(Yicai) July 30 — Private banks in China have emerged as a rising force in the country’s inclusive finance sector, which refers to the provision of affordable and accessible financial products and services to all individuals and businesses, over the past 10 years. Now, a widening gap in fintech capabilities is giving the leading players a clear competitive edge, Yicai learned from industry insiders.

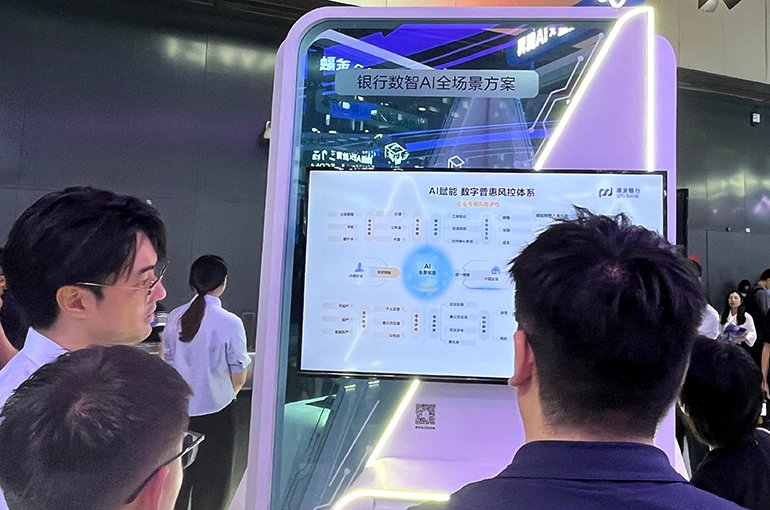

“Tech innovation has been the driving force behind private banks’ fast growth over the past decade,” an executive at a private bank told Yicai. “In the face of market challenges, private banks must continue to digitize, particularly by leveraging artificial intelligence and large language models, to build their core systems. That is the direction they must take.”

Leading online private banks such as MYbank and WeBank are taking advantage of their strong shareholder networks and substantial in-house tech expertise to attract new market resources and stay ahead of the competition.

Hong Kong-based WeBank, whose largest shareholder is tech behemoth Tencent Holdings, had CNY651.8 billion (USD90.9 billion) in assets as of the end of last year and MYbank, which is backed by fintech giant Ant Group, held CNY471 billion. By comparison, most other private banks are still under the CNY100 billion mark.

These tech-focussed banks are actively recruiting skilled talent. Last year, 67 percent of MYbank’s workforce were tech experts. That is equivalent to two out of every three employees and is the highest proportion in the industry. By contrast, over half of WeBank and SMB’s staff were tech experts, while only 10 percent of the staff at the banks at the lower end of the spectrum were tech professionals.

The gap between leading private banks and their peers is even more pronounced in terms of the amount invested in research and development. Last year, MYbank spent 36 percent of its operating revenue on R&D, while WeBank spent 7.7 percent and Nanjing-based SMB 6 percent. Most other private banks only invested between 3 percent and 4 percent.

This investment is translating into real products. MYbank has already rolled out a full suite of AI tools tailored for micro and small businesses. “Fewer than 100,000 companies in China have full-time chief financial officers, but AI can give tens of millions of small business owners professional financial advice,” Feng Liang, president of the Hangzhou-based lender, told Yicai.

Technological strengths are making operations more efficient. With just 1,600 employees, MYbank serves 68 million corporate clients.

All of China’s 19 private banks have entered the “golden era” of internet finance and fintech, said Liu Xiaochun, deputy head of the China Academy of Financial Research at Shanghai Jiao Tong University.

Due to a lack of brick-and-mortar branches and insufficient staff, many private banks are forced to rely on digital technologies to stay ahead of the curve. However, disparities in technological know-how and financial backing from major shareholders have led to a growing gap in digital capabilities and overall operations between private banks.

“We hope regulators will grant private banks more freedom to innovate,” said the executive from a top bank. “For example, adopting a sandbox regulation model so as to allow us to try out new financial ideas within controlled boundaries.”

Editors: Tang Shihua, Kim Taylor