JHVEPhoto

Fiserv, Inc. (NYSE:FI) has reported a good operating momentum in the last quarter and its valuation remains attractive, making it a good growth play for long-term investors.

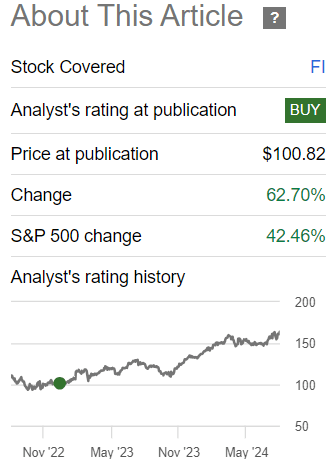

As I’ve covered in previous articles, I see Fiserv as an interesting growth play within the digital payments industry, as the company has strong fundamentals and growth prospects, but this was not reflected in its valuation. Since my last article on Fiserv, back in December 2022, its shares are up by more than 60% and have outperformed the market by some margin during the same time frame, showing that Fiserv was indeed a good growth pick.

Article performance (Seeking Alpha)

As I’ve not covered Fiserv for some time and the company has recently released its quarterly earnings, I think now is a good time to update on its financial performance and investment case. We’ll see if it remains an intriguing play for long-term investors.

Q2 2024 Earnings Analysis

Fiserv operates in the digital payments industry, providing integrated information management and e-commerce systems, having nowadays a market value of about $93 billion. Its core business is providing financial institutions and other corporate with processing, electronic billing and payment systems.

This industry is quite competitive and barriers to entry are low. Thus, competition includes large payment companies like Visa (V) or Mastercard (MA), but also smaller companies such as Fidelity National Information Services (FIS) or ACI Worldwide (ACIW).

Historically, Fiserv’s strength was mainly in the segment of small and mid-sized banks. This usually lacks in-house processing units and prefer to outsource their IT systems, but it has diversified its business recently and has nowadays a well spread business across several services. Indeed, its operations are currently organized into two main segments, namely Merchant Services and Financial Solutions, each one being responsible for about half of Fiserv’s revenue.

Despite that, the vast majority of its revenue is generated from payment processing and services, which represented about 81% of total revenues in the last quarter. These are mainly generated from account and transaction-based fees, under multi-year contracts that have historically high renewal rates. This means Fiserv’s business is highly recurrent over the long term, even though it’s naturally exposed to payment volumes, which are dependent on the economic activity in the short term.

Despite that, its long-term growth prospects are well-supported by structural factors. These include such as the digitalization of the society and more payments moving to electronic channels rather than physical payments. In addition, the company has historically also made some acquisitions and this strategy is expected to be maintained for the foreseeable future, boding well for its growth ahead.

Over the past few quarters, the company has reported positive business growth and margin expansion, a trend that was maintained during the last quarter.

Key operating metrics (Fiserv)

As shown in the previous graph, its revenues increased by 7% YoY, adjusted for the forex impact in Argentina, and its adjusted EPS was up by 18% YoY, showing that its operations are enjoying very positive momentum.

By segment, its merchant services unit reported revenues of $2.4 billion in Q2, up by 9% YoY, driven mainly by small customers, while its financial solutions unit reported revenues of $2.38 billion, representing an increase of 6% YoY. In this last segment, the digital payments business was the major growth driver, reporting revenues of $987 million in the quarter, up by 8% compared to the same quarter of 2023.

This shows that Clover, in the merchants business, and Zelle, in the digital payments segment, are two key products for Fiserv’s growth. This is given that Clover reported revenue growth of 28% YoY and Zelle’s transaction volume increased by 43% YoY, which are very impressive growth figures.

Beyond higher revenue growth, Fiserv is also enjoying positive operating leverage, as the cost of adding additional customers is low, leading to higher business margins. Indeed, in Q2 2024, its adjusted operating margin was 38.4%, an improvement of about 160 basis points (bps) compared to Q2 2023. As the company continues to add more customers within its platforms, it’s likely that it will be able to extract more synergies and improve its business margins. Thus, a rising operating margin is likely ahead.

