PM Images

SoFi Technologies, Inc. (NASDAQ:SOFI) is not getting much love from investors these days even though the fintech is growing, customers are joining at a record speed and profits are snowballing.

With this backdrop providing plenty of fuel for the fintech’s growth, SoFi Technologies once again raised its forecast for 2024 in both of its key metrics, EBITDA and net revenues.

I think that SoFi Technologies’ member upsurge is significant and taking into account that the fintech is now profitable, the pay-off profile of an investment in SoFi Technologies could be skewed to the upside.

My Rating History

In my May piece on SoFi Technologies I assigned a Buy stock classification to the fintech as SOFI profited from robust member and financial services product growth.

SoFi Technologies raised its forecast for 2024 again, both in terms of EBITDA and net revenue, in the second quarter as the company has developed some real momentum in terms of member growth.

I think that the stock of SoFi Technologies is undervalued and that the fintech is a top growth investment for investors in 2024.

Significant Member Surge

A significant amount of new members flocked to SoFi Technologies in the second quarter and it is exactly this kind of momentum that I think investors are underestimating here: In 2Q24, SoFi Technologies’ members grew by 643K after the fintech added 622K new members in the prior quarter.

Now, the fintech sports a total member base of 8.8 million, meaning the fintech doubled its members in the last two years. As a matter of fact, the company has been growing its members quite consistently over time which speaks to the strength of the SoFi Technologies banking platform.

Members Growth (SoFi Technologies Inc.)

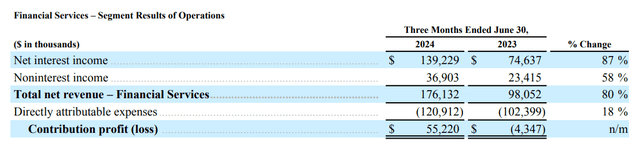

SoFi Technologies’ lending net revenue was up 3% to $340.7 million in the second quarter, but in financial services, net revenue skyrocketed 80% YoY to $176.1 million, mainly due to growth in net interest income. Lending, however, did better than in the prior quarter which is when the fintech saw a QoQ net revenue contraction.

Segment Results Of Operations (SoFi Technologies Inc.)

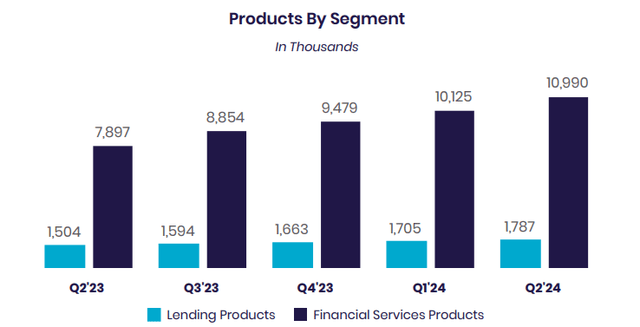

SoFi Technologies’ secret sauce is that the fintech has gotten extremely good at bringing new financial services products to its customers. Financial services have fueled the fintech’s results for a while now and I think it is a nugget that investors may not fully appreciate.

For example, financial services products rose 39% YoY whereas lending products grew at a much more moderate 19% YoY in the second quarter.

Financial services and technology products (Galileo) accounted for 45% of SoFi Technologies’ adjusted net revenue in 2Q24, up from only 32% two years ago. SoFi Technologies anticipates this revenue split to grow to 50-50 on a full year basis.

Products By Segment (SoFi Technologies Inc.)

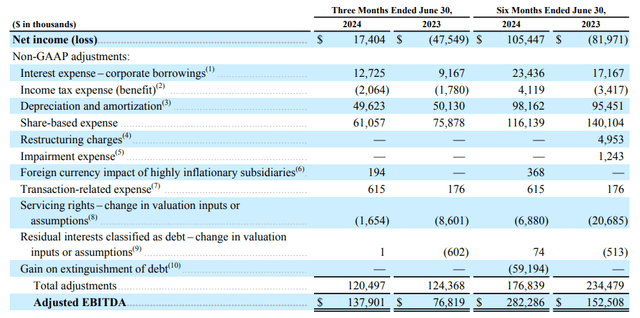

SoFi Technologies is profitable in terms of EBITDA as well as net income. In 2Q24, the fintech earned $137.9 million in adjusted EBITDA, reflecting 80% YoY growth.

The fintech’s growth mainly comes from its financial services segment as well as the underlying momentum in terms of product growth. SoFi Technologies has been unprofitable for most of its history, but finally turned the corner in 4Q23.

Due to this momentum, SoFi Technologies raised its outlook for adjusted EBITDA and net revenues: The fintech now foresees $2,425 – $2,465 million in adjusted net revenues, reflecting 17-19% YoY growth whereas its adjusted EBITDA is anticipated to fall into a range of $605 – $615 million, reflecting 25% YoY growth. For SoFi Technologies, this was the second consecutive raise in guidance in 2024.

Adjusted EBITDA (SoFi Technologies Inc.)

SoFi Technologies Is Still A Steal

The market presently models $2.82 billion in sales for 2025 which implies, given the fintech’s current equity market value of $7.5 billion, a leading sales multiple of 2.6x. PayPal Holdings Inc. (PYPL) is selling for 2.0x 2024 estimated sales, but PayPal has growth challenges and investors don’t like the stock much either.

If consensus estimates are correct, SoFi Technologies anticipates to produce sales growth of 15% next year compared to a YoY growth rate of half that for PayPal (7-8%).

The growth momentum, however, clearly benefits SoFi Technologies and the fact that the fintech now raised its forecast for 2024 twice, suggests that the company is on the right track with its financial services-centric growth strategy.

If SoFi Technologies becomes consistently profitable and drives sales growth with its financial services segment, I think that SoFi Technologies could rerate to a 4-5x sales multiple which leads us to an implied intrinsic value of between $11 and $13.

Revenue Estimate (Yahoo Finance)

Why The Investment Case Might Disappoint

SoFi Technologies is growing quickly, but it seems that the market has not yet been fully convinced of the fintech’s growth story.

This may be the case because investors lump SoFi Technologies in with other banks rather than technology companies that have considerable potential for scale. I think this is a mistake as the company profits primarily from financial services growth and not lending growth, as one would expect from a traditional bank.

I think that the risk/reward relationship is overall quite favorable for an investment in SoFi Technologies and consider the upward trajectory in members a clear indication that the fintech has implemented a successful business strategy.

My Conclusion

SoFi Technologies saw a lot of new members join its personal finance platform in the second quarter as the fintech won another 643K customers.

SoFi Technologies now raised its forecast for 2024 adjusted EBITDA and net revenue twice which proves, in my view, that the company’s growth plans are working.

SoFi Technologies is a ‘Buy’ for me primarily because of its undervalued member growth, financial services momentum and a strong valuation profile.

Paying only 2.6x leading sales for a fintech with considerable sales and EBITDA momentum is a great deal for investors that seek to invest in the fintech industry for the long haul, in my view.