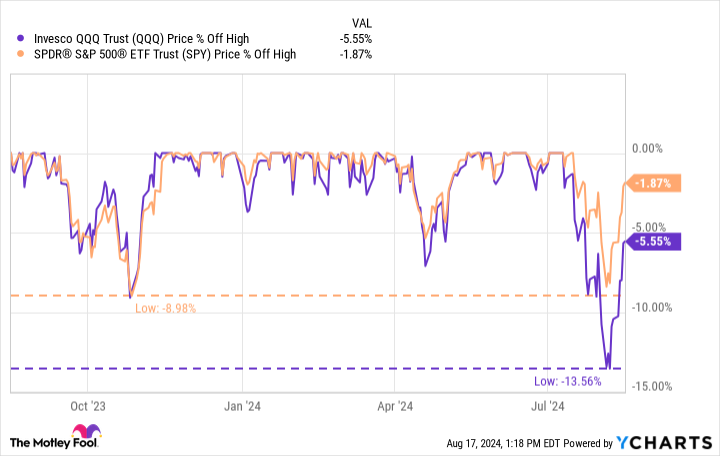

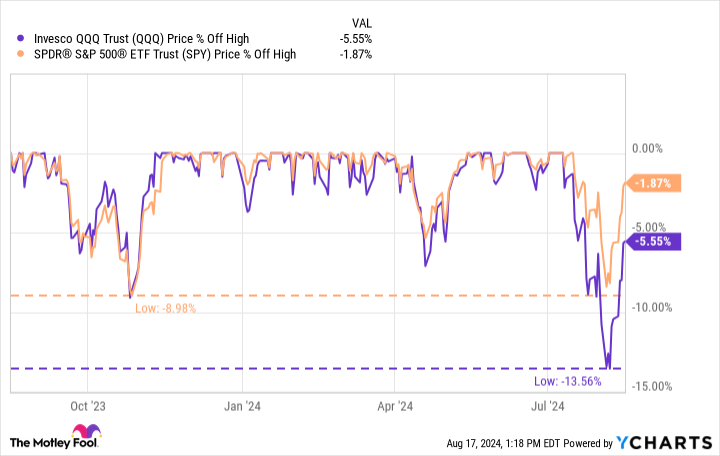

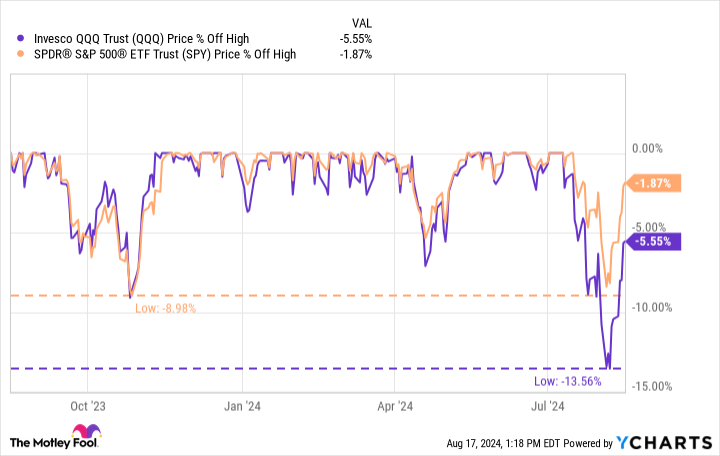

Although the early August market pullback may have been short-lived, it created opportunities to purchase excellent companies at much lower valuations. The Nasdaq Composite entered correction territory (defined as 10% off its recent high) and pulled back nearly 14%, while the S&P 500 flirted with a correction. However, both indexes recouped the majority of their losses in more recent trading sessions.

While some see sharp market pullbacks and run for the exits, savvy investors see them as fantastic opportunities. Corrections are normal and necessary events in the market. They generally occur about once a year on average and are actually healthy. Without periodic corrections, bull markets can become overheated and lead to bubbles, which are often followed by deeper crashes that can seriously harm not just the economy, but seriously dent long-term investors’ wealth building process.

And so, the best action for long-term investors amid corrections is to keep emotions at bay, and stay calm and take advantage of the volatility by purchasing shares of compelling companies at a discount.