Moreover, despite the inflationary environment and pressure on wage growth, Fiserv’s selling, general and administrative expenses were flat compared to the previous year. This shows that management is doing a good job controlling potential cost growth, being another reason why Fiserv’s operating leverage has been positive over the past few quarters.

Due to this combination of higher revenues and stable costs, Fiserv’s net income increased by $211 million in absolute terms, to $894 million in Q2 2024 (+30% YoY), which is quite impressive and shows that Fiserv’s operating leverage has a great impact on its bottom-line.

Regarding its cash flow generation capacity, it remains quite good, considering that Fiserv has generated about $1 billion in free cash flow during Q2, which is above its net income and shows a strong free cash flow conversion rate.

For the full year, due to its positive operating momentum, Fiserv has increased slightly its guidance, and is now expecting to grow revenues organically by 15-17% in 2024 (it was 18% in Q2, not adjusted for forex impact) and report an adjusted EPS growth between $8.65-8.80 (vs. $8.60-8.75 previously). It also expects to improve its adjusted operating margin by 135 bps during 2024 (vs. 125 bps previously) and generate free cash flow of some $4.7 billion (vs. $4.5 billion expected before).

These revised expectations are a strong sign that Fiserv’s business continues to grow sustainably, as the company enlarges its service offerings and gains new customers, a trend that is not expected to change much in the coming years.

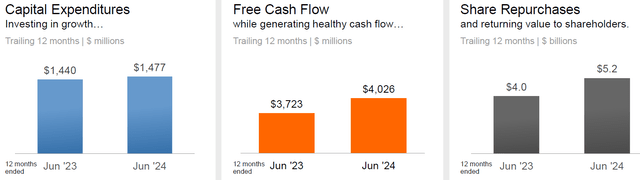

This is also supported by its investment in technology and new solutions. This explains why Fiserv’s capital expenditures amounted to $348 million in Q2, representing close to 7% of its revenues, showing that Fiserv is clearly committed to investments and growing its business over the coming years. For the full year, it expects capex to be around $1.5 billion, a similar level compared to previous years.

As shown in the previous graph, Fiserv has a very good cash flow generation capacity and is using this mainly to return capital to shareholders, given that share buybacks have amounted to some $5.2 billion over the past year. This is well above its free cash flow generation in the same period, something that is justified by Fiserv’s strong balance sheet.

Indeed, its net debt-to-EBITDA was 2.8x at the end of last quarter, which is an acceptable leverage ratio, allowing it to return most of its free cash flow to shareholders. This also means that Fiserv expects its leverage ratio to gradually decline through higher earnings rather than keeping cash in its balance sheet, which seems sensible as the company’s growth prospects are quite good.

Nevertheless, compared to other tech-oriented companies like Fiserv, its leverage position is higher than its peers, explained by Fiserv’s acquisition history recently. While I don’t think this is an issue for the company, a lower leverage ratio could potentially lead to a higher credit rating and lower debt costs. However, so far, this doesn’t seem to be its priority and is making capital returns one of its business goals.

Despite that, Fiserv does not distribute dividends, which is also questionable, as a dividend payment could lead to an enlarged investor base and be positive for its share price.

Regarding its valuation, Fiserv is currently trading at 17.2x forward earnings, a level that is higher than compared to when I last analyzed it (less than 14x), but it’s still slightly below its average over the past five years (closer to 18x). Compared to its fintech peers, including Fidelity Information Services, Visa or PayPal (PYPL), Fiserv is trading discounted. This is given that its peers trade on average at around 19.6x, showing that its valuation is still attractive despite its strong share price performance recently.

Conclusion

Fiserv, Inc. has reported a very positive financial performance in Q2 2024 and its growth prospects are quite good ahead. Despite its strong fundamentals, positive operating momentum, and significant capital returns, its valuation is still attractive to long-term investors, making Fiserv a great play in the fintech sector.