Lesaka Technologies has rapidly emerged as a vital fintech enabler in Southern Africa, with its strategic focus on township economies attracting national attention. Building on its broader market ambitions, the company is now demonstrating tangible impact at street and store level among consumers, traders and township entrepreneurs.

Lesaka Technologies has rapidly emerged as a vital fintech enabler in Southern Africa, with its strategic focus on township economies attracting national attention. Building on its broader market ambitions, the company is now demonstrating tangible impact at street and store level among consumers, traders and township entrepreneurs.

Lesaka currently serves over 90 000 micro merchants and more than 30 000 small-to-medium-sized businesses; the majority of these businesses are located in townships and villages across South Africa.

“Lesaka is synonymous with South Africa’s township economies,” says Lincoln Mali, CEO Lesaka Southern Africa. “We understand the pain points of both consumers and merchants and recognise what it takes not only to survive but also to grow. We will continue investing in our fintech ecosystem to help our clients fulfil their potential.”

As townships across South Africa digitise, Lesaka is not just providing financial tools, it is fostering inclusion, growth and opportunity. From fuel courts to taverns, from spaza shops to mall retailers, from shisanyamas to KFC franchises, the company is helping build a more connected, empowered township economy, one transaction at a time.

Enabling township merchants to grow

Lesaka has the rare capability to serve township merchants of all sizes. These businesses form the backbone of township economies.

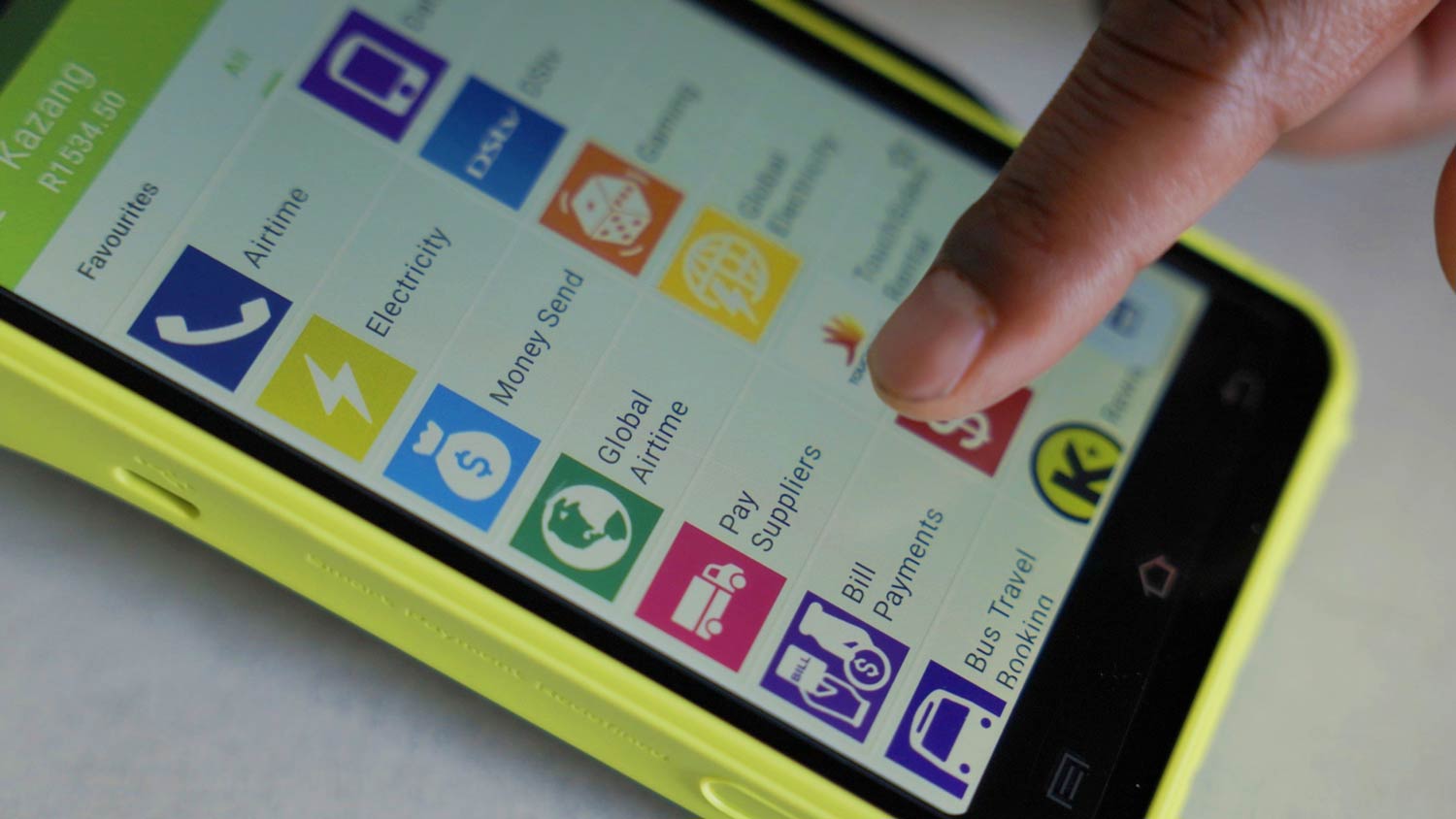

Lesaka’s solutions for businesses include:

- Point of sale solutions & card acquiring

- Capital for growth purposes

- Supplier and bill payments

- Value-added services

- Cash solutions

- Software solutions

“Lesaka is unique in the breadth of solutions we offer to a wide range of businesses in townships. Our digital tools allow these businesses to grow, become more efficient and reduce risk, all while joining the digital revolution,” says Mali.

