In the fast-moving financial technology (fintech) market, few companies have made as rapid and impactful a journey as AND Global. Founded in 2016 in Ulaanbaatar, Mongolia, by mathematicians, engineers and doctors, AND Global was born out of a need to address the severe lack of financial inclusion in Mongolia and Southeast Asia.

Indeed, the stylized word “AND” signifies “friend” in Mongolian, reflecting the company’s mission to foster trust, relationships and financial inclusion in a human-centric way. Since its founding, AND Global has grown into a player in the fintech sector, with a presence in multiple countries and a range of financial products and services.

Leading the company is Khos-Erdene Baatarkhuu, CEO of AND Global. Baatarkhuu is steering the company through its growth phases and into new markets, including Japan.

Founding vision and challenges

AND Global’s LendMN platform provides real-time loan approvals in minutes.

Image: AND Global

AND Global’s journey, Baatarkhuu explains, began with a clear and ambitious vision: to create financial solutions that could efficiently, transparently, and inclusively serve the underserved populations across Southeast Asia.

Traditional financial institutions, particularly in Mongolia, were failing to meet the needs of the broader population. These institutions relied on outdated technologies and cumbersome processes — particularly when it came to accessing credit. For many, the lack of a modern credit scoring system and the lengthy approval processes were significant barriers to financial inclusion.

To tackle these challenges, AND Global leverages advanced technologies such as artificial intelligence (AI) and machine learning. The goal has been to develop innovative financial solutions that could streamline the credit assessment and underwriting procedures, making them faster, more accurate and accessible to a larger segment of the population. This approach not only differentiates AND Global in a crowded fintech market but also sets the stage for its expansion beyond Mongolia.

Product portfolio and market reach

Mindox automates financial document processing with via OCR, NLP and LLMs Image: AND Global

As of August 2024, AND Global offers a broad range of products and services that cater to a wide set of customers. These offerings are designed to meet the needs of financial institutions and challenger banks (those new, non-banking financial entities and individuals seeking modern financial solutions).

One of the company’s flagship products is LendMN, launched in Mongolia in 2017. The platform introduced a fully automated digital consumer lending service, which utilizes AI-driven algorithms to assess creditworthiness in real time. This innovation allows users to receive loan approvals within minutes, a significant improvement over the traditional lending processes.

LendMN now serves approximately 80% of the economically active population in Mongolia, making it one of the country’s largest fintech entities.

In 2024, LendMN expanded its offerings to include non-collateral digital business loans, a first in Mongolia, Baatarkhuu shares. This initiative is aimed at providing much-needed capital to unregistered micro-enterprises, helping them to compete.

Another key component of AND Global’s portfolio is AND Solutions, a business-to-business (B2B) subsidiary that offers fintech products designed to empower financial institutions. AND Solutions’ services include “mindox” — an intelligent document software that automates the processing of financial documents using optical character recognition (OCR), natural language processing and large language models.

