From the evident IPO wave to several startups shutting down, the Indian startup ecosystem saw several milestones while facing some challenges along the way in the year 2025. However, investor interest patterns continued to remain unchanged throughout the year.

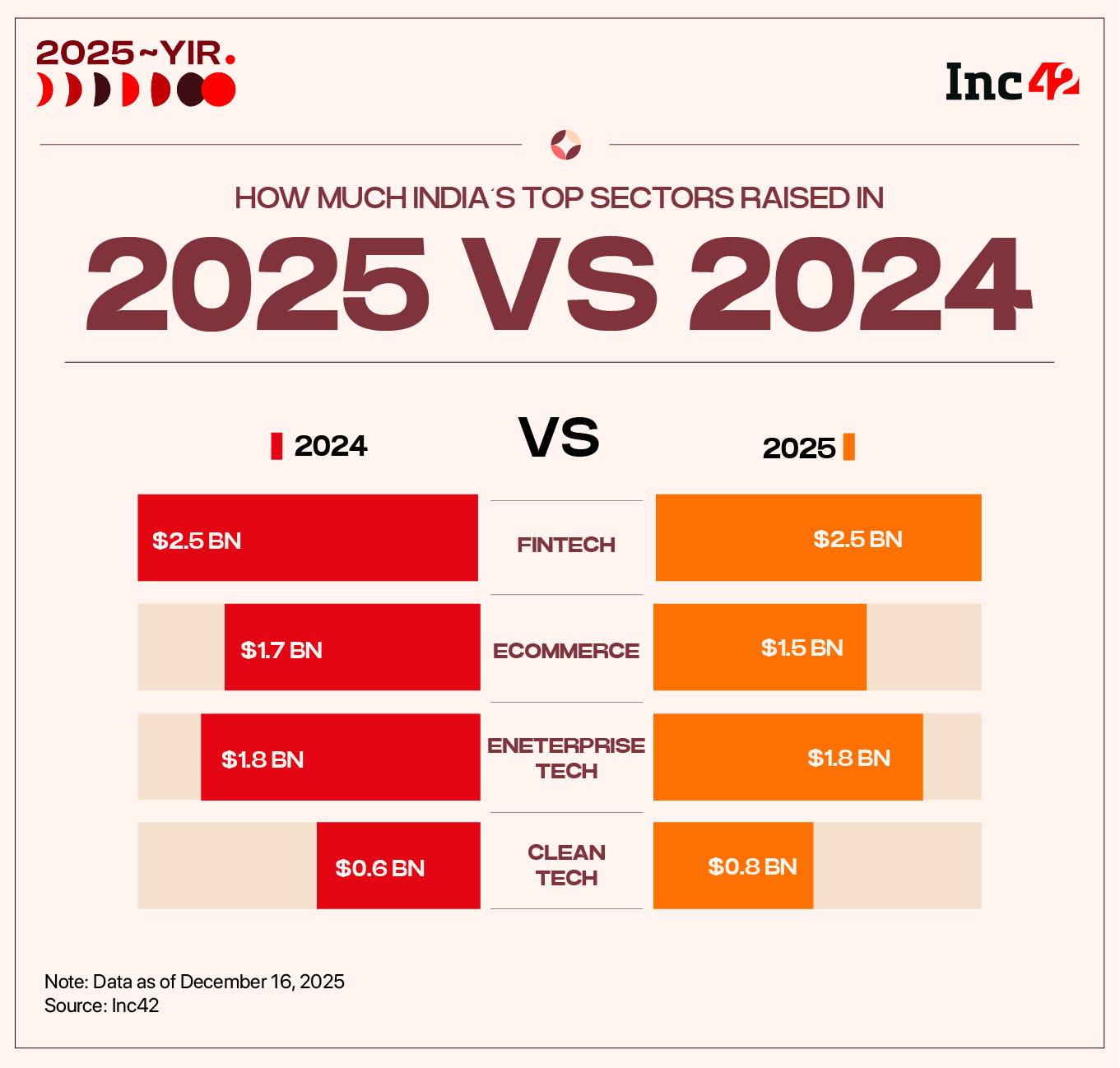

Although Indian startup funding declined 8% YoY to $11 Bn across 936 deals over the past year, as per Inc42’s “Annual Indian Startup Trends Report, 2025”, fintech and ecommerce sectors continued to remain on top of investors priority lists.

