With Social Security’s uncertain future, these three ETFs offer compelling income opportunities for retirement planning.

Market uncertainty and mounting concerns about Social Security’s future have investors increasingly focused on building reliable income streams. The Social Security Administration’s projections suggest the program’s trust funds could face challenges in maintaining full benefit payments in the coming decades, highlighting the importance of developing independent income sources for retirement.

Personal retirement planning has never been more crucial as demographic shifts put pressure on traditional support systems. While Social Security has served as a cornerstone of retirement planning for generations of Americans, evolving financial realities demand a more proactive approach to income generation.

Image source: Getty Images.

Exchange-traded funds (ETFs) offer an efficient way to build diversified income streams without the complexity of managing individual securities. Here are three ETFs designed to generate reliable income streams for retirement portfolios.

Value-focused cash-flow generation

The Pacer US Cash Cows 100 ETF (COWZ 0.52%) employs a distinctive strategy focused on maximizing shareholder value through cash-flow generation. The Pacer US Cash Cows 100 ETF identifies companies with high free-cash-flow yields — a crucial metric that typically signals both financial resilience and the ability to maintain consistent dividend payments.

The ETF delivers a modest 1.89% yield to investors. While its expense ratio of 0.49% runs higher than many comparable funds in the space, the unique investment approach helps justify the premium.

This ETF’s methodology targets companies that generate substantial cash flow beyond their operational requirements. The portfolio’s largest positions showcase this approach, featuring established names like Hewlett Packard Enterprise, Airbnb, Nucor, Qualcomm, and Chevron.

Over the past five years, excluding fees, the ETF has slightly outperformed the S&P 500 on a total return basis.

Traditional dividend growth approach

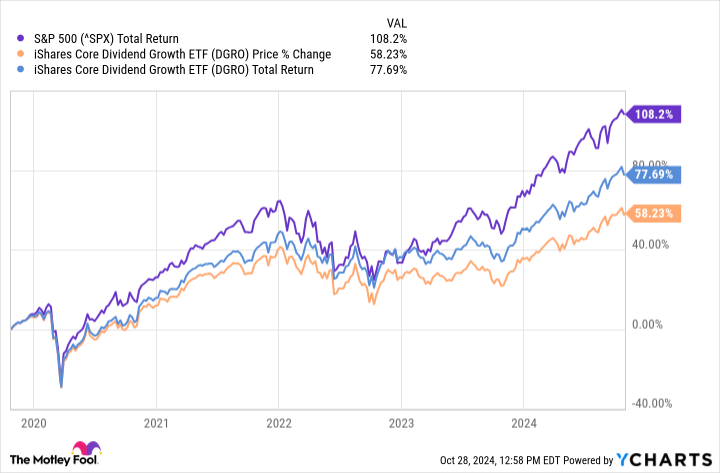

The iShares Core Dividend Growth ETF (DGRO 0.50%) prioritizes companies that demonstrate consistent dividend growth over time. The fund maintains a competitive 0.08% expense ratio, enabling investors to retain more of their returns while accessing quality dividend-paying companies across the U.S. market.

The iShares Core Dividend Growth ETF sets a minimum requirement of five consecutive years of dividend growth for portfolio inclusion. This disciplined approach is reflected in its top five holdings: ExxonMobil, Microsoft, Apple, JPMorgan Chase, and Chevron — all established market leaders with strong dividend histories. The ETF currently offers investors a solid 2.2% yield.

The fund’s core strength lies in its commitment to companies that regularly increase their dividend payments. This strategy aligns with historical market data, showing dividend growers have delivered superior long-term performance. Such consistent distribution growth often indicates strong business fundamentals and an expanding market presence.

The fund has lagged the S&P 500 over the prior five years, but it has still delivered solid share price appreciation and steady dividends over this period.

Enhanced income strategy

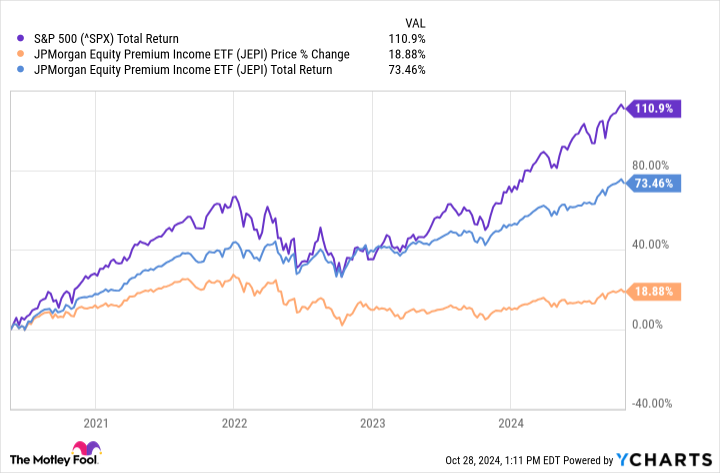

The JPMorgan Equity Premium Income ETF (JEPI 0.22%) employs an innovative approach to income generation. The JPMorgan Equity Premium Income ETF combines high-dividend stocks with an options overlay strategy, designed to deliver enhanced monthly income while helping to manage portfolio volatility.

The ETF’s sophisticated approach has garnered substantial investor attention, particularly for its ability to generate above-average yields. The portfolio’s largest positions reflect this strategy, featuring established names like Trane Technologies, Meta Platforms, Progressive, Southern Company, and AbbVie.

The fund currently offers investors a substantial 7% yield, while maintaining a moderate 0.35% expense ratio. Since its 2020 launch, the ETF has delivered lower total returns than the S&P 500 but has maintained its focus on generating consistent income, making it an ideal vehicle for a retirement portfolio.

An essential component of retirement planning

Building multiple streams of passive income is a prudent approach to retirement security. These ETFs offer different methods for generating income, from traditional dividend growth to more sophisticated options-based strategies.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. George Budwell has positions in AbbVie, Chevron, JPMorgan Chase, Microsoft, and iShares Trust-iShares Core Dividend Growth ETF. The Motley Fool has positions in and recommends AbbVie, Airbnb, Chevron, JPMorgan Chase, Meta Platforms, Microsoft, Progressive, and Qualcomm. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.