Lesaka’s point of sale (POS) terminals turn spaza shops and local traders into one-stop service points, streamlining operations and increasing safety. For example, through Lesaka’s supplier payments portal, now used by more than 700 suppliers, businesses can order and pay for stock digitally.

“A prominent dairy company’s delivery driver used to collect up to R30 000 in cash daily on his route, posing major risks to himself and our merchants. Using our supplier payments platform, cash holdings are significantly reduced, efficiency has improved for both merchants and suppliers and quality products can be delivered to township consumers.”

Lesaka also utilises merchant data such as stock and sales history to provide short-term working capital loans and growth capital more rapidly than traditional financial institutions.

A tavern owner has been able to access R4-million in growth capital within 24 hours via Lesaka’s app to expand his business by building a new wing to his establishment.

Digitising fuel courts and township hospitality

Lesaka has extended its fintech solutions to township fuel court operators through software that simplifies and centralises business operations. George Nkosi, who owns petrol stations in Dobsonville and Diepkloof, says: “Lesaka’s fuel solutions solve my pain points. I can plan better and remove the guesswork. It gives me peace of mind.”

Another operator, Songezo Nayo, highlights Lesaka’s role in helping him expand.

“Through Lesaka, we accessed next-day funding to acquire new sites. The banks took too long. With Lesaka, it was click and borrow. Without them, we would have missed the opportunity.”

The township food and beverage industry, worth approximately R150-billion a year, is also seeing digital uplift. Around 850 township restaurants and taverns, including global franchises like KFC and local brands such as Honchos, now use Lesaka’s hospitality tools.

“It is a battle to survive in the F&B (food and beverage) hospitality industry,” says Mali. “The more technology support an operator has, the better their chances of success.”

Lesaka’s POS and card acquiring tools are paired with analytics to help owners manage stock, design promotions and build customer loyalty.

“We are now able to give other businesses and suppliers rich data and insights into the growth, vibrancy and dynamism of the township market to help their distribution and investment decisions.”

Improving lives of township consumers

Lesaka currently serves 1.7 million social grant beneficiaries. Lesaka’s consumer services cover banking, micro-loans, insurance, bill payments and value-added services specifically tailored for social grant recipients. For example, its personal loans are capped at R4 000, are repayable over up to nine months and clients must settle one loan before applying for another.

Gertrude Jones, a customer since 2017, initially took out a loan to pay school fees. She now uses Lesaka to help make ends meet.

Read: Lesaka announces new executive leadership appointments

“If I didn’t have access to these loans, my life would be very different. The staff at the branch are very kind and helpful. They treat us well, and I have never had any problems,” she says.

For Dorah Komane, who’s been a customer since 2014, safety and legitimacy are key.

“We were scared of loan sharks, but now I don’t need to take money from strangers. I walk in, show my ID and receive my loan immediately. It is safe and legitimate. Since I took out my Lesaka loans, things have been a lot better.”

Insurance products, including funeral and pensioners’ plans, are also designed with affordability in mind. Maggie Manyeke, a customer for nearly two years, explains: “They made it possible for us to afford insurance. I am so happy about this. You guys are changing people’s lives for the better.”

Insurance products, including funeral and pensioners’ plans, are also designed with affordability in mind. Maggie Manyeke, a customer for nearly two years, explains: “They made it possible for us to afford insurance. I am so happy about this. You guys are changing people’s lives for the better.”

Lesaka’s digital channels have seen major uptake. Customers can now open accounts, apply for loans and access insurance from their home, saving time and transport costs.

For those preferring in-person support, the Lesaka’s EasyPay Everywhere branch network has grown to over 220 locations, conveniently situated in and near townships and in rural areas.

Beyond grant beneficiaries, Lesaka serves the wider townships with additional digital solutions. Lesaka’s bill payments and value-added services offer further convenience to township consumers, facilitating easy settlement of their monthly accounts and utilities as well as paying for airtime, data and electricity.

Likewise, depositing cash wages and earnings into a bank account is sometimes not possible or desired. Lesaka’s vouchers solve this and are a convenient alternative not requiring personal information, paperwork or deposit fees. Consumers can buy vouchers at local spaza shops, tuck shops or petrol stations, converting cash for easy digital spend.

Mali concludes: “We are deeply embedded in the daily lives of township residents and merchants, and our offerings are now woven into the economic fabric of these communities. Our core purpose is to empower consumers and merchants to reach their full potential by making financial services easier, safer and more inclusive.”