J Studios

My thesis

SoFi Technologies (NASDAQ:SOFI) is an impressive and promising business. Its revenue growth demonstrates impressive growth, outpacing growth projections for the whole fintech industry. The business model of a “one-stop shop for financial services” works well, as the company’s profitability profile demonstrates impressive improvements in line with revenue growth.

I have high confidence in SoFi’s potential to sustain its impressive growth trajectory, as it has a strong cross-selling potential. There are two vital variables to exercise cross-selling power in the industry: broad customer base and diversified products portfolio. SoFi performs extremely well in both directions as its customer base is expanding at a massive growth rate and products mix diversification is also extremely aggressive. The stock is extremely attractively valued, with a $9.25 target price for the next twelve months. SoFi’s stock is certainly a Strong Buy, and I am adding it to my portfolio.

SOFI stock analysis

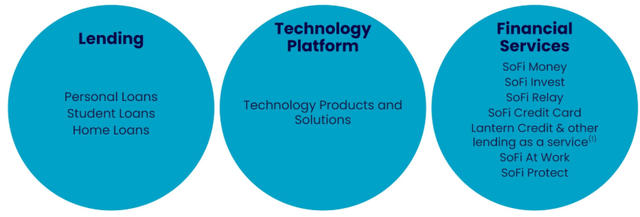

SoFi positions itself as a one-stop shop for financial services. The company’s disruptive approach is underscored by the fact that it calls its customers as “members”. SoFi has the U.S. banking license, meaning that it offers a myriad of services that banks usually do. The difference between SoFi and traditional banks is that it delivers these services via its digital application rather than in physical branches.

Such a business approach to render financial services is also commonly known as ‘fintech’. The emergence of fintech is a global phenomenon because using an application to conduct banking operations instead of spending time visiting bank branches saves loads of hours for customers. BCG projects the US fintech industry to observe a 17% CAGR by 2030. This is a solid bullish catalyst for SoFi.

SoFi boasts staggering growth across all key financial and business metrics. The company delivered a massive quarterly growth once again in Q2. Revenue grew by 22% YoY in Q2. The adjusted EBITDA margin spiked YoY from 16% to 23%. These numbers suggest that SoFi is quite successful in capitalizing on industry tailwinds. Moreover, its revenue growth is substantially higher than the industry’s CAGR projected by BCG.

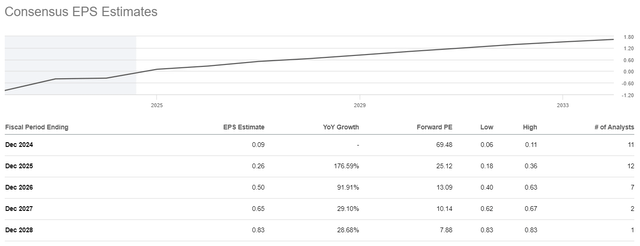

Revenue growth is nothing if the company does not show improving profitability in line with the top line expansion. SoFi’s profitability growth has been stellar so far, which is evident from the below chart. SoFi is close to entering its break-even phase on the TTM basis, and the historical dynamic of EPS expansion in line with revenue growth is another strong bullish sign.

Consistent profitability expansion in line with revenue growth means that the company’s business model is scalable further, and more revenue growth will create more operating leverage. Since the industry is expected to grow and SoFi currently outpaces the industry, I am very optimistic that its stellar EPS trajectory has high chances to continue looking up.

For any financial services company, expanding the customer base is extremely important. It is reasonable because a bank is an ecosystem of financial services, and when a bank attracts one customer it has the potential to sell several services to this one customer. From this perspective, it looks like SoFi has a massive potential to “land and expand”. The pace of new members’ additions is absolutely jaw-dropping, with a 41% YoY growth in Q2.

The management is also highly confident in the company’s rock-solid potential. This is evident from the notably upgraded FY 2024 guidance shared in the latest earnings slides. Frankly speaking, I share this optimism as the company demonstrates strong momentum is expanding its mix of financial services products compared to lending products. Diversification of products highly likely provides more predictable and recurring and revenue streams, in my opinion.

