Thomas Barwick

Main Thesis / Background

The purpose of this article is to evaluate the iShares Core U.S. Aggregate Bond ETF (NYSEARCA:NYSEARCA:AGG) as an investment option. This fund has an objective to track “the investment results of an index composed of the total U.S. investment-grade bond market”.

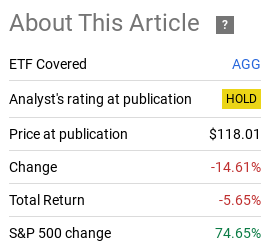

It has been a while since I covered AGG, but it is a popular fund that I keep on my radar. It is a low-cost, easy way for retail investors to own a diversified bond ETF filled with investment-grade quality holdings. While this sounds great, it isn’t always a “buy” in my view – even for those who want diversification. In fact, the last time I covered this fund I had a neutral outlook on it. In hindsight, my caution was indeed vindicated:

Fund Performance (Seeking Alpha)

While this fund has exhibited long-term weakness, the fact is it has seen some strength in the shorter term. The story of 2024 has been the restoration of positive bond returns, and that includes through vehicles such as AGG:

AGG’s 6-Month Return (Seeking Alpha)

Given this positive momentum and the changing macro-environment, I thought it is time to upgrade my outlook for AGG. I see a couple of tailwinds on the horizon and believe investors would be well-served to amplify their fixed-income holdings at this juncture. I will explain why in detail below.

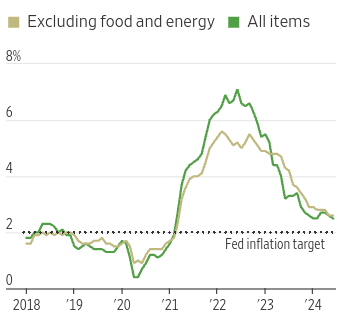

Inflation’s Decline Is The Main Story

The most important topic – in my opinion – that bond investors should usually focus on is inflation rates. This is especially true for IG-rated credit. When we move below quality bonds, than credit risk may be paramount. But for the sectors that make up AGG, which include mostly treasuries, agency mortgages, and high grade corporate bonds, than inflation stats to me impact this fund the most.

With that in mind, it should be fairly clear why I view this fund positively. The inflation metrics that have been coming out recently show figures that are nearing the Fed’s “target” 2% rate. This is a massive shift in headline measures like the PCE, which have fallen well off their highs from 1-2 years ago:

PCE Index (US) (US Commerce Dept)

The impact here is two-fold. One, when inflation declines that means the “real” return of bonds goes up. The reason being that inflation eats away at an investor’s actual return. If one earns a 5% interest rate, for example, but inflation is also 5%, then the real return is 0%. The logic is that inflation has decreased the value of the dollar to the point where an investor hasn’t actually “earned” anything. (Of course, this is still better than a negative return!).

We see this scenario playing out today in that “real” returns are historically high today compared to recent memory:

Real Returns (US Treasuries) (FactSet)

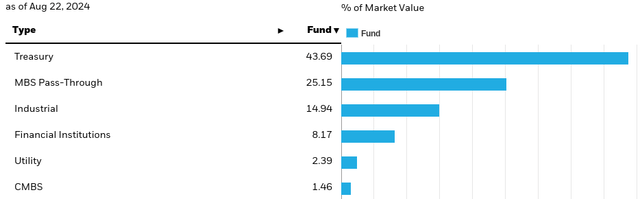

What this is showing is the real return from yields after inflation is taken into account is higher now than it was a year ago and before the Fed began its rate hiking cycle. To me this shows the value in treasuries that didn’t exist before – and why I am upgrading my rating on a fund that holds almost 44% of its assets in that treasury bond sector:

AGG’s Sector Breakdown (iShares)

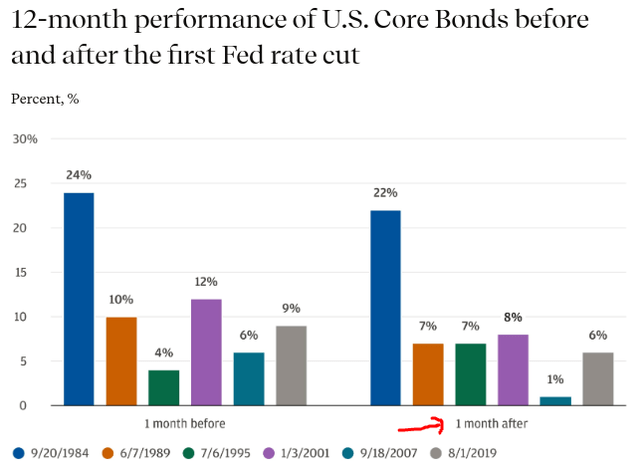

The second reason why the decline of inflation is important is because of its significance on the Fed’s desire to cut interest rates. If the Fed does begin to lower rates then fixed-income investors are going to likely celebrate. This drives buying into the sector – pushing yields down. But for those who already own the securities, it results in capital appreciation.

And you don’t need to take my word for it. If we look back at past cycles we see that core bond funds (of which AGG is one) tend to perform quite well in the aftermath of the Fed’s first “cut” of the cycle:

Performance (US Core Bonds) (JPMorgan)

What this all adds up to is that bonds are poised to deliver positive returns in the months ahead. But investors may be running out of time to act. You don’t want to wait until the Fed begins cutting or once yields have hit rock bottom. You want to front-run this in order to lock-in competitive yields and benefit from rising securities prices going forward. Buying an ETF like AGG is one way to do this.

