Fiserv Inc. (FI, Financial) is a fintech company that provides technology services to various financial institutions. These services range from processing transactions and digital cards for banks or credit unions to accepting and managing payments for businesses. With a market cap near $90 billion and revenue approaching $20 billion, Fiserv is one of the largest fintech companies in the United States.

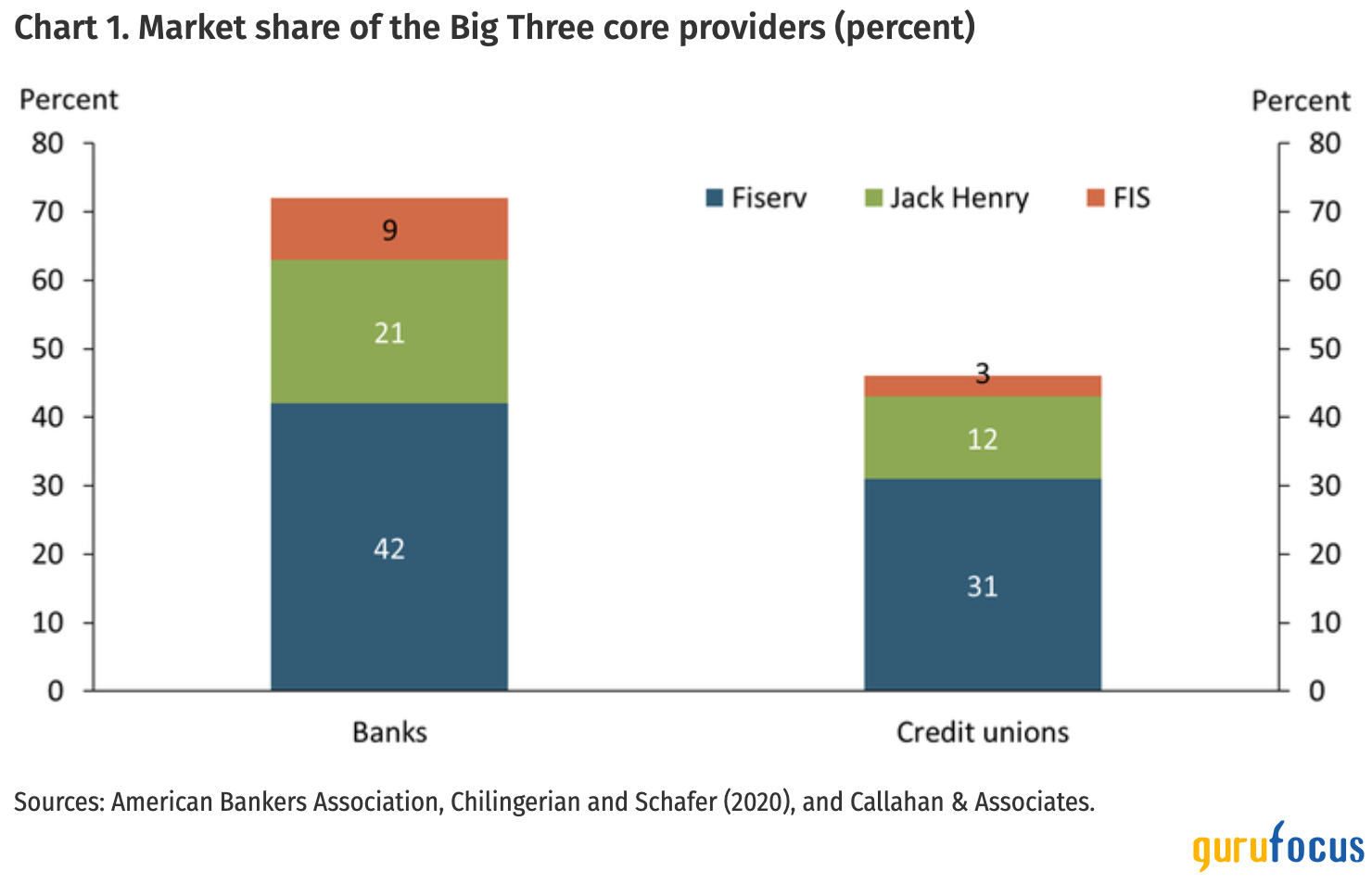

In the bank core processes market, the company has double the market share of its closest competitor, Jack Henry (JKHY, Financial).

“Bank core processes” is a term only MBAs could invent. However, it is a critical component of the important financial services market. Essentially, bank core processes are the back-end systems in banks that allow them to do business. So things like handling deposits for customers or processing loans and transactions for banks, credit unions and mortgage servicers.

