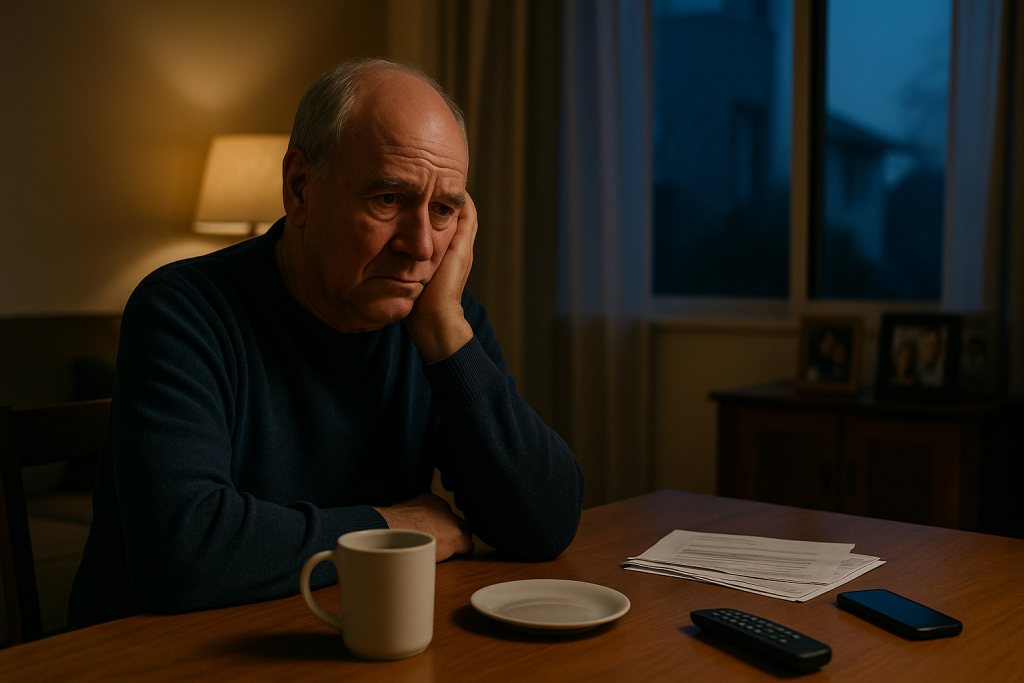

Richard showed me his spreadsheet at fifty-five—retirement at sixty-five, pension plus Social Security, the Florida house already purchased. “Ten more years,” he’d say like a mantra. Now, at seventy-one, he calls from that Florida house. The spreadsheet was perfect. The reality is unbearable. “I don’t know who I am anymore.”

He’s not alone. Across golf communities and retirement villages, a generation that revolutionized youth is discovering they catastrophically misunderstood aging. The mistakes weren’t made in retirement—they were made in the crucial decade before it.

The fifties are when retirement gets determined. Not financially—most boomers figured that out—but existentially. It’s when patterns solidify, relationships either deepen or atrophy, identity either expands or calcifies around a job title.

1. They let their entire identity collapse into their job title

“I was the regional sales director.” That’s how Tom introduces himself at the retirement community, three years after leaving. Present tense. The business cards are gone but the identity remains.

Throughout his fifties, work consumed everything. Hobbies became “golf with clients.” Friends became “work friends.” By retirement, removing the job was like removing a load-bearing wall.

Research confirms that people who derive primary identity from work experience the most difficult retirement transitions. But in your career-peak fifties, it’s easy to become your LinkedIn profile.

2. They believed retirement was a reward rather than a transition

“I’ve earned this,” Sandra said throughout her fifties, declining invitations, working weekends. Retirement was the prize for endurance. She treated her fifties like a final sprint rather than training for a different race.

But retirement isn’t a reward—it’s a massive life transition requiring skills she never developed. You can’t suddenly become good at leisure. You can’t flip a switch from workaholic to fulfilled retiree.

3. They stopped making new friends

Somewhere in their fifties, they closed the friend roster. The social circle became fixed—college buddies, work colleagues, couple friends from the kids’ childhood. No new applications accepted.

