s Policy Easing Has a Long Way to Run

The likelihood of further policy easing in China is strong, in our view, and the horizon for its easing cycle extends well into the future. This month’s market correction may prompt the US Federal Reserve and European Central Bank to cut rates sooner or more than had been expected, but it’s unclear at this stage how long their respective easing cycles may last.

Meanwhile, China’s policy and inflation outlooks – together with the RMB’s continuing internationalization and pockets of growth within the two-speed economy – present credit investors with opportunities that, in our view, deserve careful research and consideration.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.