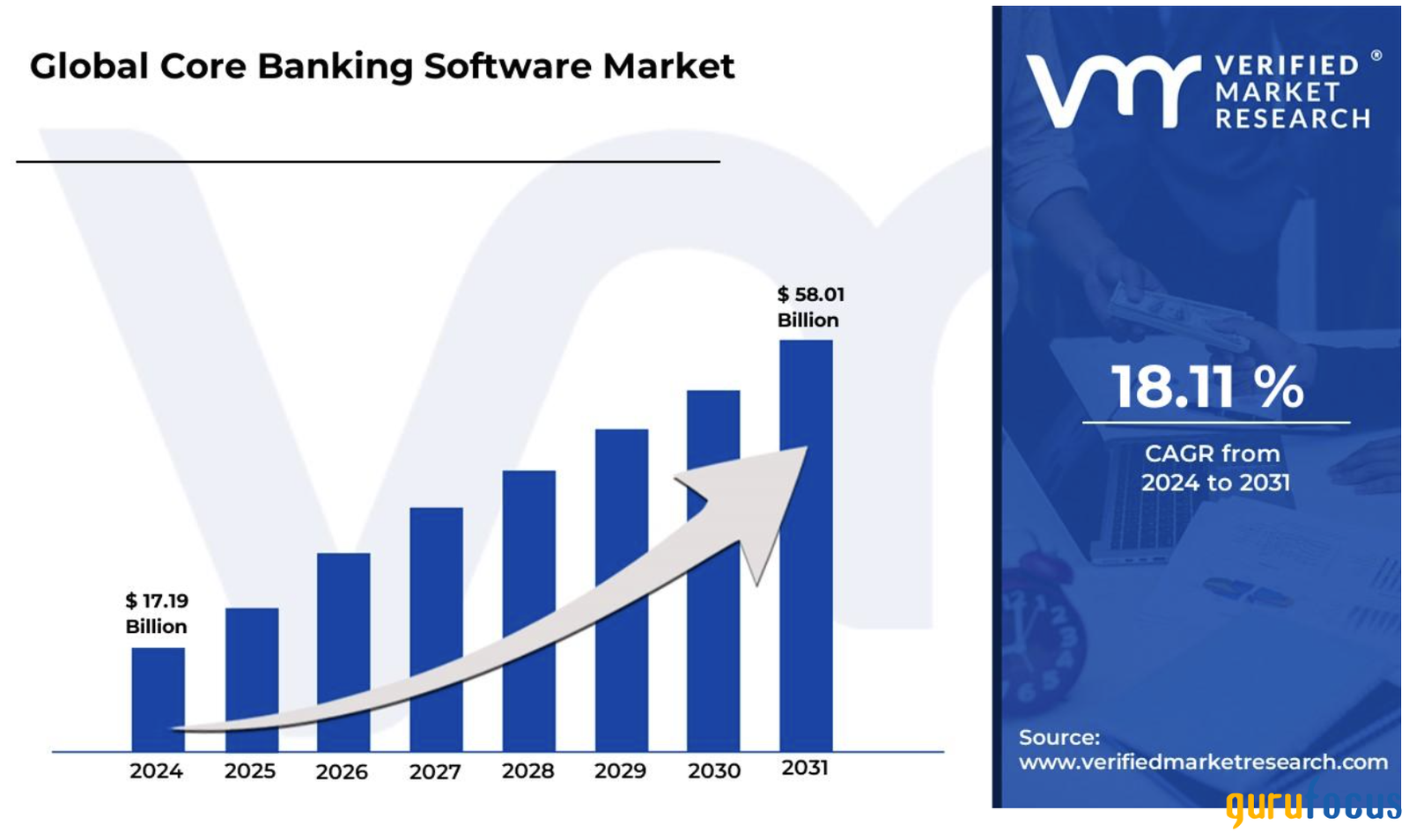

It does not sound too exciting, but throwing in an 18% expected growth rate until 2030 will get your investing blood pumping a bit.