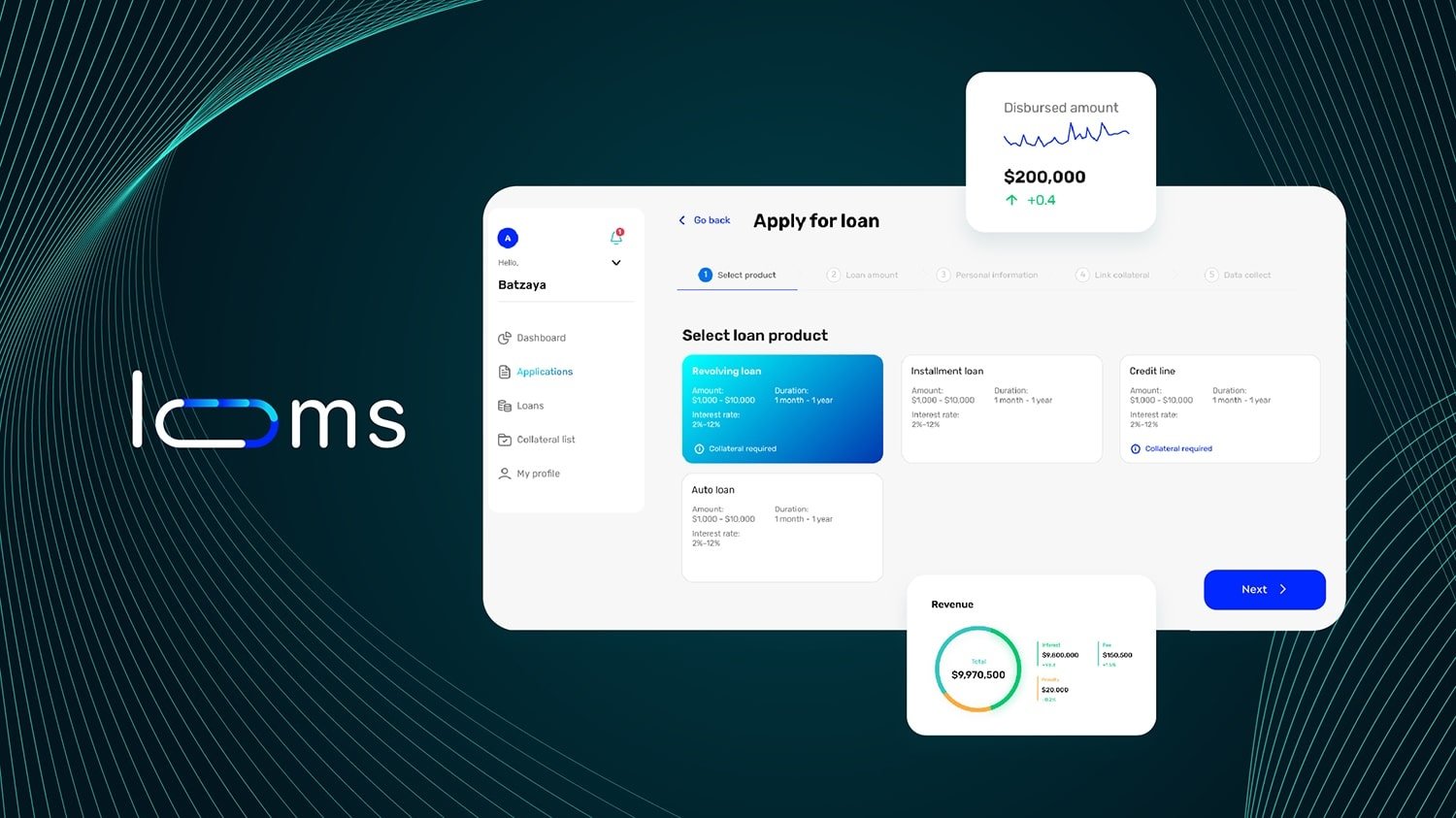

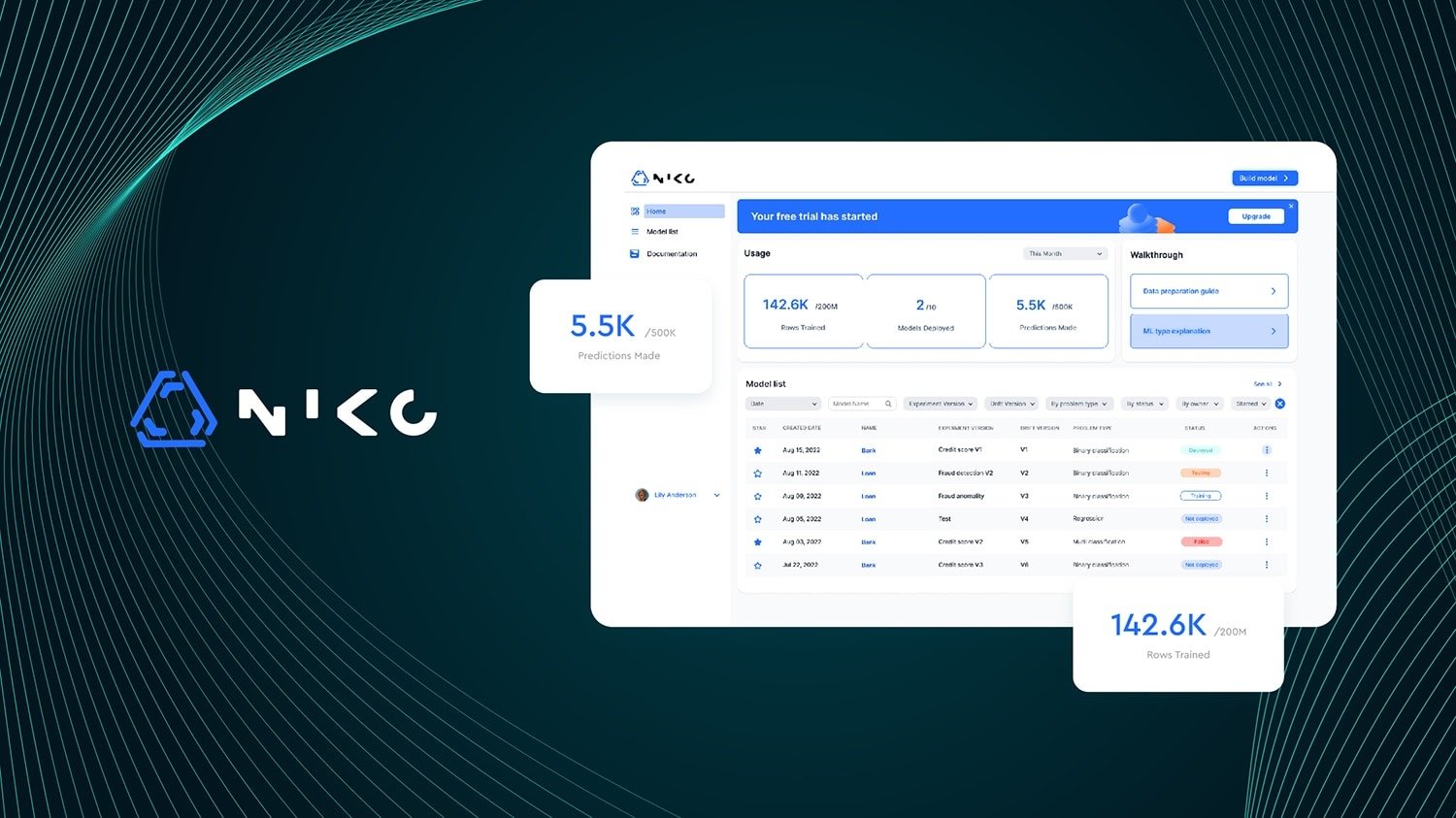

The subsidiary also offers “looms” — a loan origination and management system that streamlines the lending process from application to disbursement—and Niko, an automated machine learning (AutoML) platform that enables businesses to build AutoML models without extensive coding.

AND Solutions’ custom credit scoring solution, which combines rule-based systems with machine learning, impacts the accuracy and inclusivity of credit assessments. These solutions are designed to drive significant improvements in efficiency, accuracy and customer satisfaction for financial institutions.

Expanding into Japan

Looms simplifies lending with a streamlined loan origination and management system. Image: AND Global

AND Global’s expansion into Japan represents a strategic move to tap into one of the world’s most unique and challenging fintech markets. While Japan is not the company’s core focus, it has made inroads into the market by leveraging its diverse talent pool, which includes professionals with experience in both Mongolian and Western markets, as well as knowledge of Japan.

One of the key factors in AND Global’s market entry has been its strategic partnerships with two major Japanese conglomerates: Marubeni Corporation and SBI Holdings. These partnerships highlight the strength of AND Global’s offering and its potential to contribute meaningfully to Japan’s fintech ecosystem.

“Japan has a distinctive fintech landscape, and our goal is to contribute by co-creating with Japanese businesses, bringing our innovative technology and know-how to enhance the ecosystem,” Baatarkhuu says. “This collaborative approach has allowed AND Global to carve out a niche in Japan, where it continues to focus on forming meaningful partnerships rather than aggressive market expansion.”

