Overall startup funding in India fell 8% YoY to about $11 Bn in 2025, yet fintech remained the top-funded sector, raising ~$2.5 Bn across 120 deals

Fintech funding mirrored India’s rising credit-led consumption, with strong investor interest in card-led, consumer and MSME lending platforms, alongside payments and financial infrastructure players

As the sector moves past the reset phase, future winners will be defined by underwriting quality, regulatory compliance and capital efficiency

India’s startup funding landscape remained under pressure in 2025, with total capital deployed declining 8% YoY to around $11 Bn, as per Inc42’s Annual Indian Startup Trends Report, 2025. While the headline number is reflective of a market that is still recalibrating from the peak fund deployment during the 2021–22 cycle, the underlying story is more about a recalibration.

Amid this funding stability, investors continued to favour startups with clear paths to monetisation, repeat demand and disciplined capital deployment, resulting in fewer but more conviction-led bets. In this, fintech as a sector continued to be the preferred destination for capital deployment.

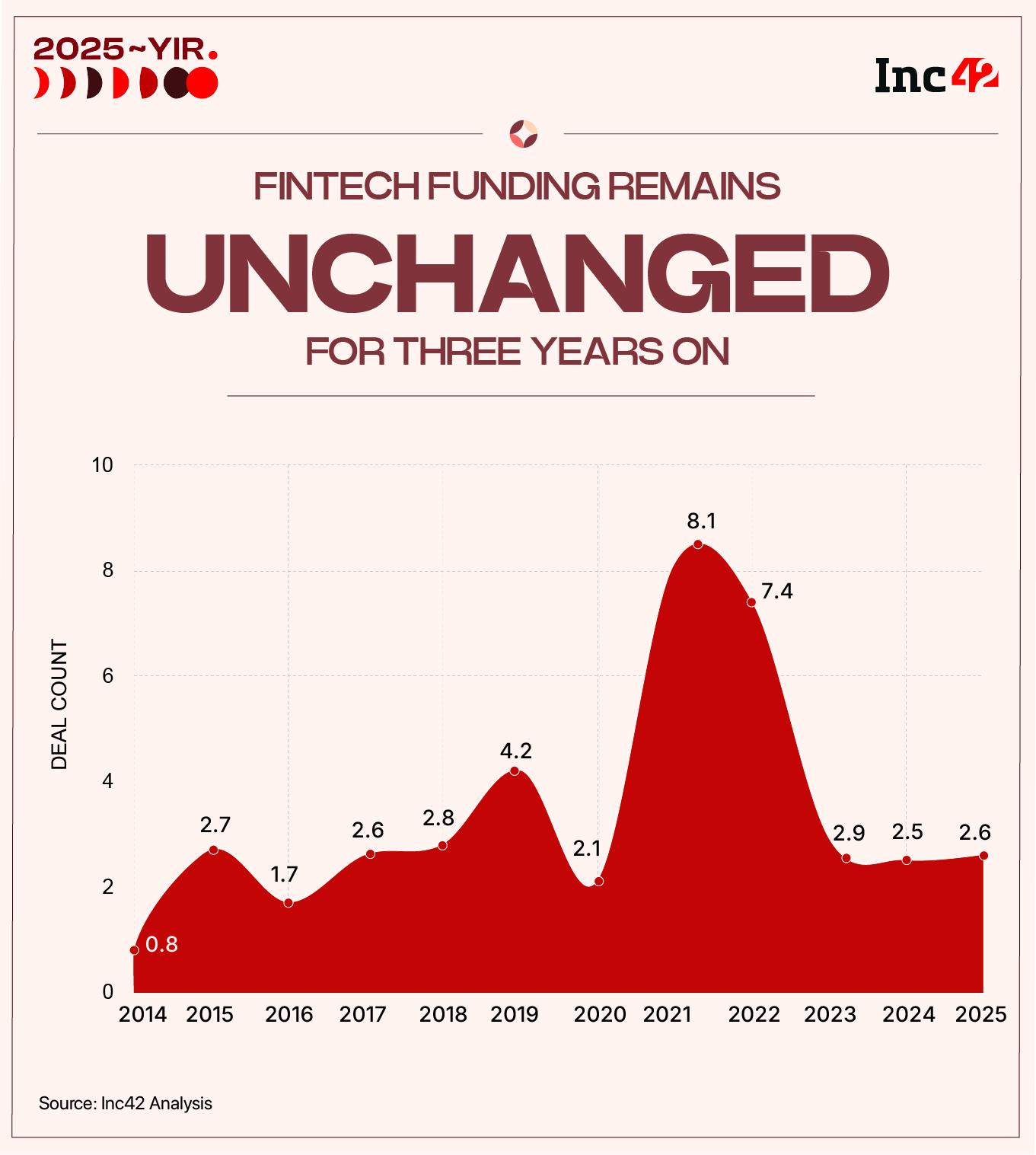

In 2025, fintech remained the largest magnet for startup capital in India. Homegrown fintech startups raised roughly $2.5 Bn across 120 deals during the year, the highest funding haul among all sectors, even as overall funding activity moderated.

