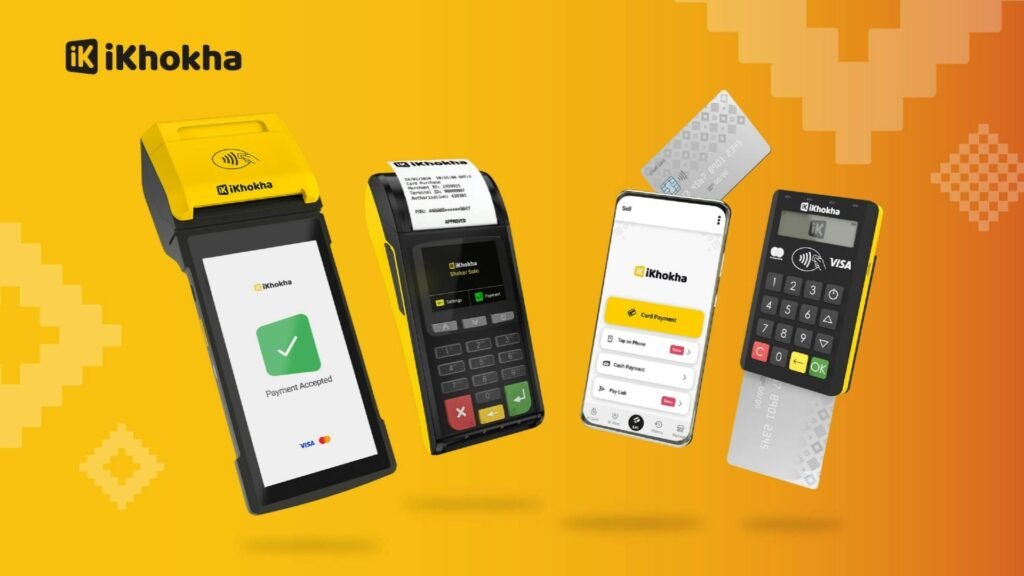

- Nedbank has announced that it is acquiring local fintech company iKhokha.

- It is said to be an all-cash deal to acquire 100 percent of the fintech.

- iKhokha will become a wholly owned subsidiary of Nedbank, but will continue to operate under its own brand and leadership team.

Nedbank appears to be bolstering its SME and point-of-sale offerings, as this week it announced the acquisition of local fintech iKhokha.

More specifically, the Nedbank Group has entered into a binding agreement to acquire 100 percent of iKhokha in an all-cash deal for approximately R1.65bn. The final acquisition figure is subject to certain adjustments upon conclusion, Nedbank confirmed.

The financial institution also noted that this move, “marks a significant milestone in Nedbank’s strategy to deepen its support for small and medium-sized enterprises (SMEs) through digital innovation and inclusive financial services.”

“This acquisition is a natural evolution of our existing relationship with iKhokha and we are incredibly excited to welcome iKhokha to our Nedbank family. The acquisition is a pivotal moment in our strategy to empower the SME market. By combining their innovative technology with our deep banking experience, we will provide small business clients with the best-in-class tools they need to thrive,” added Ciko Thomas, Group managing executive for Personal and Private Banking, in a release to Hypertext.

It is also worth pointing out that iKhokha will become a wholly owned subsidiary of Nedbank once the deal is concluded, but crucially, will continue to operate under its own brand and leadership team. As such, for existing iKhokha customers, not much is expected to change on the aesthetic and communication fronts.

“This is a proud moment for both the founders and the broader iKhokha leadership team. Joining forces with Nedbank gives us the platform to scale our impact, further accelerate product innovation, and unlock new value for our merchants. There is great alignment across both leadership teams on the synergies that can be unlocked through this transaction, and we believe our combined strengths will result in a truly differentiating and highly competitive value proposition for SMEs in market. It also opens the door for us to explore expansion into other strategic markets on the continent,” noted Matt Putman, CEO and co-founder of iKhokha.

“We remain committed to our mission of empowering entrepreneurs and building tools that help small businesses thrive,” he concluded.

At the time of writing, no precise date has been outlined for the acquisition to be completed, but when it is, Nedbank will have a notable fintech and point-of-sale brand under its umbrella.