Ramp Business Corp., a provider of corporate credit cards and accounting software, today announced that it has raised $500 million in fresh funding.

ICONIQ led the Series E-2 round with contributions from nearly two dozen other investors. Alphabet Inc.’s GV fund and Khosla Ventures were among the participants. Ramp’s total outside funding now stands at about $2 billion.

The company’s latest round values it at $22.5 billion, which represents an increase of $8 billion in under two months. Ramp announced its previous $200 million raise in mid-June. Between the two investments, it debuted a set of artificial intelligence agents designed to automate manual work for accounting teams.

In the enterprise, the process of approving business expenses can be highly time-consuming because there are many transactions to review. Ramp says that its AI agents perform the task automatically. When a worker makes a purchase, the AI agents compare the transaction against internal reimbursement policies and approve it if it meets all the necessary criteria.

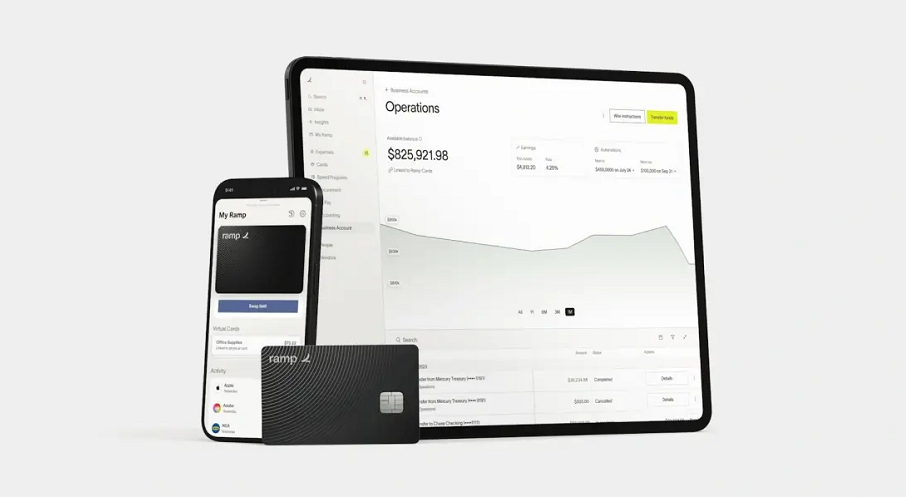

Ramp launched in 2019 with a focus on providing corporate credit cards. It continues to offer those cards alongside its newly introduced AI software. They provide features that enable accounting teams to monitor employee purchases, as well as set supplier-specific spending limits.

The company says its cards provide access to more than $350,000 worth of discounts and other offers. OpenAI, for example, provides up to $2,500 in application programming interface credits to startups. There are also offers from cloud providers, delivery companies and other firms.

In January, Ramp expanded its product portfolio with a service called Treasury. It enables companies to open deposit accounts in which they can store funds to cover operating expenses. There are also investment accounts that offer a higher interest rate. Ramp disclosed that Treasury already manages more than $1 billion in customer funds.

For finance teams, the company provides software tools that automate tasks such as account reconciliation. That’s the task of checking a company’s accounting data for inconsistencies. Ramp also provides procurement tools that ease tasks such as renewing software-as-a-service subscriptions.

In March, sources told TechCrunch that the company’s annualized recurring revenue had topped $700 million. Ramp says its customer base includes more than 40,000 organizations. The company claims to have saved more than 27.5 million hours of manual work for those organizations’ employees with its automation features.

“Right now, Ramp users are getting 3x more done per minute compared to two years ago,” co-founder and Chief Executive Officer Eric Glyman wrote in a blog post today. “By 2027 – as our agents start working in parallel – we’re aiming for 30x.”

Ramp will use the proceeds from its latest funding round to accelerate its product development efforts. In the coming months, the company plans to release new AI agents for automating account reconciliation and procurement tasks.

Image: Ramp

Support our open free content by sharing and engaging with our content and community.

Join theCUBE Alumni Trust Network

Where Technology Leaders Connect, Share Intelligence & Create Opportunities

11.4k+

CUBE Alumni Network

C-level and Technical

Domain Experts

Connect with 11,413+ industry leaders from our network of tech and business leaders forming a unique trusted network effect.

SiliconANGLE Media is a recognized leader in digital media innovation serving innovative audiences and brands, bringing together cutting-edge technology, influential content, strategic insights and real-time audience engagement. As the parent company of SiliconANGLE, theCUBE Network, theCUBE Research, CUBE365, theCUBE AI and theCUBE SuperStudios — such as those established in Silicon Valley and the New York Stock Exchange (NYSE) — SiliconANGLE Media operates at the intersection of media, technology, and AI. .

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a powerful ecosystem of industry-leading digital media brands, with a reach of 15+ million elite tech professionals. The company’s new, proprietary theCUBE AI Video cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.