Passive ETFs Are The Rage

Digging deeper into using AGG as an option, I want to point out that retail investors are flocking to these types of products in droves. Clearly, fixed-income investors have a plethora of options at their disposal. They can buy individual issues, mutual funds, CEFs, and, of course, passive ETFs that are multi-sector. AGG falls into that last category and is an extremely popular way to play the bond market.

One reason why that is the case is cost. The passive nature of the fund removes active management fees and it also avoids leverage costs that plague many CEFs. The cost to own this fund is almost non-existent, as shown below:

AGG’s Expense Ratio (iShares)

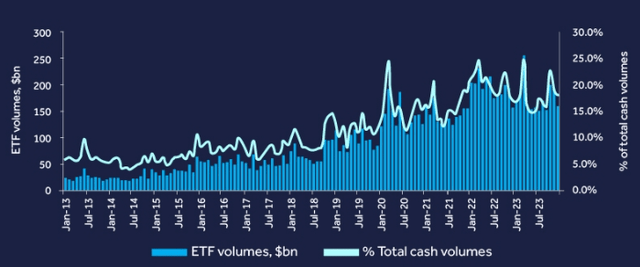

This makes it attractive for retail investors and they certainly have taken notice. Funds like AGG and its peers have been pulling in tons of retail cash – and this is a trend that is accelerating, not slowing down:

Funds Flow Into Bonds (ETFs vs. Cash) (Barclays)

What I am trying to convey here is that buying AGG is a low-cost way to join the popular trend that has been sweeping the market for the past decade. Readers can take comfort in knowing that core bond funds like AGG are gaining in popularity and it doesn’t cost much to become a member of this club. That is another factor supporting my bullish take on the fund.

Will The Fed Actually Cut Rates?

So far much of this backstory counts on the Fed actually moving on interest rates. It is all well and good to say things like “inflation has peaked” and the Fed is “going to act” – but until it actually happens those are just predictions. If one is buying in now on the expectation that yields are going lower in the months to come, there is a risk that this forecast won’t be accurate. And to be fair, investors have been anticipating Fed rate cuts for the last year and been wrong – so that is something to keep in mind. No investment prediction is foolproof or risk-free, and buying AGG is no exception.

But I do believe things are different this time around. The Fed has taken note of the decline in inflation and has made it quite clear they believe the time is getting ripe for cuts, as last week’s meeting pointed out. Here are a few headlines supporting that narrative:

Headline News (CNBC)

Headline News (Bloomberg)

Again, this is not a guarantee, but the time seems to be ripe and Fed officials are beginning to finally give the market what it has been waiting for.

As further support for this notion, we should also note that most cycles have seen cuts sooner than this. The time between hikes and cuts is generally less than a year, and only one cycle has been longer (in months) than the current one:

Months Between Hikes & Cuts (Fed)

The broad takeaway here is the Fed appears ready to cut rates and history suggests this is likely as well. With this being the macro-environment it seems clear to be that buying bonds now is a smart move. AGG is a reasonable option to take advantage of this dynamic.

As Equities March Higher, Risk Appetite Falls

Keeping a macro-focus, there are other reasons why bonds could have a few strong months ahead. To understand why we need to consider the broader investment landscape. Equities have been on a roll lately, storming back from the correction earlier this month and nearing all-time highs again. Concurrently, investors are starting to get nervous about valuations and recession risk. The is leading to a decline in risk appetite among retail investors:

Risk Appetite (US Investors) (S&P Global)

The point here is that as investors get some anxiety, bonds are a natural choice. While investor mindset is fickle, it does suggest that a rotation into safer assets could be forthcoming. This would play right into the hands of owners of AGG, which supports my rationale for buying it here.

US Debt Offering Higher Yields Than European Counterparts

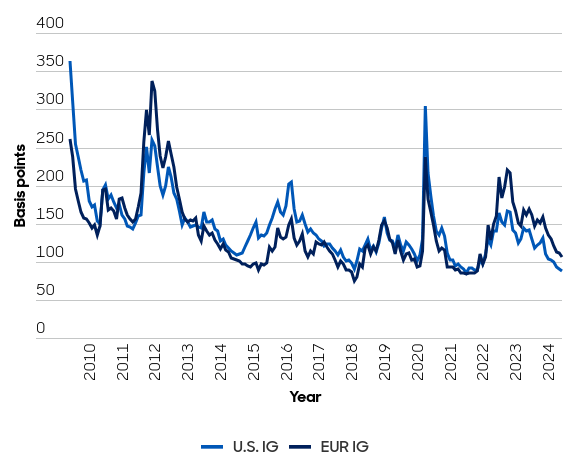

My final point looks at relative value. While I am generally a US-focused investor, I do look to non-US developed markets for diversification. This includes both the equity and the bond market. In this light, evaluating whether or not the US offers relatively higher yields compared to other markets is critical to determining if AGG is a good deal at these levels.

Fortunately, the story is indeed positive for US-focused debt right now. If we look at comparable IG-rated debt here and across the pond we see that US debt has a clear edge in terms of yield on offer:

Yield Spreads (IG-Rated Debt) (US Bank)

The conclusion I draw here is that if someone wants IG-rated credit then the choice for US debt is probably the better bet. This means funds like AGG are a better choice than its peers with Euro-denominated debt. Again this is a supporting factor for the buy rating on this ETF.

Bottom-line

AGG showed a lot of weakness over time but the tide has begun to turn. I see value in staying with domestic fixed-income plays given the yield spread between European debt and the potential for rate cuts to begin from the Fed as early as September. Further, passive ETFs continue to gain a lot of traction among retail investors and AGG is one of the biggest players in this space and has a dirt cheap expense ratio. The summation to me is that AGG has a good story behind it and I believe an upgrade to “buy” makes sense now. I would encourage my followers to give the idea some thought at this time.