I did this with Dell (NYSE: DELL) and Micron (NASDAQ: MU), two companies that are benefiting from the boom in artificial intelligence (AI) and data centers.

Data centers are critical to AI

The shift to cloud computing over the last couple of decades necessitated the construction of a host of massive data centers (buildings filled with infrastructure, servers, network, and storage equipment, etc.) to process and store data. Without them, software for businesses, online banking, streaming television, gaming, and many other applications wouldn’t function. The boom driven by AI programs creates another technical challenge.

Generative AI software requires much more processing power than other applications, so more capacity is needed now. Some data centers are small, less than 10,000 square feet, while others are massive, at more than 1 million square feet. So-called hyperscalers like Amazon, Meta, and Alphabet build these massive centers. Here are a few fun facts:

-

The U.S. is home to more than half of the world’s approximately 10,000 data centers.

-

120 new hyperscale data centers could become operational each year for the next 10 years.

-

Elon Musk’s xAI plans to build a gigantic data center in Tennessee that could include 100,000 Nvidia (NASDAQ: NVDA) liquid-cooled GPUs.

Dell and Micron will benefit significantly from rising data center demand. Both have industry expertise, critical products, and long-standing partnerships with AI chip leader Nvidia. But the recent correction sent their stocks tumbling, at one point down 51% and 43%, respectively, before recovering slightly, as depicted below.

Despite their strength over the past year and a half or so, the stocks are still down significantly from their recent highs. Here’s why I picked up significant positions in both.

Is Dell an overlooked AI stock?

Dell divides its business into two segments: the client solutions group (CSG) and the infrastructure solutions group (ISG). The client side includes PCs, laptops, and gaming products. CSG revenue was relatively flat in its fiscal 2025 first quarter (which ended May 3, 2024) due to a weak consumer market. However, my focus is on the infrastructure solutions segment. This segment supplies data center infrastructure, including AI-ready servers, data storage, and liquid cooling technology.

The ISG segment posted 22% growth in fiscal Q1 to reach $9.2 billion in revenue, while servers and networking sales grew 42% year over year to $5.5 billion, illustrating the increasing demand from data centers. The company also reported $1.7 billion in AI-optimized servers shipped in fiscal Q1, double the amount shipped in the prior quarter.

Dell stock trades at a price-to-earnings ratio (P/E) of 22, higher than its 3-year average. However, its forward P/E is just 14 based on analysts’ forecasts. Given the current demand, Dell has a great chance to beat these estimates.

Management believes the AI runway is long, and announced a refocused effort tailored to AI in the last earnings call. The recent pullback in its stock price should be compelling for long-term investors.

Is Micron stock a buy now?

Data centers and AI programs require boatloads of memory in addition to the infrastructure discussed above. Micron is one of the leading memory providers in the world. It operates in three main end markets: data center, PC, and mobile and intelligent edge (which includes automotive and industrial). While sales into the PC and mobile markets are expected to rise slightly, the excitement is around the data center business.

Micron produces a product called high-bandwidth memory (HBM), which is designed for AI and high-performance computing (HPC). In the latest earnings report, Micron points out that:

-

HBM sales hit $100 million in the quarter. Management expects several hundred million dollars of HBM sales this fiscal year and “several billion” next fiscal year;

-

It has already sold out of HBM through the end of 2025;

-

Its customer base is expanding.

Total revenue in its fiscal 2024 third quarter (which ended May 30) was $6.8 billion, a year-over-year increase of 82%. AI-related sales grew 50% over the prior quarter. Strong demand allowed Micron to significantly expand its margins, operating profits, and cash flow.

Micron stock is difficult to value using a simple P/E ratio because the company has substantial non-cash expenses, primarily depreciation and amortization, that skew its net income. However, analysts have more sophisticated methods of valuing companies. Currently, an overwhelming majority of analysts following the stock have given it buy or strong buy recommendations, and their average price target on it is $157. Micron stock would need to gain 45% to reach that level.

Dell and Micron will benefit from the AI/data center up cycle, which could last years. Long-term investors should consider them after the recent pullback.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon, Dell Technologies, and Micron Technology. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

2 Stocks Down 51% and 43% That I Just Made Huge Investments In was originally published by The Motley Fool