I’ve previously discussed the danger of selling equities during a market crash to fund your retirement income. The solution, I argued, is to hold a “war chest” of stable assets to pay your income, allowing your equities time to recover.

For many retirees, this “war chest” is made up of what they see as ‘safe’ assets – typically cash and bonds. The common wisdom is: when stocks are down, draw from this safe buffer.

ADVERTISEMENT

CONTINUE READING BELOW

But this strategy has hidden flaws. While cash is stable, its returns are usually very low, meaning your money is likely losing value to inflation over time.

To try and get a better return on their ‘safe’ money, many people turn to bond funds (such as unit trusts). And unfortunately, bond funds can suffer from the exact same problem as equities: they can, and do, fall in value for extended periods, forcing you to sell at a loss just when you need the money.

Subscribe for free to receive new weekly posts focused on retirement income.

The problem with bond funds

A bond fund holds a basket of different bonds. The price of your “units” in this fund moves up and down every day based on interest rates and market sentiment.

If you need to draw income from your bond fund when its unit price is down, you have to sell more units to get the same amount of rands. This locks in a capital loss, permanently damaging that “safe” portion of your portfolio.

This is fundamentally different from a bond ladder, which is what we advocate for a retirement “war chest”. With a ladder, you buy individual bonds that mature in specific years (Year 1, Year 2, Year 3, and so on). You are not exposed to the daily price changes because you simply hold the bond until it matures and pays you back in full.

So, how bad can the drawdowns in bond funds get?

The “safe” asset drawdowns: A historical look

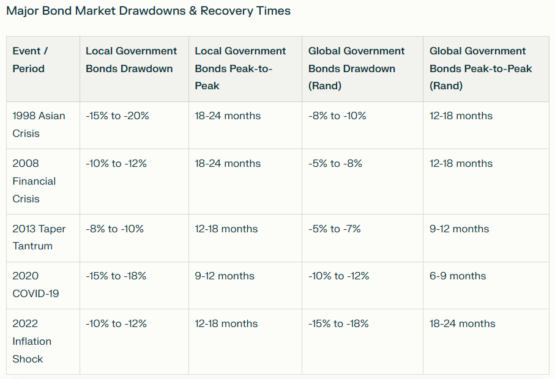

We analysed major bond market crises from a South African investor’s perspective. We looked at the local and global government bonds (in rand terms) to see how long it took for them to recover to their previous peak.

The results are sobering.

ADVERTISEMENT:

CONTINUE READING BELOW

- 1998 Asian crisis: During this emerging market panic, South African bonds fell sharply by -15% to -20%. It took 18 to 24 months for portfolios to recover to their previous highs.

- 2008 financial crisis: While global investors fled to bonds (seen as “safe”), the local market was still volatile. Local bonds experienced a drawdown of -10% to -12% and took 18 to 24 months to fully recover.

- 2013 “taper tantrum”: When the US Federal Reserve hinted it would “taper” its stimulus, bond markets panicked. This interest-rate-driven event saw the local index to fall -8% to -10%, taking 12 to 18 months to recover.

- 2022 inflation shock: This is a perfect, recent example. As inflation surged globally, central banks hiked interest rates, which crushed the value of existing bonds. Offshore bonds were hit particularly hard, falling -15% to -18%. The recovery time was 18 to 24 months.

Conclusion: Use the right tool for the job

History shows that bond funds, your “safe” money, can be down by 20% for two years. With governments all over the world becoming increasingly indebted, this volatility is likely to rise.

If your retirement plan was to “just sell bonds” when equities are down, you could easily find yourself in a difficult position: both your stocks and your bonds could be in a drawdown at the same time. This is exactly what happened in 2022.

This is precisely why a bond fund is the wrong tool for providing predictable income.

The “war chest” strategy is not just about owning bonds; it’s about how you own them.

By building a ladder of individual bonds, you ensure that your income for the next 8-10 years is secure. You get a predictable amount back at a predictable time, regardless of what the market is doing. You effectively bypass all the volatility and risk that comes with a bond fund, which is the entire point of a “war chest” in the first place.

Before you go

Whenever you are ready, here are three ways I can help you:

- Work through my “Retirement Income Blueprint”

- Create a one-page financial summary – I’ll send it to you with some high-level feedback

- Send me an email and let’s start a conversation: jonathan@rexsolom.co.za