Strategic investment and growth

Raising funds from Japanese investors — including the aforementioned Marubeni Corporation and SBI Holdings — has been a critical aspect of AND Global’s strategy for scaling its operations and strengthening its presence in international markets. These investments have provided AND Global the necessary capital as well as strategic insights and access to valuable networks that have been instrumental in its growth.

Baatarkhuu emphasizes the strategic value of these investments, noting that they have played a crucial role in helping AND Global navigate the complexities of the Japanese market.

“The expertise and networks that our Japanese investors bring have been invaluable in accelerating our growth and expanding our reach,” he tells Japan Today.

“Our goal is to integrate our expertise into the Japanese market in a way that benefits both sides” —AND Global CEO Khos-Erdene Baatarkhuu

Opportunities and challenges in Japan

Baatarkhuu adds that Japan’s fintech economy is at a pivotal juncture, presenting both significant opportunities and challenges for companies like AND Global. The market is highly regulated and conservative, with regulators cautious about new technologies. This creates challenges for fintech companies looking to introduce innovative solutions while ensuring compliance with stringent regulations.

However, the opportunities seem to be immense. Japan’s fintech market, valued at USD$45.7 billion (about ¥6.1 trillion in 2023), is expected to grow at a compound annual growth rate (CAGR) of 16.5% between 2022 and 2027. This growth is being driven by several factors, including the government’s push for a cash-lite society, advancements in technologies such as blockchain, AI, the Internet of Things and the increasing need for digital transformation in financial services.

Baatarkhuu sees particular potential in areas such as digital payments, AI-driven financial services and blockchain.

“The demand for efficient, user-friendly and secure financial solutions is growing, particularly as Japan’s aging population and businesses increasingly seek digital transformation,” he notes. Companies that can navigate the regulatory landscape while providing innovative solutions will be well-positioned in Japan.

Future roadmap

Niko allows businesses to build AutoML models without extensive coding. Image: AND Global

Looking ahead, AND Global is focused on further strengthening its presence in Japan through strategic partnerships, new product launches and continued fundraising. These include developing an e-wallet and scoring system for a financial institution and creating a marketplace platform for farmers.

AND Global is also actively engaged in its Series B fundraising. Discussions are ongoing with institutional investors, venture capital firms and other potential stakeholders. These efforts are part of the company’s broader strategic roadmap, which includes exploring opportunities for collaboration and partnership in Japan.

Baatarkhuu notes: “Our goal is to integrate our expertise into the Japanese market in a way that benefits both sides,” he says. “We see our presence in Japan as an opportunity to innovate together with local companies and to offer new perspectives and solutions that can help drive the industry forward.”

Advice for entering Japan

AND Global CEO Baatarkhuu’s advice to foreign entrepreneurs entering Japan: focus on cultural integration, navigating complex regulations and localization. Image: AND Global

For foreign CEOs considering to enter the Japanese market, Baatarkhuu offers three key pieces of advice:

- Cultural integration and relationship building: Japan operates on deep-rooted cultural norms, especially in business. Building trust and relationships takes time — and it’s essential to respect and understand these nuances. Patience and a commitment to long-term relationships are valued more than aggressive sales tactics.

- Navigating the regulatory landscape: Japan’s regulatory environment is complex, and compliance is non-negotiable. Understanding local laws, especially around labor practices, product standards, and data protection, is crucial to avoid costly delays and build credibility with partners and customers.

- Commitment to localization: Japan’s market has specific consumer preferences, making localization a necessity rather than an option. Tailoring products and services to fit local tastes and expectations, as well as investing in Japanese-language customer support, can significantly enhance customer trust and market acceptance.

As AND Global continues to navigate Japan’s fintech ecosystem, its journey may exemplify the potential for foreign companies to enter and expand in a challenging — yet apparently lucrative — market. Focusing on innovation, collaboration and a deep understanding of local needs, the company is poised to make significant inroads in the world’s fourth-largest economy.

© Japan Today