While the number of fintech deals declined sharply from 162 in 2024, the absolute capital deployed into the sector remained largely flat in 2025.

When compared against other sectors’ performance in the calendar year, fintech trailed ecommerce in terms of total deal count. Ecommerce recorded the highest deal count in 2025 at 206 transactions, but with significantly lower capital deployed per deal.

Fintech, by comparison, attracted fewer cheques but meaningfully larger ticket sizes, translating into a median ticket size of approximately $20.8 Mn — among the highest across sectors. This reflects a near 75% jump from last year’s median ticket size of $11.9 Mn.

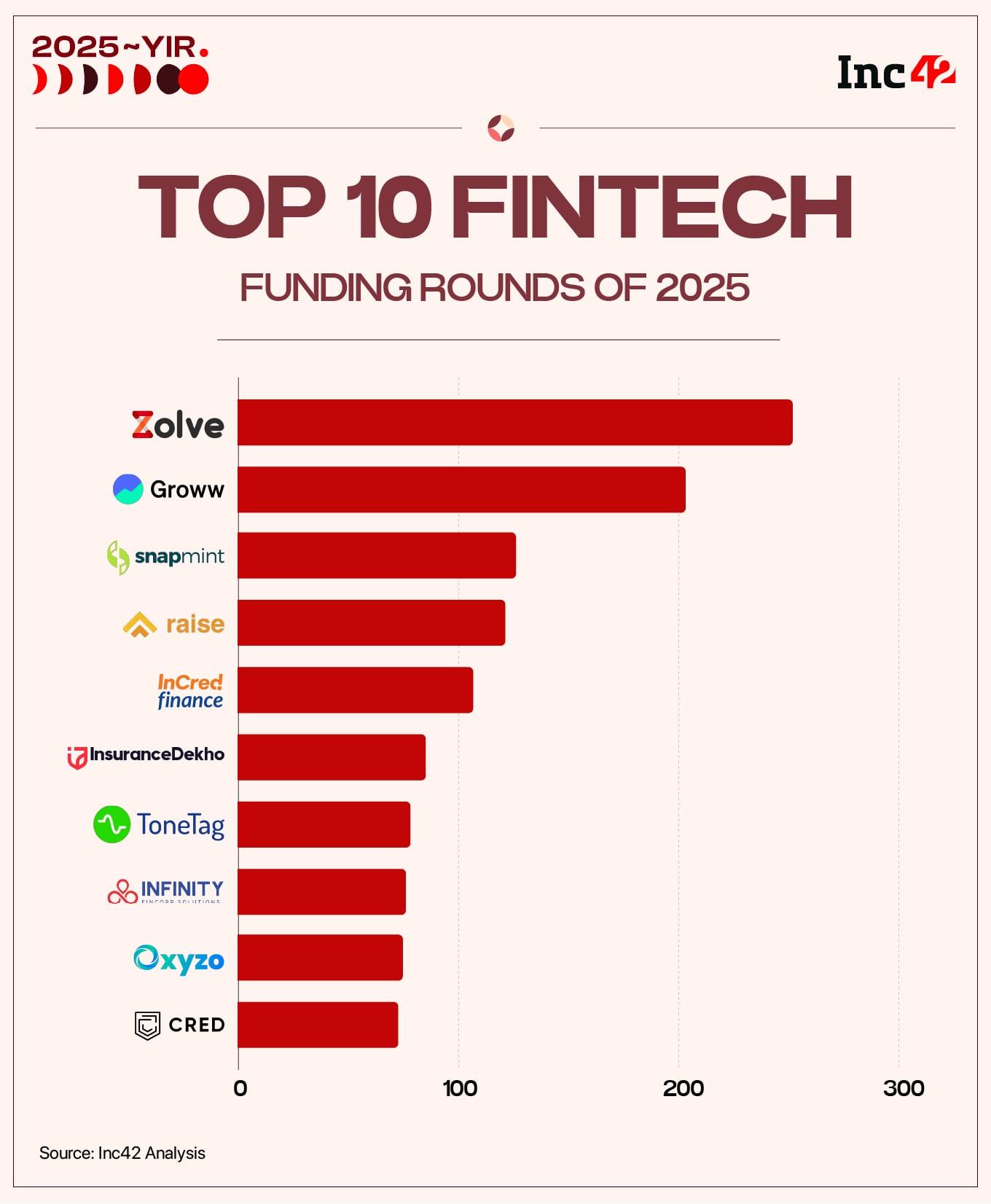

Important to mention that fintech dominated the top end of the funding spectrum. Two of the largest startup raises of 2025 came from fintech: cross-border neobanking platform Zolve raised $251 Mn, while stockbroking major Groww secured $202 Mn in a pre-IPO Series F round before going public later in the year.

