Confession time. I’m a pushover for online calculators. Actually, any type of gadget gets my attention (hold on while I check email on my

As an example, the very best mortgage calculator in my opinion is one many have never used. It’s Dr. Karl Jeacle’s mortgage calculator, and I’ve used it for years. It has endless ways to look at a mortgage, particularly if you want to explore different scenarios for paying off your mortgage early. (Full Disclosure: I’ve offered to buy the mortgage calculator from Karl on multiple occasions. He’s turned me down every time.)

Calculators are also ideal for retirement planning. A good online retirement tool can make crunching decades of numbers and assumptions a snap. The best tools allow you to understand the assumptions that are being made and to change those assumptions easily. Having used just about every online retirement planning tool available, I thought I’d share the five that rate among the very best.

1. Personal Capital’s Retirement Planner

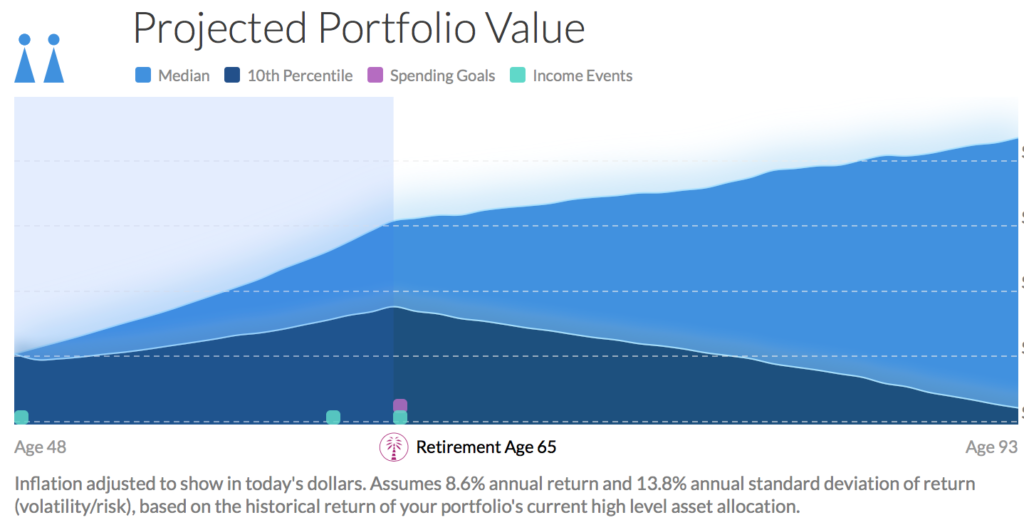

The first option is the newest on the list. Personal Capital has just launched a Retirement Planner as part of its free financial dashboard. It makes the list for several reasons. First, once investment accounts are added to the financial dashboard, the Retirement Planner takes all of the available data and runs 5,000 investment scenarios automatically. There’s no data entry required. Second, the underlying assumptions (e.g., inflation, life expectancy, social security) can be changed easily. Finally, the results are displayed with both attractive graphs and in table format.

2. Fidelity myPlan Snapshot

The Fidelity myPlan Snapshot enables you to get a glimpse into your retirement finances in seconds. Input just a few basic numbers, such as age, annual savings, annual income, and total investment portfolio, and this tool generates a graphical picture of your projected assets.

Fidelity customers can take the data from the snapshot and create a more detailed retirement plan.

3. Flexible Retirement Planner

For those that want to roll up their sleeves and spend hours with a retirement too, the Flexible Retirement Planner is the tool of choice. The tool allows for very detailed inputs. For example, you can set your taxable portfolio, tax deferred portfolio, and tax free portfolio (i.e., Roth accounts). You can even configure the Monte Carlo simulator’s sensitivity analysis and the asset allocation of your portfolio. The result is a graph of future retirement fund values and the probability of the success of your retirement portfolio.

4. The Ultimate Retirement Calculator

With the Ultimate Retirement Calculator, you can enter the typical data, such as retirement savings and annual contributions. There are a few things, however, that set this calculator apart. First, it allows you to account for leaving a certain amount in your estate at your death. It also enables you to enter one-time benefits that you expect to receive, such as an inheritance. You can also enter pension or Social Security income and set an annual cost of living adjustment. The results are in table format, and you can email the results to yourself for later analysis.

5. Vanguard Retirement Nest Egg Calculator

The final tool is the easiest to use. The Vanguard Retirement Nest Egg calculator is designed to tell you the odds of your nest egg lasting in retirement. There are only four inputs: how many years your portfolio must last, its current balance, annual spending, and asset allocation. As an example, a $1,000,000 portfolio has an 86% chance of producing $45,000 a year in income for 30 years with a 60% allocation to stocks.