cagkansayin

Paysign (NASDAQ:PAYS) is a fintech company with a niche focus on healthcare, specifically Plasma donor compensation and patient affordability programs. It is a small-cap company with a quarter of a billion dollars in market cap, volatile revenue, and earnings, and it has been having a great year.

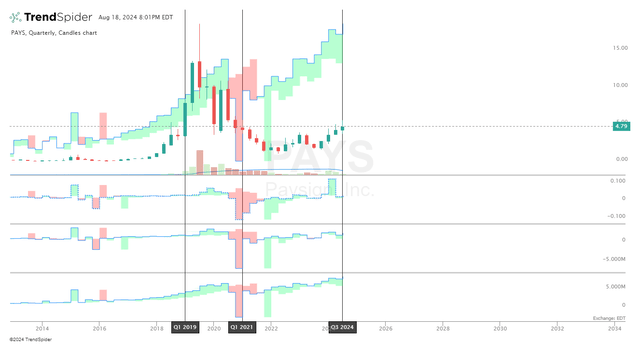

Price Revenue & EPS (TrendSpider)

The pandemic hit its affordability hard, as seen in the image, but it also increased its revenue and size. It seems that it may finally be returning to its former glory, but with greater revenue, a better outlook, and improved product lines and efficiency.

The article will explore

- Basics of the company and products

- Financial Outlook and Valuation

- Risks and considerations

- The Tortoise and the Cat portfolio.

The company and its products

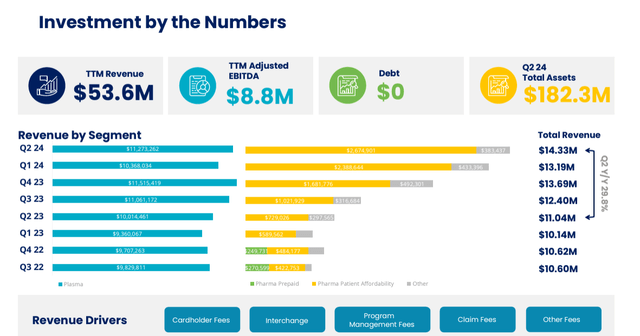

The company’s two main segments are plasma donor compensation and patient affordability; as we can see in the chart below, Plasma has had sustainable and stable revenues with some growth. However, Patient affordability has been growing remarkably since last year.

Revenue Split and Growth (Investor Relations)

This growth has been obscured in the total company growth as initially, the segment represented only a tiny part of the total revenue. Now, it represents a substantial portion of the revenue. If the segment continues to grow, it will be reflected in the total revenue.

The company expects this trend to continue and even strengthen in future years, not only in patient affordability, but also in “other” segments that currently represent a minuscule amount of revenue.

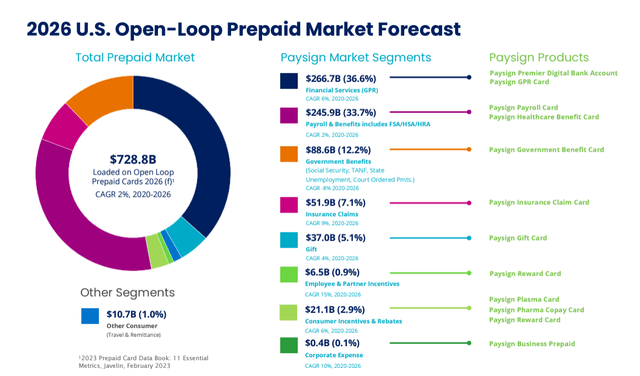

2026 US Open Loop Prepaid Market forecast (Investor relations)

Plasma cards represent less than 3% of the TAM the company is targeting. Insurance claim cards have a forecasted TAM of 3x Plasma and a CAGR of 9% vs. the 6% of Plasma. Payroll and healthcare benefits are 10 times the TAM and have growth prospects similar to Plasma’s.

