BALTIMORE — A Maryland schoolteacher is fighting to get back his nearly $40,000 after investing it online with a company he thought had federal bank protections.

Chris Buckler did everything financial experts recommend. He built up an emergency fund and put it in an account that accrues interest. What he didn’t know, until recently, was that the third-party working with his bank would go under causing his funds to be frozen.

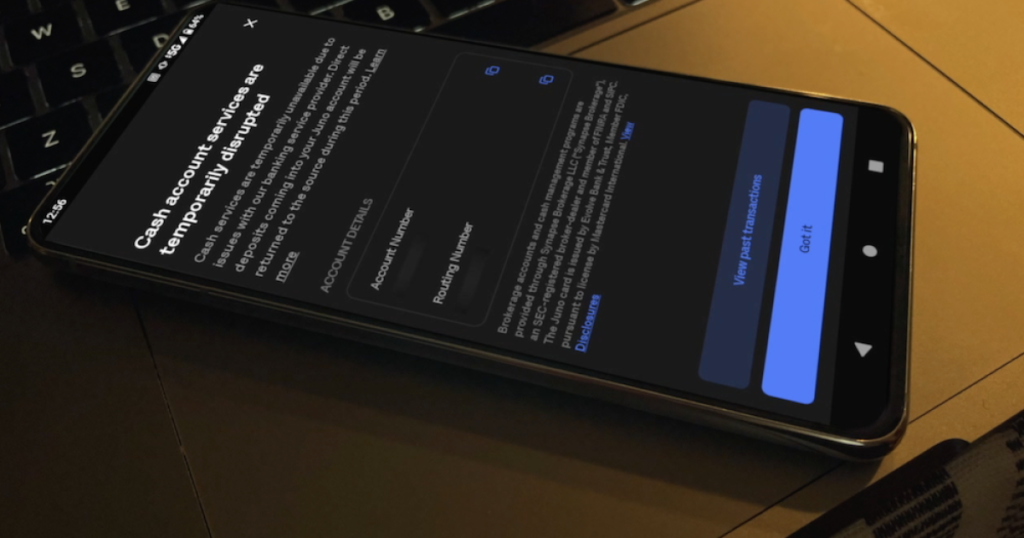

“It doesn’t let you do anything. It just says services are disrupted,” Buckler said.

Buckler can see his balance in Juno’s app, a financial technology company that he chose based on their high-yield savings account, but he’s unable to withdraw it.

“What I assumed happened was, when you deposit money into Juno, it goes right into a federally registered, FDIC-registered institution. In this case, it was Evolve Bank and Trust. And so, I assumed that the money would go there, it would be safe, it would be FDIC-protected,” Buckler said.

But this past May, he learned his assumption was wrong.

“It turns out that behind the scenes, the money wasn’t going straight from Juno to Evolve. There is this middleman company called Synapse,” said Buckler.

Chris Verri

And Synapse Financial Technologies Inc., the third-party company providing online banking software, filed for bankruptcy in April impacting over $225 million in user funds.

Some partner banks have since returned this money, however, Evolve Bank and Trust said it has encountered irregularities and inconsistencies in Synapse’s ledgers.

And according to the July 31 status report in bankruptcy filings, Evolve still does not know who is owed what and is working with a consulting group to track down this information.

“It’s been about three months at this point, and as of right now, we don’t really have an end in sight as to when the money is going to come,” said Buckler.

WMAR-2 News contacted Evolve Bank and Trust but has not yet received a response.

Juno denies ever holding these funds and said they have limited visibility in the ongoing issues and reconciliation process.

And Buckler also learned while Evolve is FDIC-insured, the third-party failed, not the bank so he doesn’t qualify for federal protections.

“The big lesson that you know the FDIC, the Federal Reserve, all the government agencies, seems to be, is put your money directly into an insured institution, and that’s what I’ve been doing ever since this has gone down,” said Buckler.

The Federal Reserve is strongly encouraging all relevant parties to return money to consumers as soon as possible. And so has the U.S. Senate Committee on Banking, Housing, and Urban Affairs.

“I have read of people who have had a lot of difficulty paying their rent, paying their electricity bill, their basic bills, car payments, mortgage,” said Buckler. “There are a lot of people who are really suffering, and I hope that somehow, someway, somebody is going to step in and get this fixed.”

WMAR-2 News Mallory Sofastaii also contacted Senator Chris Van Hollen (D-MD), a member of the Senate banking committee. In an email, he wrote:

“Synapse, Yotta, and its partners have violated the trust of tens of thousands of Americans who sought to save and manage their hard-earned money. These companies have an urgent responsibility to work together to restore customers’ access to their funds immediately, just like any bank would, and I hope the Consumer Financial Protection Bureau (CFPB) will pursue every available action to protect customers and prevent this kind of risk.”

To file a complaint with the CFPB, click here.

The Federal Reserve also operates Federal Reserve Consumer Help (FRCH). The FRCH encourages consumers who are experiencing issues with accessing funds to file a complaint. Consumers can file complaints online or can contact FRCH directly at 1-888-851-1920 if they need assistance or have questions about filing a complaint.