Mumbai: Adani dollar bonds have rallied even as key group stocks came under pressure after the US short-seller Hindenburg’s 10 August conflict of interest allegations against Sebi chairperson Madhabi Puri Buch, who rejected the claims.

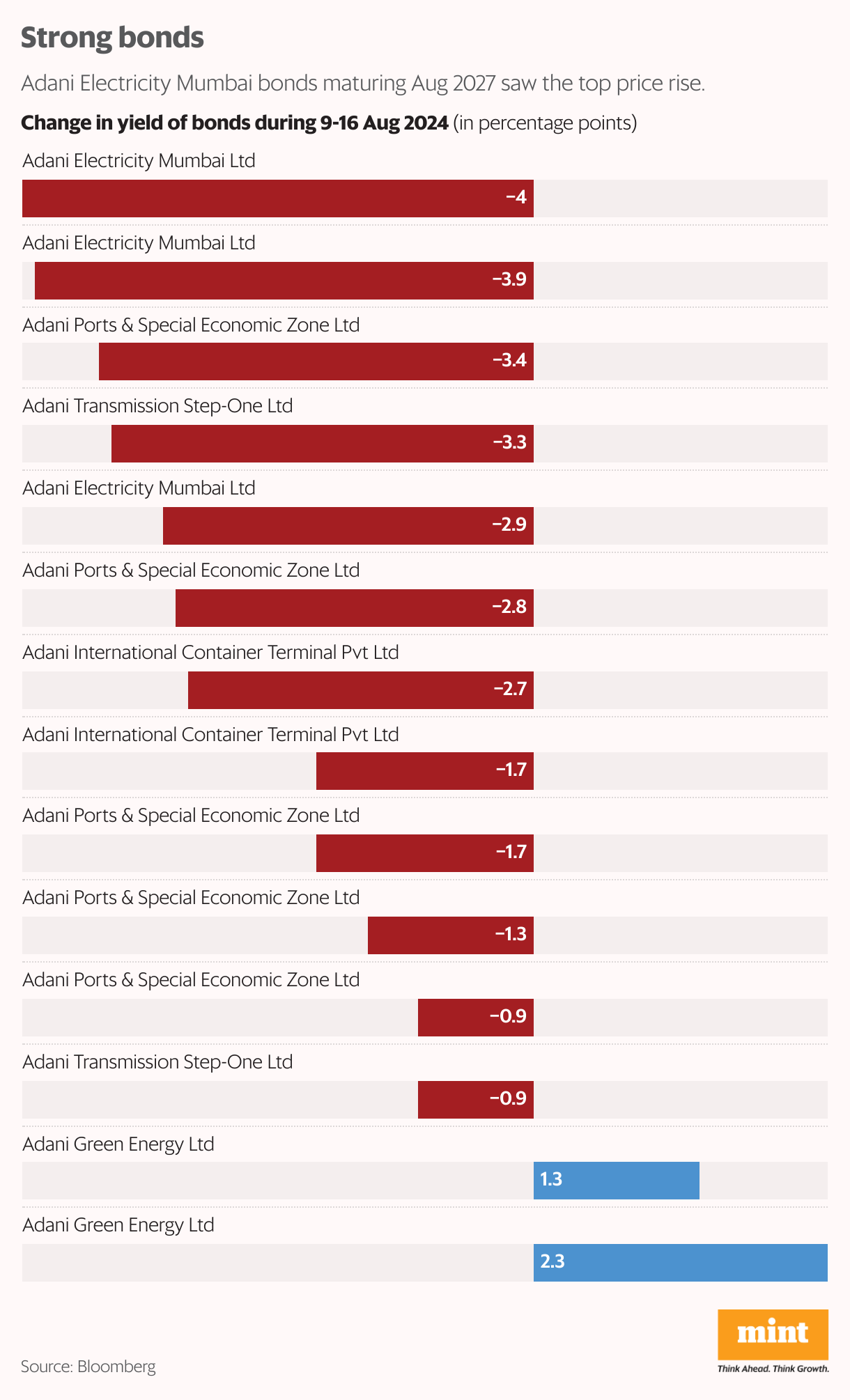

The group’s 14 bonds maturing from September 2024 to as far out as August 2041 rose 0.1% to 1.34% between 9 August and 16 August. Bond prices and yields move in opposite directions.