This is to say that while Paysign may control a substantial portion of the Plasma TAM and has relative security there as the market leader, its growth in other segments may be smothered at first, considering the size of the market and the small part and niche benefits the company has.

The company obtained AstraZeneca as a customer in Q3 of 2023, and in the last earnings call, it explained that it expanded the number of programs.

Since then, we have increased the number of programs from their initial four to a total of 12 by the end of the second quarter. The AstraZeneca programs encompass a mix of retail and specialty therapies, covering a wide array of therapeutic classes, and include both new launch and transition programs. This is only one example as we currently manage programs for six of the 20 largest pharmaceutical companies in the world. – Mark Newcomer – President and CEO

Having expanded the number of pharma companies and the programs they run seems promising for the company’s growth. New programs tend to be low revenue, and scale from there, if the company manages these programs well, it could represent a higher growth in revenue than the one the market expects.

Financial Outlook

Let’s look at the stock’s past performance and its fundamentals. On the top part, we can see revenue growth has been increasing since 2022, and revenue is much higher than in Q1 of 2021 and 2019, both previous times when the company traded at this price.

Revenue, EBITDA, EPS (TrendSpider)

The same holds true for EBITDA and gross margin, while EPS is comparable. While this alone does not show the company as undervalued when we compare its revenue prospects, we can see that revenue growth is expected to be higher than in 2021 and 2019.

Revenue growth prospects seem higher or comparable, even in the low range, where pharma does not shine particularly well.

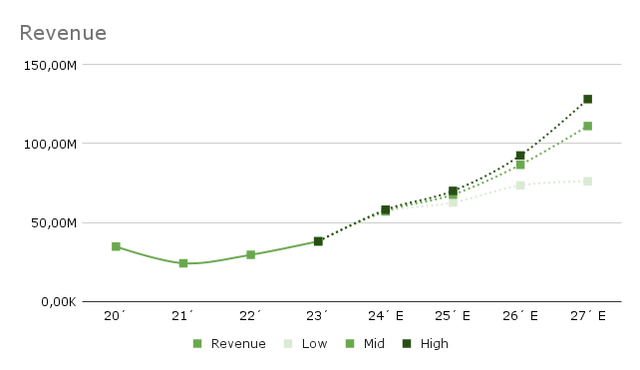

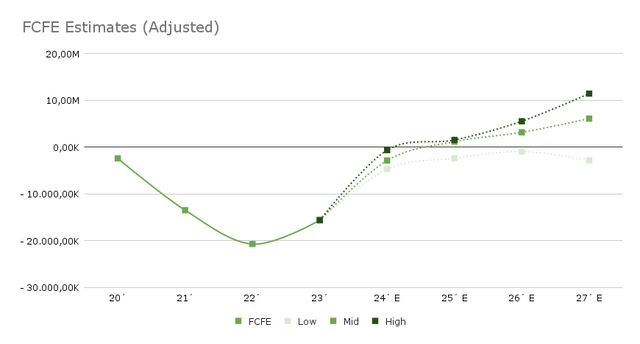

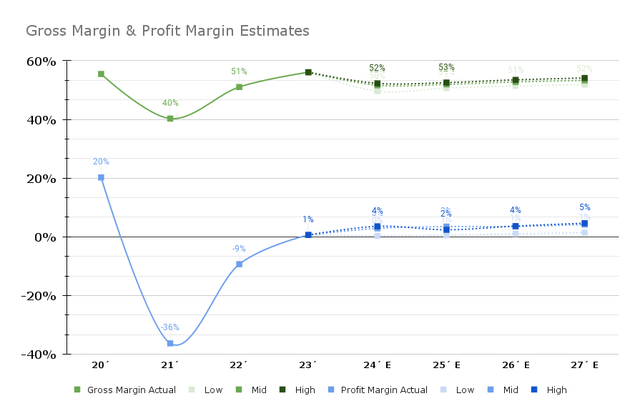

Gross Margin and Profit Margin Estimates (My Charts)

In every scenario here, the gross margin remains within the bounds shown in previous quarters; this may be overly pessimistic, as Pharma revenue may have a higher margin than Plasma.