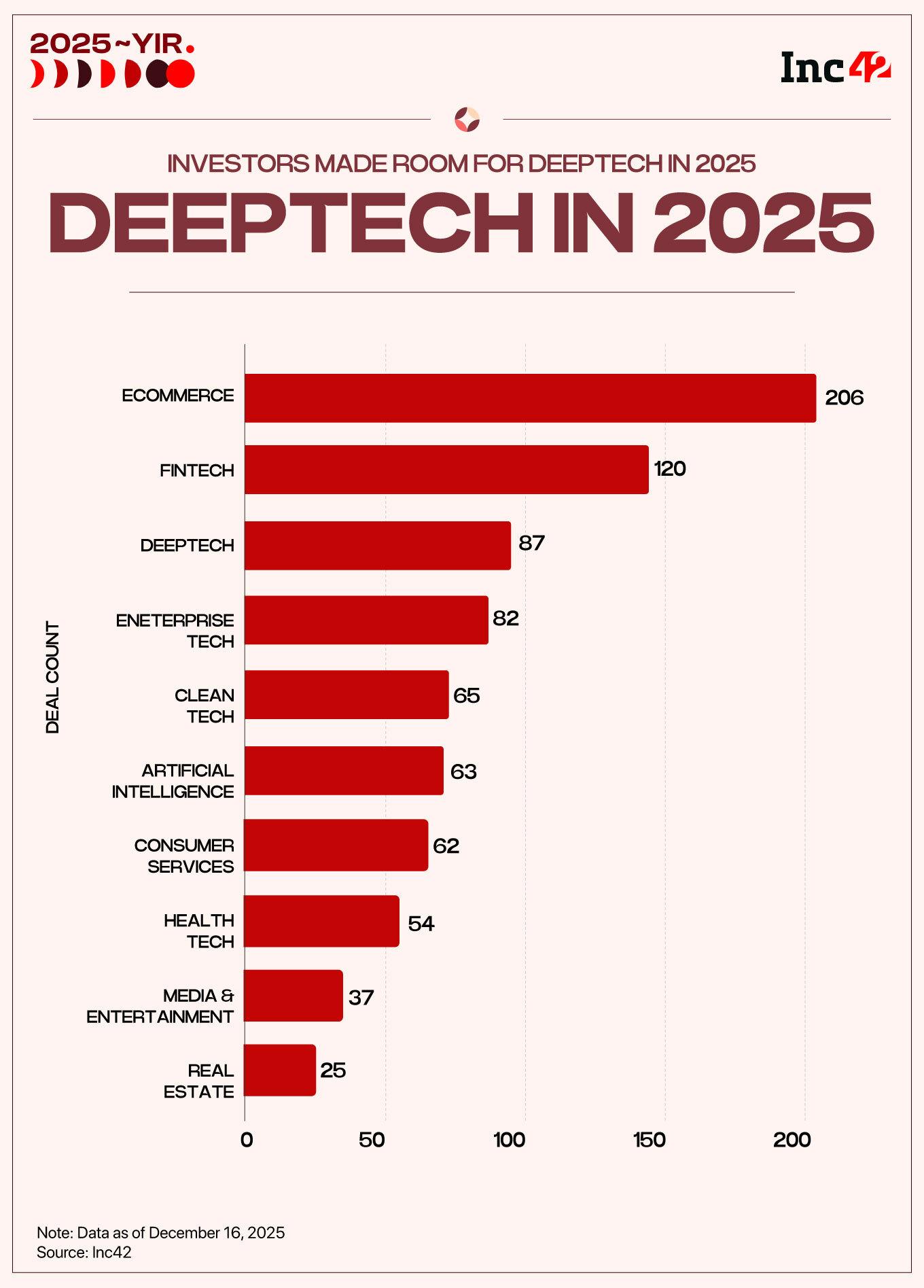

While the fintech sector bagged $2.5 Bn across 120 deals this year, ecommerce managed to be on the top in terms of deal count of 206, raising a total of $1.7 Bn in 2025.

It must be noted that fintech and ecommerce continue to convert scale into unicorn outcomes most efficiently, dominating the current unicorn cohort.

India is home to 126 unicorns till date, out of which fintech segment account for 26 unicorns and ecommerce segment for 28 such companies.

While these segments commanded a third of the overall capital influx in the world’s third largest ecosystem over the past year, a diversification in preference becomes more evident when we take a glance at sectoral funding beyond the top two segments. Crucially, deeptech emerging as the third most funded startup segment this year emerged as a key silver lining in the Indian startup funding trends this year,

Deeptech Becomes The Third Most Funding Startup Sector Of 2025

Deeptech, which ranked much lower in terms of deal activity last year, emerged as one of the most active sectors in 2025, clocking 87 funding deals during the year. That said, the surge came off a relatively small base. Despite the higher number of transactions, deeptech startups raised about $500 Mn in total funding — significantly lower than the capital attracted by the two leading sectors in 2025.

This trend can largely be traced to the capital and exit dynamics of the deeptech sector. Building deeptech companies requires patient capital and sustained investment, with significant funding needed even to run initial pilots, while full-scale commercial rollouts can take years.

The spotlight on the sector intensified earlier this year after commerce minister Piyush Goyal contrasted India’s food delivery boom with China’s focus on deeptech innovation, sparking a broader debate on the country’s innovation depth.