Adani Electricity Mumbai bonds, maturing on 4 August 2027, rose the most at 1.34% to $88.14 during the period. Adani Ports & Special Economic Zone bonds maturing on 21 May, 2026 rallied 1.25% to $81.20, while Adani International Container Terminal’s notes are up 0.9% at $86.37.

In January last year, Hindenburg, after alleging corporate malfeasance against the edible oil-to-ports group, disclosed it was short on Adani bonds. While the group denied the allegations, Adani group stocks wiped out $150 billion in market value.

The group has recouped the losses, and the latest report against the regulator has had a marginal impact on its key stocks that are part of the Nifty index.

Adani Enterprises Ltd and Adani Ports and Special Economic Zone Ltd’s counters have underperformed the index since Hindenburg alleged conflict of interest by Buch on 10 August. A few short positions have been created on the active futures and options contracts of the stocks.

Also read | Mint Explainer: Hindenburg’s latest salvo against the Sebi chief

While the Nifty futures contract expiring on 29 August rose 0.75% to 24,585.5 in the week through 16 August, the AEL contract expiring on the same date fell 2.7% to ₹3,119.35 a share during the period. Adani Ports’ contract slipped 2.8% to ₹1,497.35.

In January last year, Hindenburg, after alleging corporate malfeasance against the edible oil-to-ports group, disclosed it was short on Adani bonds.

The fall in prices of the two contracts has been accompanied by a minor rise in their open interest (OI)-outstanding buy-sell positions. A fall in prices and rise in OI imply bearish sentiment.

The AEL active futures contract has seen its OI rise from 2.02 crore shares to 2.07 crore shares, while Adani Ports’ OI is up from 2.75 crore shares to 2.8 crore shares.

“Retail participation in the group stocks has been low and unless the latest events don’t snowball into a political volcano, I don’t see any material impact on the stocks or other instruments of the group,” said Rajesh Palviya, SVP, head technicals & derivatives, Axis Securities. “The activity seen post the report would be more institutional in nature and by some punters taking shorts.”

Also read | Adani Ports’ stock at new highs as investors cheer growing footprint

SK Joshi, ED, Khambatta Securities, said small investors should avoid the counters until greater clarity emerges on the latest allegations by the short-seller.

On the options front, too, call option contracts on AEL have witnessed a rise in their OI as their prices fell, implying more short creation between 9 and 16 August.

For example, the 3,200-strike call expiring on 29 August plummeted 66% to ₹29.40 as its OI increased from 24.82 lakh shares to 25.57 lakh shares over the week through 16 August. This implies option traders expect the stock to be under pressure and to pocket the premium paid by the call buyers.

Buch counters Hindenburg claims

This time, the US short-seller, citing whistleblower documents, has alleged that Buch and her husband invested in a fund, managed by 360 One (erstwhile IIFL Wealth & Asset Management), that invested in Adani Group stocks. Hindenburg also alleged that she was a shareholder of a consultancy firm while in harness at Sebi.

Buch termed the Hindenburg’s latest report an attempt at “character assassination”, and a detraction from responding to Sebi’s show-cause notice of 27 June for violation of Indian securities laws.

She said the investment in the fund was made in 2015 as a private citizen, two years before she joined Sebi as a whole-time member. She invested because the fund’s chief investment officer was her husband’s close friend and the investment was redeemed after he left the fund, she said in the response.

Referring to the Singaporean and Indian firms in question, she rebutted that they became immediately dormant on her appointment with Sebi and that explicit disclosures on her shareholding in them were made to Sebi. 360 One also informed the stock exchanges that the fund it set up never made any investments in Adani group stocks, bonds or derivatives.