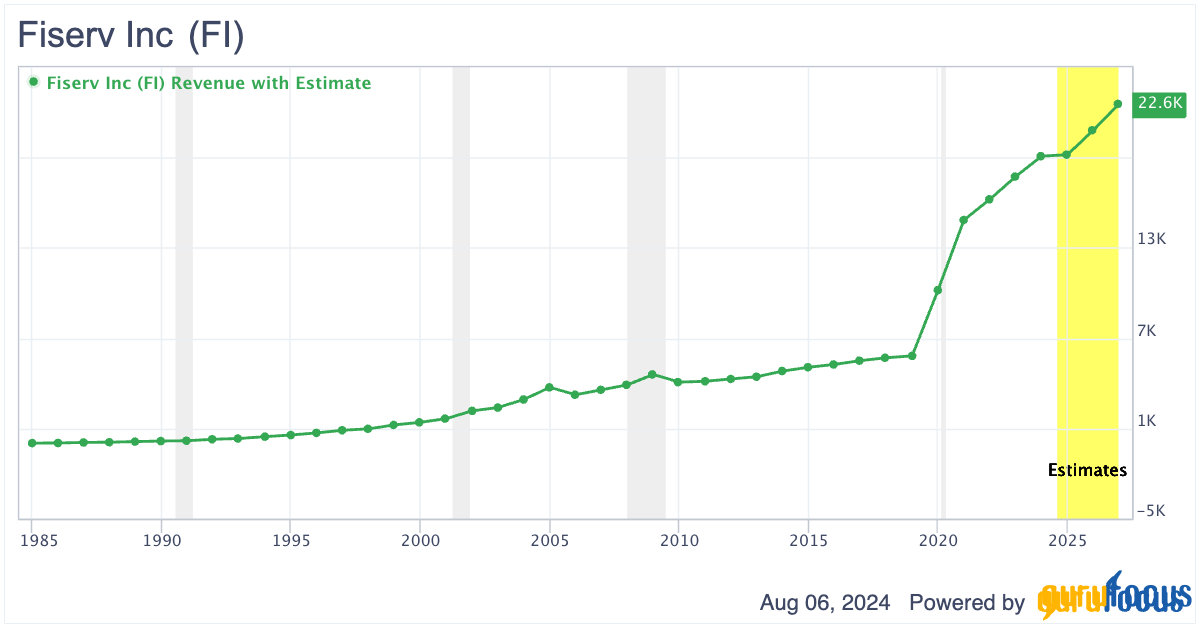

Revenue for Fiserv has increased significantly over the past decade.

FI Data by GuruFocus

Revenue jumped in 2019 after Fiserv bought First Data Corp. (FDC, Financial), a debit card and merchant payment processing company. Following the acquisition, Fiserv changed its operating segments to better reflect the consolidated company.

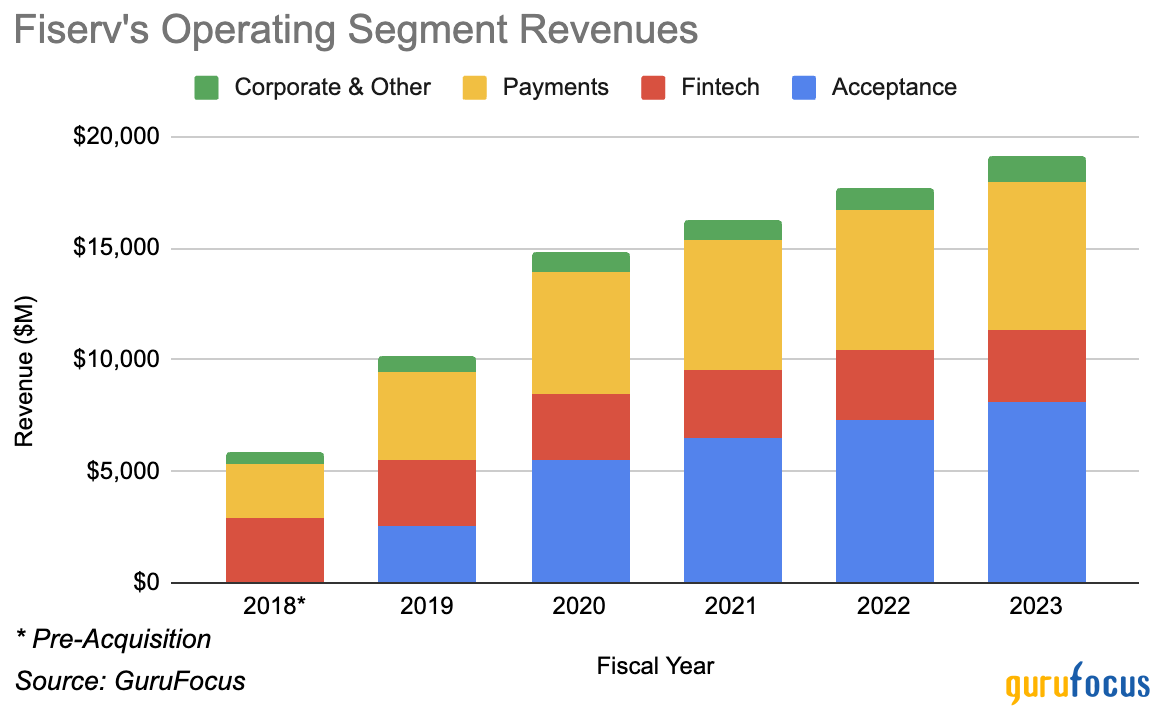

Revenue for Fiserv is broken into the following operating segments:

- Acceptance – This segment is payment processing for merchants, including things like mobile payment processing and fraud protection as well as sales tracking.