But retirement decimates that roster. Work friends evaporate. Couple friends complicate after divorces or deaths. That fixed list becomes a shrinking one.

“I don’t know how to make friends anymore,” admits Carol, seventy-three. The skill atrophied when she was too busy. Now, when social connection becomes crucial for health, she’s forgotten how.

4. They ignored their health until it was crisis management

The fifties send bodily invoices for decades of neglect. But instead of paying attention, many worked harder, ignoring the check engine light.

“I’ll focus on health in retirement,” Mark promised. But bodies don’t wait. By retirement, it wasn’t about building health but managing decline. His imagined active retirement became doctor’s appointments and medication schedules.

The cruel irony: the fifties are the last decade when you can build reserves rather than just slow depletion.

5. They avoided difficult conversations with their spouse

Parallel lives seemed sustainable in their fifties. She had book club; he had golf. They’d “reconnect in retirement.”

But retirement doesn’t restore intimacy—it amplifies distance. Suddenly you’re together 24/7 with someone you haven’t really talked to in years.

“We’re strangers,” Robert says about his forty-year marriage. The gray divorce rate has doubled since 1990, largely driven by couples discovering their marriage was held together by busy schedules, not connection.

6. They dismissed therapy as weakness

The fifties brought challenges—aging parents, career plateaus, existential questions. But therapy was for people with “real problems.”

So anxiety got medicated with wine. Depression got called “stress.” Marital problems got buried under work.

Now in retirement, without work as distraction, those unprocessed issues surface with compound interest.

7. They abandoned learning

“I’m too old for new things,” became their fifties refrain, usually about technology but eventually everything. They stopped reading challenging books. They stopped being curious.

The brain atrophies without challenge. By retirement, the cognitive flexibility needed for massive life change has withered. The world feels confusing rather than interesting.

Margaret, who refused to learn email in her fifties, now can’t video-chat with grandchildren. But it’s bigger than technology—it’s about maintaining neuroplasticity.

8. They never developed interests that weren’t productive

Every hobby had purpose. Golf for networking. Reading for professional development. Nothing for joy.

In retirement, without productivity as justification, they don’t know how to enjoy anything. “What’s the point?” Jennifer asks about the painting class she quit.

The fifties are when you discover what you actually like, not what’s useful. But that requires admitting not everything needs optimization.

9. They ignored their changing relationship with their children

In their fifties, they kept playing the parent role from when kids were young—advice-giving, problem-solving, boundary-crossing. They didn’t notice their children becoming adults who needed peers, not parents.

Now when they need connection most, relationships are strained. “They never call,” Barbara complains, not recognizing how decades of unsolicited advice created distance.

10. They thought money would solve everything

The fatal assumption: if finances were right, everything else would follow. They spent their fifties maximizing 401(k)s, calculating “enough.”

But retirement’s miseries are rarely financial. They’re existential, social, psychological. Money doesn’t buy purpose or meaning.

“I have more money than I can spend,” says James, “and I’ve never been more miserable.” He spent his fifties solving the wrong problem.

Final thoughts

The cruelest truth about these mistakes is their invisibility in the moment. Working hard feels virtuous. Deferring pleasure feels responsible. Only in retirement’s harsh light do these choices reveal themselves as miscalculations.

But here’s what Richard learned at seventy-one: it’s never completely too late. He joined a writing group—not to publish, just to write. Started therapy—not for crisis, just for understanding. Learned to text his grandchildren—badly, but enthusiastically.

The mistakes of the fifties don’t have to be permanent sentences. They require acknowledgment, grieving what was lost, and humility to begin again. Because retirement isn’t life’s epilogue. It’s an entire third act. And third acts are where the real revelations happen.

What’s Your Plant-Powered Archetype?

Ever wonder what your everyday habits say about your deeper purpose—and how they ripple out to impact the planet?

This 90-second quiz reveals the plant-powered role you’re here to play, and the tiny shift that makes it even more powerful.

12 fun questions. Instant results. Surprisingly accurate.