As the discussion gained traction, the lack of dedicated capital for deeptech emerged as a key concern. In response, 2025 saw several specialised deeptech fund launches, with firms such as Speciale Invest, 888VC, Riceberg Ventures and Chiratae Ventures rolling out new vehicles focused on the sector.

Of the 90+ new funds announced in 2025, 21% carry explicit deeptech mandates, signalling early-stage alignment toward longer-duration AI and infrastructure bets, the report further adds.

“Deeptech has never been about chasing short-term cycles.It is about building institutions that can compound value over decades—often starting with uncomfortable science risk and long timelines,” Speciale Invest founding partner Vishesh Rajaram said.

Apart from this, eight prominent India and US-based VC firms —Celesta Capital, Accel, Blume Ventures, Gaja Capital, Ideaspring Capital, Premji Invest, Tenacity Ventures, and Venture Catalysts, together launched ‘India Deep Tech Alliance’ (IDTA) to infuse more than $1 Bn in the country’s deeptech startups over the next decade.

Additionally, the Cabinet also approved a research development and innovation (RDI) scheme with a corpus of INR 1 Lakh Cr to fuel capital in the sunrise sector.

Ecommerce Retained Its Position With Highest Deal Count

Like previous year, the ecommerce sector managed to retain its position as the sector with the most funding deal counts. The sector raised $1.7 Bn across 206 deals in 2025. The sector counts more than 480 Mn ecommerce users, with 192 Mn users coming from urban cities.

The overall deal count also increased about 2% to 206 in the year under review.

Most of the investors, which participated in the Inc42 report survey, said that tier II and tier III purchasing power is likely to drive the ecommerce cycle in the coming year.

Meanwhile, the sector also saw a major IPO boost this year with companies like Meesho, BlueStone, Wakefit, and Zappfresh hitting the public market this year. Going ahead, ecommerce companies like Flipkart, OfBusiness, boAt, among others are also planning to hit the bourses in the next fiscal year.

Growth-Stage Fintech Leads The Funding Race

While ecommerce maintained its lead in terms of the number of funding deals that materialised this year, the latter remained the top most sector with highest amount of fundraise. Among the largest funding rounds this year, fintech startups Zolve and Groww collectively raised $453 Mn this year. Groww also hit the public market, at a valuation of $7.4 Bn.

However, the deal count in the fintech sector declined 26% to 120 this year, from 163 in 2024.

Notably, the sector saw a major decline in investors’ interest towards seed stage funding. This year, seed stage startups in the fintech sector raised $88 Mn, down $163 Mn raised in 2024.

On the other hand, investors showed enthusiasm around growth-stage fintech startups. The growth-stage fintech investment grew to $1.4 Bn in 2025, up 130% from $ 609 Mn raised in 2024.

Late stage fintech startups also saw a decline in total fundraise to $1.1 Bn in the year under review, from $1.7 Bn in 2024.

Enterprise Tech Accounts For Year’s Largest Rounds

Enterprise tech managed to raise $1.8 Bn across 82 deals this year. While the sector maintained uniformity in the amount of funds raised, the deal count declined drastically by 51% from 167 in 2024.

Some of the biggest deals this year came from the enterprise tech sector —-for instance, InMobi raising $350 Mn, MoEngage raising $280 Mn, and Uniphore’s $260 Mn funding round.

The sector gained investors’ interest for its late-stage startups. The late-stage enterprise tech startups raised a total of $1.3 Bn funding this year, from $1 Bn raised in the previous year.

Notably, enterprise tech startups including MoEngage and Fractal are also eyeing public listing in the near future.

“Enterprise tech and AI show greater representation in the unicorn pipeline, signalling a shift in where value creation is building, even if conversion timelines are longer.”

Apart from fintech, enterprise tech, and deeptech, sectors like cleantech, AI, and consumer services managed to rise and gain investors’ traction this year.

Fintech and ecommerce startups gained most popularity, like other years, and bagged hefty funding this year, along with deeptech making a prominent space in the industry.

According to Inc42’s “Annual Indian Startup Trends Report, 2025”, Indian Startups cumulatively raised $11 Bn across 936+ deals during the year. While this figure represents an 8% decline from the $12 Bn raised across 993 deals in 2024.

While early stage startups cumulatively raised a total of $793 Mn in 2025, down 12% YoY, across 433 deals in 2025, growth stage funding saw a 14% increase to $4 Bn across 269 deals in 2025 from $3.5 Bn raised across 287 deals last year.

The year, which is being remembered as the IPO centric one for Indian startups, saw total late stage funding decline to $6 Bn in 2025, from $7 Bn in the previous year.

Now, on the sector front, fintech and ecommerce continued to be investors’ favourite this year.

Another highlight of the year is deeptech becoming the third most funded sector, with respect to deal counts, in 2025.