- Fintech – This segment includes services for financial institutions to handle things like customer deposits or loans.

- Payments – This segment is for processing payments with things like credit cards, debit cards, ATMs and prepaid cards.

- Corporate or Other – This segment encompasses everything that is left over and mainly deals with M&A activity.

The revenue for these segments has been generally increasing since first reported.

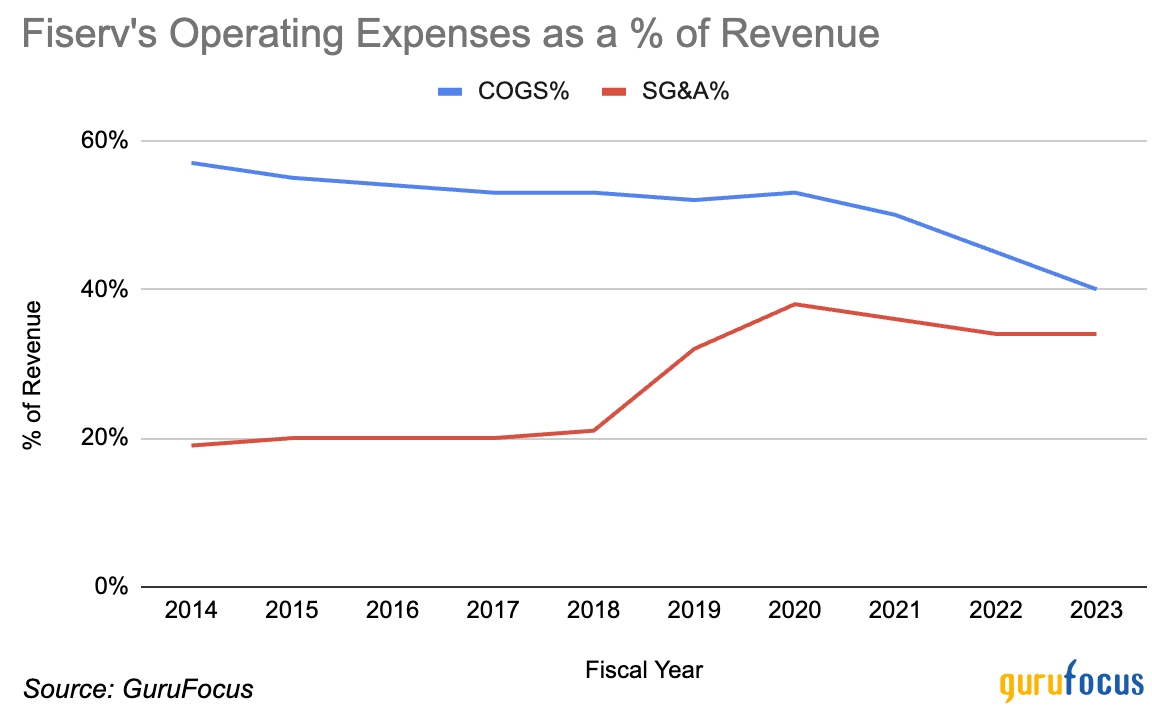

The two main operating expenses for Fiserv are cost of goods sold and selling, general and administrative. COGS has risen, but at a much lower rate than revenue. SG&A expenses have risen faster than revenue, but the decrease in COGS has more than offset the increase.