These deals reinforced fintech’s position as the sector where investors were still willing to write large cheques, even in a risk-off environment.

Much of this capital concentration was underpinned by a deeper structural shift playing out beneath the surface, the rapid rise of credit-led consumption in India.

Rising Credit Adoption Is Rewriting The Fintech Playbook

The most important tailwind for fintech in 2025 came from a structural shift in household behaviour. India’s household debt-to-GDP ratio recently stood around 42% of GDP, a rise above its 5-year average but lower than many emerging economies, with a significant portion over 50% shifting towards consumption-driven unsecured loans like personal and gold loans, indicating increased credit dependence for daily needs.

Card data makes this transition tangible. Between 2019 and 2025, the number of credit cards in circulation nearly doubled from over 55 Mn to about 114 Mn per RBI data, growing at about 13% CAGR, while debit card growth remained muted at around 4%.

Usage trends further highlight the divergence. Between FY22 and FY25, credit card transaction value expanded at a CAGR of 19% and transaction volumes rose 27%.

Fintech capital allocation in 2025 closely mirrored this behavioural shift. A disproportionate share of funding, structured capital and partnerships flowed into card-led and consumer-credit models that embed credit directly at the point of consumption.

Kiwi, which focuses on UPI-linked RuPay credit cards, raised a Series B round of around $24 Mn, while travel-focused credit card fintech Scapia raised fresh funding to scale its co-branded Federal Bank card and deepen airline and travel-platform partnerships.

After acquiring North East Small Finance Bank, fintech unicorn slice doubled down on a regulated, card-led lending model and continued to raise debt and convertible instruments to fund its growing loan book.

Uni and OneCard also remained active across pay-later and app-first card offerings, supported by earlier equity rounds and ongoing warehouse lines. Alongside card-led models, pure-play consumer and MSME lending platforms also attracted meaningful capital as demand for short-tenure and embedded credit rose.

Players such as Progcap and Arthan Finance continued to deploy capital into retailer and small-business lending, while CASHe, ZestMoney and DMI Finance focused on consumer loans, BNPL and embedded credit use cases.

Fintech Infra Takes A Leap

Another major slice of funding in 2025 went into payments systems and financial infrastructure players. ToneTag led this pack, raising $77.5 Mn, as investors doubled down on its sound-based and contactless payment technology.

Juspay followed with a $60 Mn fundraise and Cashfree Payments secured $53 Mn to expand its payment and payout offerings for online businesses. Other notable startups included Zeta, which raised $50 Mn and Recur Club who raised $50 Mn.

Complementing this infrastructure momentum, major consumer-facing fintech platforms also saw significant funding. In this, Groww secured a $202.3 Mn Series F round while also going public later in the year cementing its position as one of the most funded wealth and investment platforms in the sector. Meanwhile, CRED also saw a capital infusion of $72 Mn, continuing its trajectory as a premium credit-and-rewards ecosystem,

A third important subsector drawing capital in 2025 is wealthtech, insurtech, and financial marketplaces. Smallcase, which enables thematic and model portfolio investing, raised $50 Mn, while InsuranceDekho secured $84.5 Mn, emerging as one of the highest-funded insurtech players during the year, as investors continued to back digital insurance distribution and comparison platforms amid rising online insurance adoption.

What’s In Store For Fintechs In 2026?

After a prolonged reset marked by funding discipline and tighter regulation, India’s fintech ecosystem is set to enter a more consequential phase in 2026. The easy wins of user acquisition and product-led growth are largely behind the sector. The next leg will be defined by execution depth, in underwriting, distribution, compliance and capital efficiency.

However,regulatory scrutiny will continue to remain a defining constraint. Payments, in particular, will continue to operate under a tight policy lens, with little indication that the zero MDR regime will be rolled back in the near term.

This is likely to keep pressure on pure-play payments businesses, forcing them to deepen monetisation through lending, wealth, insurance and merchant services.

At the same time, competitive intensity is set to rise. Large conglomerates and regulated financial institutions are expected to scale their fintech ambitions more aggressively.

Jio Financial Services is now seen as a key disruptor-in-waiting, with deep balance-sheet strength and distribution reach that could reshape lending, payments and wealth platforms.

This is also likely to intensify pressure on incumbent fintech super-apps such as PhonePe, Groww and CRED, particularly around pricing, customer engagement and cross-sell.

Edited by Akshit Pushkarna