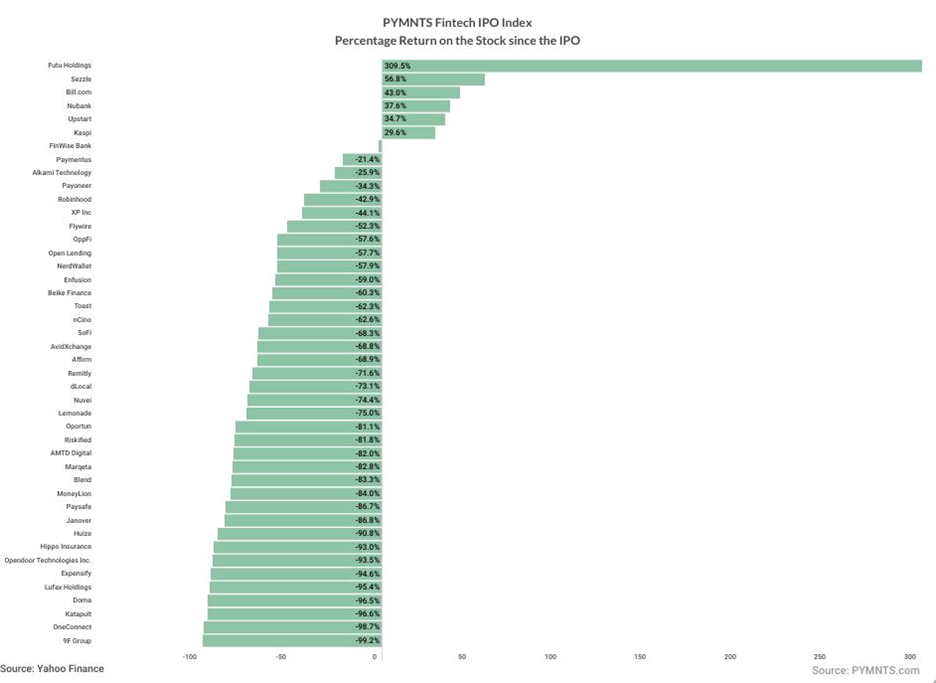

It was a relatively quiet week on Wall St. as FinTech news started to hit the slow part of the Q2 earnings season. A lot of the action took place overseas this week. Chinese FinTech Futu, which still tops the index with a 300-point percentage return since its IPO, led the way with solid earnings or new partnerships, as did nCino and Affirm. All in, the index lost a bit more than a percentage point.

Among the notable winners and losers for the week:

Hong-Kong based Futu, an online brokerage and wealth management FinTech, announced its earnings results on Tuesday (Aug. 20). It ended the second quarter with over two million paying clients, representing a 28.8% growth year-over-year (YoY) and 8.2% growth quarter-over-quarter. Futu added 155,000 paying clients in the second quarter, down 12.5% sequentially off of a high base but up 167.8% YoY.

In the first half of 2024, it achieved over 80% of full-year new paying client guidance. Given the strong year-to-date momentum, Futu raised its full-year guidance to 550,000 new paying clients in 2024. After starting the week at $62.12 per share, it ended Thursday at $62.74.

OneConnect, a Shenzhen, China-based banking-as-a-service firm, reported earnings on Aug. 16 and did not fare as well as its neighbor Futu. Revenue from continuing operations was RMB692 million ($96.8 million), compared to RMB939 million ($131.4 million) for the same period of the prior year.

Chongfeng Shen, chairman of the board and CEO, commented: “During the first half of 2024, we achieved encouraging results in overseas markets and improved our bottom-line despite the year-over-year decrease in revenue. Throughout this time, we focused on our strategic goal of achieving mid-term profitability by upgrading and integrating products, deepening customer engagement, and expanding our presence in overseas markets. Consequently, our high-value products, protected by high barriers to entry, gained broader appeal from customers, reflected in the 14.8% year-over-year increase in revenue from third-party overseas customers in our continuing operations during the first half of the year.

“We completed the disposal of our non-core virtual banking business to focus on our core businesses and continued to implement disciplined expense control measures,” Shen continued. “As a result, we recorded net profit from continuing operations and discontinued operations during the first half of the year while further cost reductions continued to narrow our loss from continuing operations.”

After starting the week at $1.47 per share, the stock dipped to $1.25 on Thursday.

On the software-as-a-service side of the banking equation, London-based nCino capitalized on a positive development early in the week as it announced on Tuesday that ABN AMRO Bank had selected nCino as a key technology platform to strengthen the bank’s ambitions to be “a personal bank in the digital age by supporting continuous innovation.”

ABN AMRO is utilizing nCino across its corporate lending operations, as well as for collateral management across all its lines of business,” the news release added.

By implementing nCino, the company said ABN AMRO is unlocking new business value through improved collateral management and by consolidating multiple legacy systems into one platform, unifying its lending process for customers and employees.

Monday’s start price for nCino was $34.01, and despite a sharp drop during the day on Thursday, it rebounded to end the week to $34.25.

Speaking of positive announcements, BNPL-platform Affirm rode its news that it will partner with Hotels.com. This builds on Affirm and Expedia Group’s existing partnership, where Affirm is the exclusive buy now, pay later provider on Expedia and Vrbo.

“We are delighted to advance our partnership with Affirm and Hotels.com. This expanded collaboration offers travelers greater payment flexibility when booking their dream stays,” said Clayton Nelson, vice president, strategic partnerships and affiliates at Expedia Group. “It emphasizes our dedication to enhancing the travel experience with innovative technologies, empowering our partners to offer exceptional service to their customers.”

Affirm started the week at $30.38 and ended it slightly higher at $30.51.

And finally, Sao Paulo-Brazil-based based Nubank celebrated its 100 millionth customer on Tuesday. Nubank, which says it is the world’s largest digital banking platform outside of Asia, has reached its milestone in just 11 years. The FinTech is marking the occasion by making over 300 job openings available.

“Nubank has matured. We have undergone international expansion, an IPO, celebrated 10 years in 2023, and now we’ve reached 100 million customers. As a result, what we offer to our employees has also evolved. We want to make this clear so we can continue to attract talents who are eager to do something extraordinary in their careers, who want to redefine what no longer makes sense, and want to be a part of the future we are building,” Suzana Kubric, chief human resources officer of Nubank, said.

After starting Monday at $14.24 per share, it finished slightly up at $14.31.