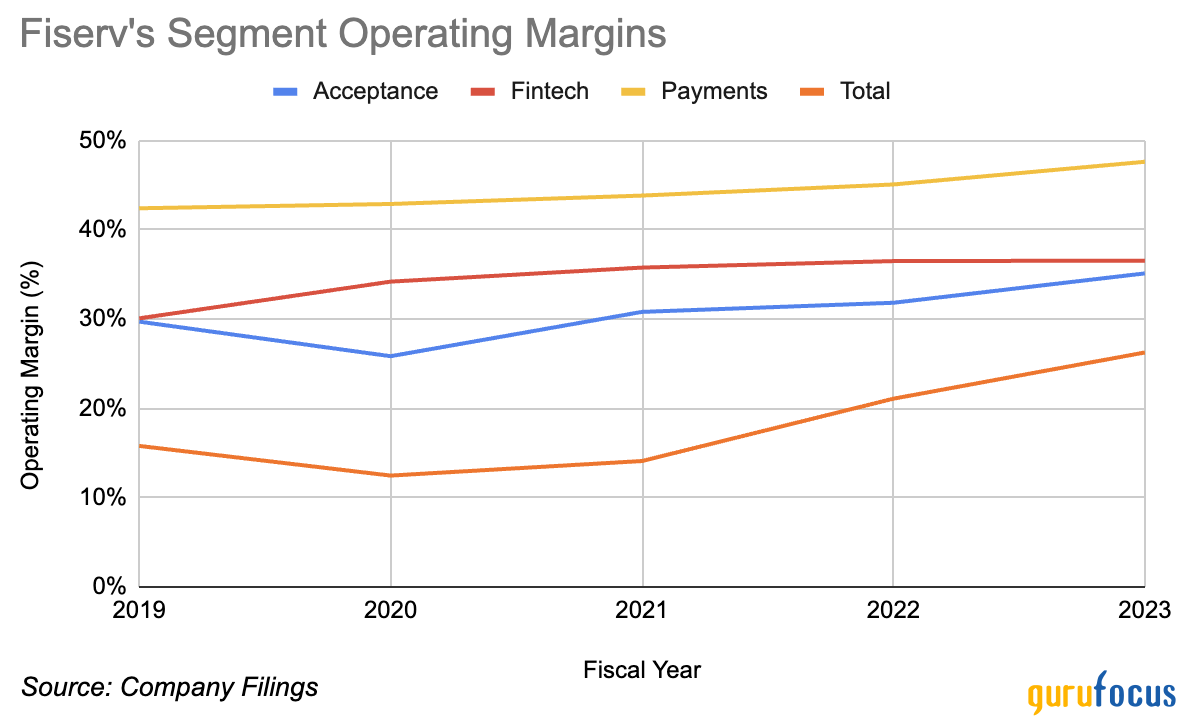

Lower expenses as a percentage of revenue has led to operating margins increasing at a steady rate across all of its operating segments.

Corporate & Other was removed since its operating margin was negative and volatile, which made the chart unreadable for everything else. This also explains why the total for the company is below the charted segments.