This translates almost directly to profit margin, considering the economics of scale that the company has shown. This is where the company’s previous pandemic experience managing its operations may come in handy.

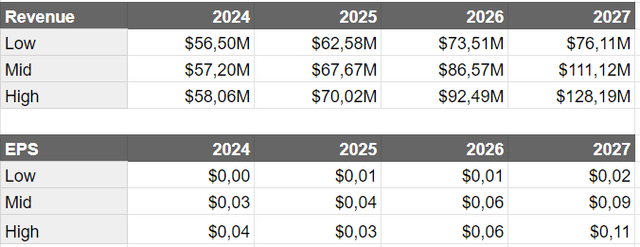

Revenue and EPS Forecast (My Charts)

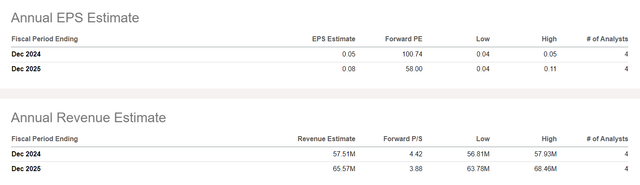

For 2024, the low range of the estimates is more pessimistic than the one shown in Seeking Alpha, as the valuation normalizes the P&L figures. Even on the high side of the valuation, 2025 EPS shows a much lower level than the one forecasted by Seeking Alpha.

Seeking Alpha Revenue EPS Estimates (My Charts)

At even extremely optimistic levels, 2027 EPS in the high range barely reaches the high side of the 2025 estimates.

Low earnings do not necessarily translate to cashflows; the firm’s accounts payable are higher than its receivables, and this variation has increased for the past few years.

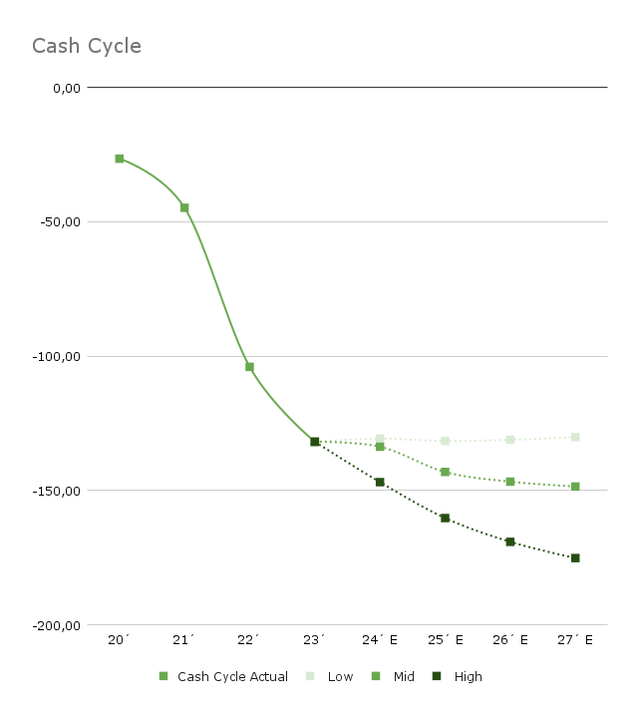

Cash Conversion Cycle (My Charts)

This Cash Conversion cycle would likely change as not all accounts payable are the same and depend on product mix; however, if the company maintains this cash conversion cycle structure, it could sustain its growth while generating enormous amounts of cash in the process.

Free cash to equity reflects revenue growth with relatively low margins but a highly beneficial cash conversion cycle. This is the basis of the valuation, and below-market gross margins are even considered to increase revenue and show promising cashflows.

