As a new FinTech preparing to launch, your limited resources will face competing demands. At a high level, you’ll need to:

- Build a secure platform to support your services.

- Obtain your Regulatory Permission (FCA license).

- Hire skilled staff to meet regulatory requirements and serve your customers.

- Market your services effectively to your target audience.

Prioritizing Resources

Ask yourself, how quickly do you want to launch and

what resources do you have in place?

- Staffing and Regulation

Your team must have the expertise to satisfy regulatory requirements, onboard customers correctly, and ensure funds are secure. A strong compliance framework is essential to maintain trust and avoid costly mistakes. - Marketing and Customer Awareness

Building awareness in your target market is crucial to gaining momentum. Early-stage marketing efforts should focus on creating visibility and driving user adoption. - Platform Security

Trust is paramount in the financial sector. Your platform must be secure, resilient to cyber threats, and adaptable to evolving risks. Cybersecurity is not just a technical issue—it’s key to maintaining customer trust and avoiding reputational damage. - Regulatory Compliance

Staying compliant with the ever-changing regulatory landscape is time-intensive and costly. Your systems must adapt to new requirements seamlessly, ensuring you avoid penalties and maintain credibility. - What Capabilities do you need for Minimum Viable Product (MVP)?

Minimum Requirements

Ledger & Account Management

Hosting, Management & Security

Connections to at least one

- Basic Customer Account Capability

- Payments

- Settlement

- Reconciliation

- Reporting

- Server & Firewall Management

- Development / Sandbox / Production instances

- Replicated Databases

- Deployment & patching

- Monitoring

- Replication & Backups

- Logging & Reporting

- Penetration Testing, DDoS, Virus prevention …

- Payment Platform

- AML / KYC / KYB / Sanctions provider

- Transaction Monitoring provider

- Single Point of Management

Nice to Have

- Joint Accounts

- Company Accounts

- Savings, Loans & Overdrafts

- Multi-Currency

- API Provision

- Mobile Apps

- Cloud native solution

- Forex Provider(s)

- Additional Payments Providers

- Additional AML / KYC / KYB provider(s)

- Loans and Savings Partners

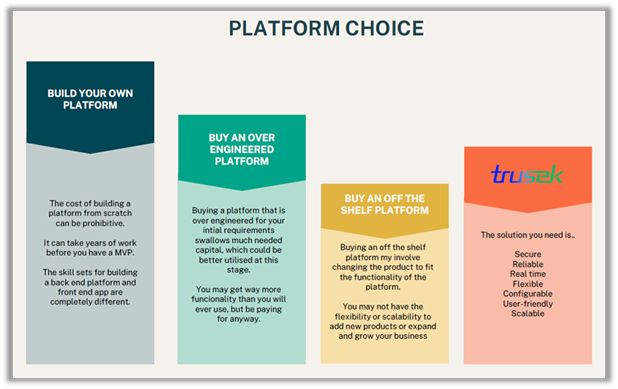

- Build vs. Buy: Choosing the Right Platform

|

Time-consuming and expensive, both in development and ongoing maintenance

|

Quickest MVP and most cost-effective approach is to build on a proven platform.

|

Proven Platform Benefits

By leveraging an existing platform, you gain access to:

- Functional modules for payments, foreign exchange, risk management, and more.

- Built-in security and compliance frameworks.

- Pre-established integrations with key service providers.

- Previous experience with successfully achieving regulatory approval

- Accelerated Time-to-market

This approach allows you to focus on what you do best—developing your services and delivering an exceptional user experience — while minimizing costs and accelerating your time to market.

Future-Proof Your Business

A proven platform not only reduces upfront development costs but also ensures scalability and adaptability as your business grows, helping you avoid long-term operational challenges.

Ready to launch your FinTech startup faster?

Leverage a proven platform to gain the functionalities, security, and compliance you need to hit the ground running.

As a new FinTech preparing to launch, your limited resources will face competing demands. At a high level, you’ll need to:

- Build a secure platform to support your services.

- Obtain your Regulatory Permission (FCA license).

- Hire skilled staff to meet regulatory requirements and serve your customers.

- Market your services effectively to your target audience.

As time is money I strongly recommend you look at options to

Accelerate your Time-to-Market.