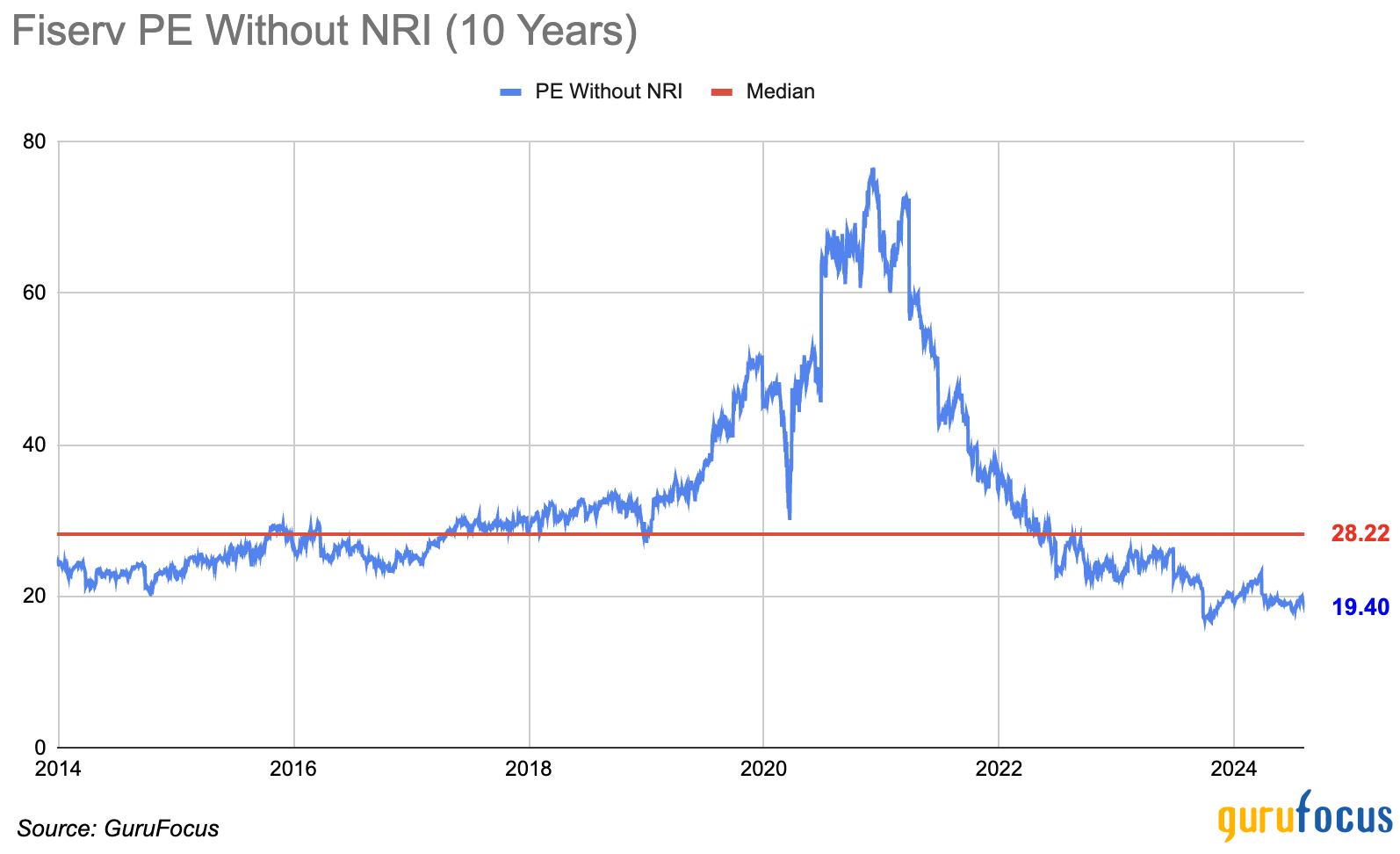

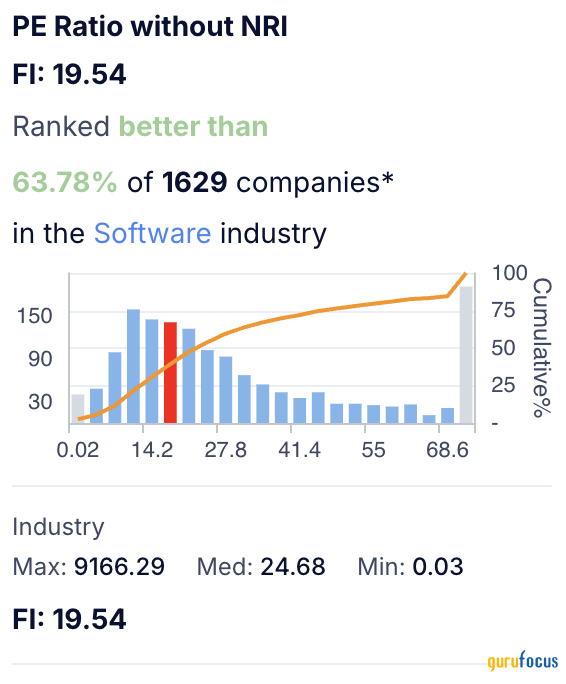

The current price-earnings ratio without nonrecurring items is just below 20. This is more than 30% lower than its 10-year median value of 28, which is a significant discount.

This ratio is also below the software industry’s median and better than more than 60% of its peers.