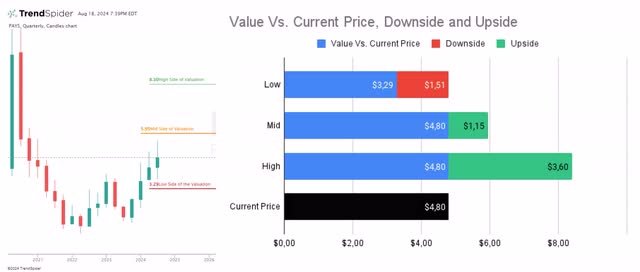

Fair Value Estimates (My Charts)

With this valuation, the company would be 30% above the most pessimistic range of the estimates, while the “most likely scenario” shows a fair value of 23% above the current price. The highest side of the valuation shows remarkable upside potential.

Risks and considerations

When considering the risk of a stock, I believe it makes sense to separate the financial aspects, the industry and macro perspective, and the market risk.

Financially

The company has virtually no debt and a strong working capital position, so risks are scarce. It also has a substantial amount of cash (over 130 Million), representing about $2.4/share, which is significant and should eliminate any liquidity concerns.

Industry & Macro

The number of fintech companies seems to grow like weeds from an industry perspective. There is a relatively low barrier to entry, and the true test of them is whether they can capture a niche and facilitate services that traditional banking or low-tech solutions cannot provide.

While Paysign has demonstrated these differentiators in the plasma space, it is too early to tell for the pharma segment. While they have captured important partners, their time in the space should help them. Bigger fish and newcomers to the space will not make this easy. This may reduce the growth of the pharma segment or at least make it more bumpy than expected, which could reflect volatility in the stock price.

Market Risk

The market risk with stocks below a billion dollars is not to be neglected. Small caps, in general, are more sensitive to Macro turns as arguably they are less prepared and have narrower moats than Blue-Chip companies. So, the market tends to punish them under those circumstances.

A good example of this is Paysign’s stock price performance during the pandemic. While its results took a hit, the overall picture remained quite impressive, and its financials were strong. Nevertheless, the price took a substantial dive. This was arguably because of the company’s size.

The Cat, The Tortoise, and my portfolio

The stock is exciting. On the one hand, it has plasma revenue that may act as a buffer for harsh financial conditions. In economic downturns, the company would arguably have higher plasma donations and activity.

On the other hand, the pharma business seems to be growing smoothly, and it likely has the strength and edge to carve out a substantial portion of its share of the insurance and payroll areas. This shift in company segment revenue is similar to the one Aspen Aerogels (ASPN) has been experiencing since last year.

If the stock is not widely covered or the coverage is not profound, it is likely that the growth in pharma was not noticed by many, as it did not have a meaningful impact on total revenue.

Let’s look at the Tortoise and Cat portfolio outlook.

The Tortoise portfolio would allocate a portion to this stock. The relatively low downside risk and the risk parameters that the plasma donation segment represents, paired with a good business model, fit well with the portfolio objectives. The only complex issue here is the company’s market cap, which may make it more volatile than other stocks. For that reason, the portfolio would allocate 2/3 of the position and increase the other 1/3 if the next quarter’s information confirms the investment thesis.

The Cat portfolio would take a position in the company. The risk-reward opportunity is there, and the catalysts seem to be clear and have enough upside potential for an allocation in the risk-seeking portfolio.

For my portfolio, my biggest issue with the stock is that it does not fit perfectly within the 7 most important trends in the XXI century. However, the portfolio is missing some exposure to the healthcare industry.

The closest trend in which it fits is the transformative shifts in demographics.

Transformative Shifts in Demographics and Healthcare: As demographic conditions evolve, the healthcare industry undergoes a radical transformation propelled by technological and data-driven innovations.

While the company does not perfectly fit these, Plasma’s antifragile nature, paired with its strong undervaluation, makes a compelling case to include it in the portfolio, at least for a while.