When I look at SoFi’s business, I see only green flags. The industry is thriving, and SoFi has been extremely efficient at absorbing favorable industry trends so far. I think that it is building a solid basis to fuel future revenue and profitability growth thanks to its immense pace of the customer base expansion and aggressive diversification of its product mix. These two variables are vital to maximize the company’s cross-selling potential.

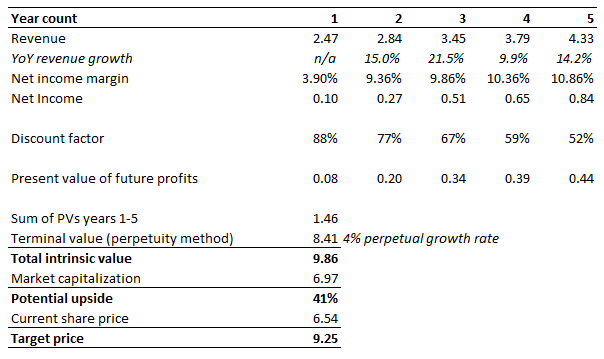

Intrinsic value calculation

Discount rate is a vital assumption for the discounted cash flow (DCF) model. Therefore, I start with calculating the cost of equity using the capital-asset pricing model (CAPM). The below working outlines my calculations. SOFI’s cost of equity is 14.1%. I ignore the cost of debt for SOFI’s DCF calculation because for a bank/fintech, there is an inherent variability in debt structure. Therefore, I believe that relying on cost of equity to discount future profits will provide a clearer picture of SOFI’s intrinsic value.

Consensus estimates appear conservative, as they project a notable revenue CAGR deceleration for the next five years. Since SOFI is a bank and there are no substantial non-cash revenues and expenses recorded by banks, I use the net income projection instead of traditional free cash flows that are used to value non-financial businesses.

Consensus estimates forecast a $0.09 EPS in the current fiscal year, which equals to around $96 million if we multiply the projected EPS by the current outstanding shares count (1.07 billion). This will be the base year net income assumption, which will increase every year in line with the above consensus projections. Please note that my year 1 net income assumption is more conservative than the management’s guidance. The perpetual growth rate is at 4% given SoFi’s relatively small-scale and strong secular tailwinds for the fintech industry.

DT Invest

SoFi’s intrinsic value is 41% higher than the company’s current market capitalization, which means there is a compelling potential upside. I think that the valuation is extremely attractive for a company demonstrating such a massive expansion across all key metrics. With a 41% potential upside, the target price recommended by DT Invest is $9.25.

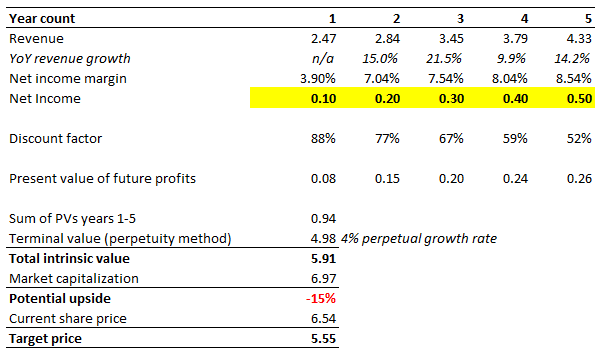

What can go wrong with my thesis?

My DCF model incorporates aggressive net income growth for the next five years. According to my model, the EPS is expected to expand by more than eight times over the next five years. This looks like a challenging task, even considering that the base year’s comparative number is quite low. For example, if I incorporate that the EPS will expand by five times over the next five years, the valuation does not look that good in this case.

DT Invest

Despite me being extremely bullish about SoFi’s potential, I also realize that it competes not only with young fintech companies, but also with such financial industry’s behemoths like JPMorgan Chase (JPM) and Bank of America (BAC). To understand the difference of scales between SoFi and these giants, let me give just one example. Bank of America spends on technology around $12 billion every year, which is around two times higher than SoFi’s market cap. Therefore, competition risks are extremely high, and this makes SoFi quite a risky bet.

Summary

SoFi has a strong potential to remain on its impressive growth trajectory for the next several years. The company is strong in capitalizing on favorable industry trends. Trends in its profitability profile clearly indicate the strength of SoFi’s “land-and-expand” potential, which is the ultimate goal of any successful financial services business.