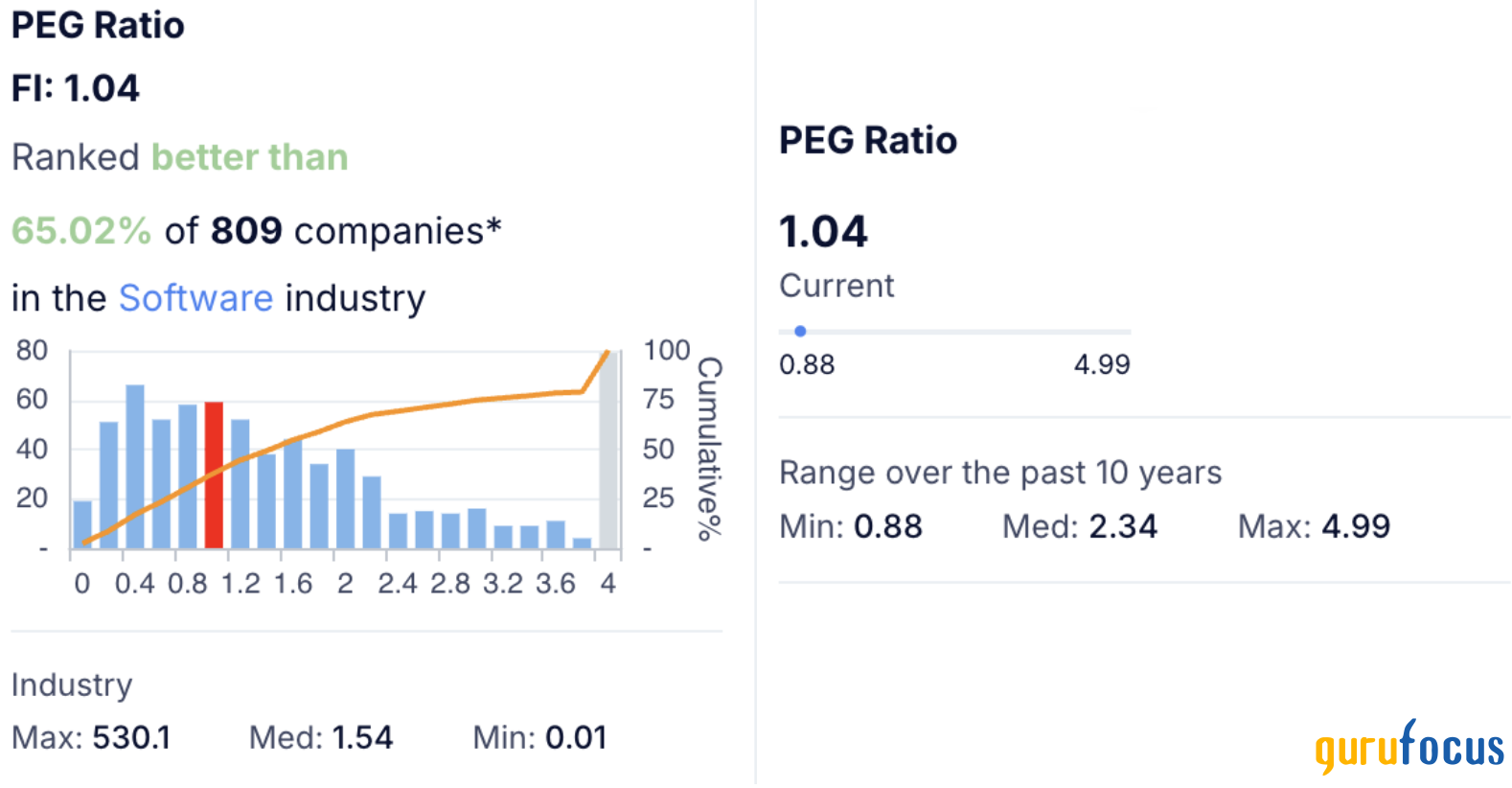

The PEG ratio for Fiserv looks even better. It is currently hovering around 1, which is more than 30% below the industry median and less than half of its own 10-year median.

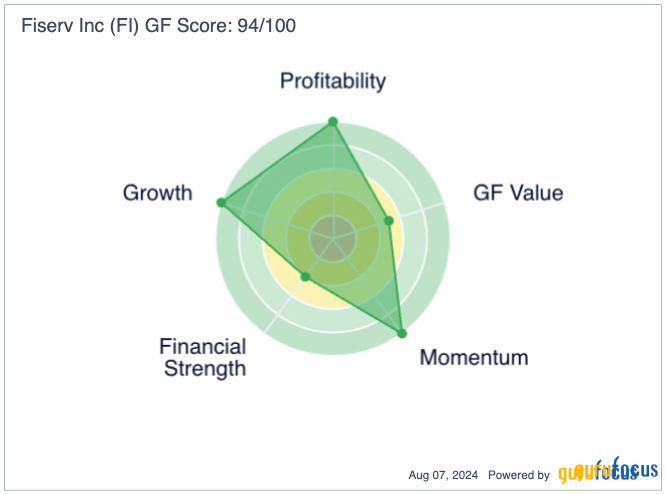

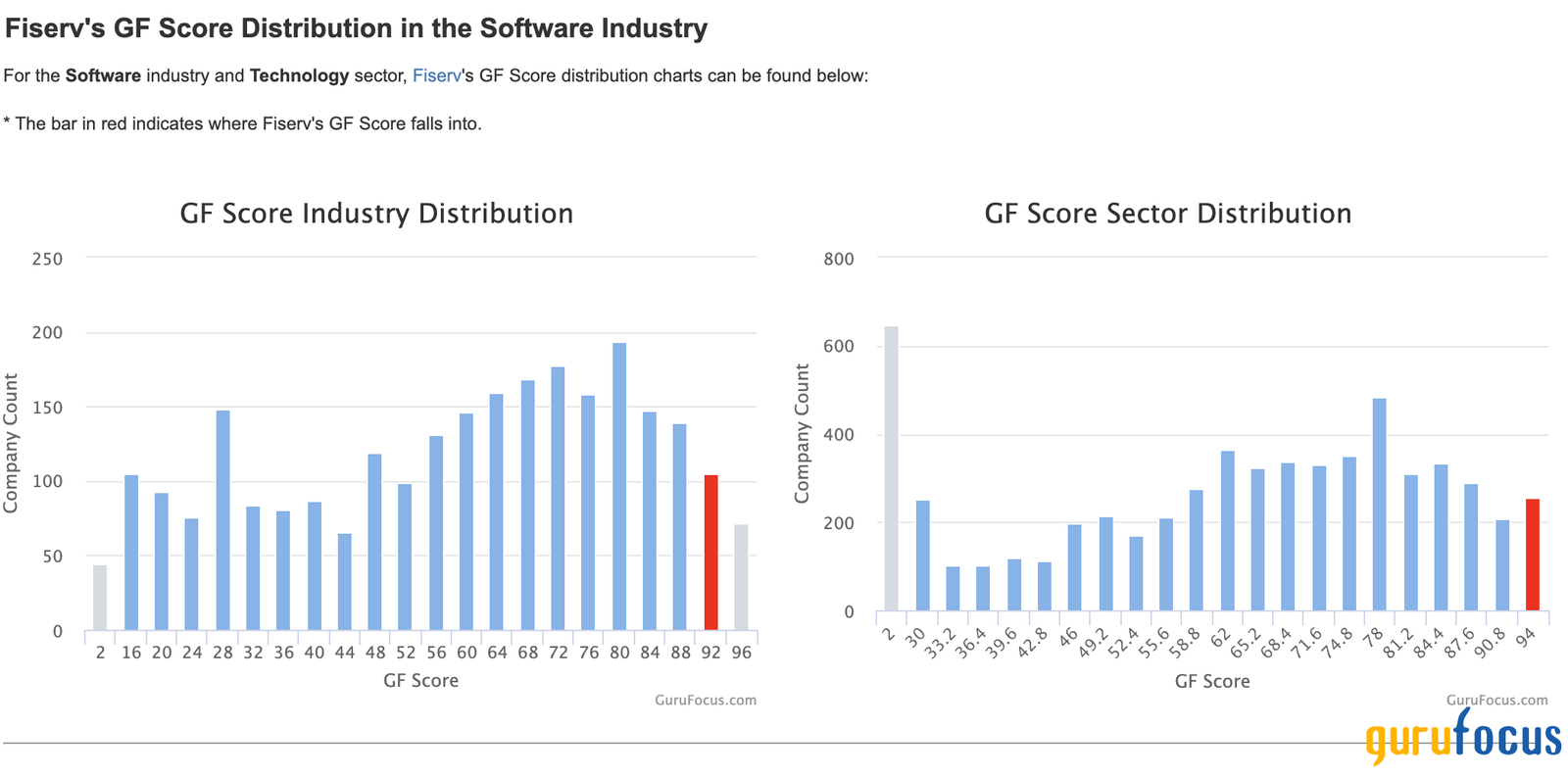

With a GF score in the 90s, Fiserv seems like a no-brainer investment, especially compared to other companies in the software industry.

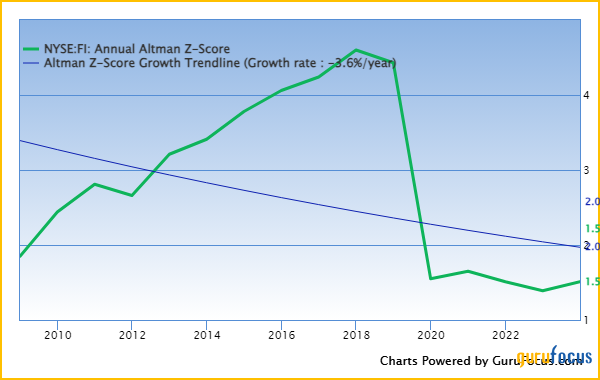

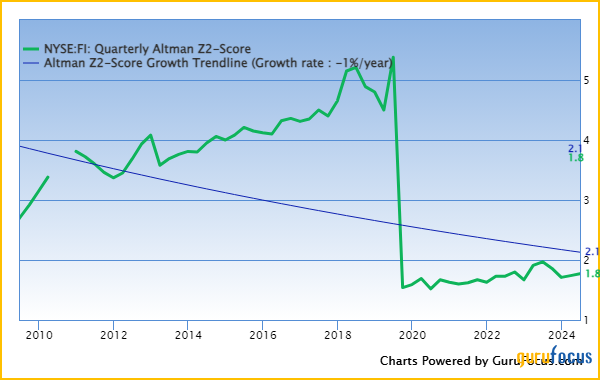

Things are not all perfect for Fiserv. GuruFocus lists out a few severe warning signs, but the one that worries me the most is the Altman Z-score in the distress zone.

If you are not familiar with the Altman Z-Score, GuruFocus has a really helpful page detailing everything you need to know. The executive summary is Z-Scores below 1.80 suggest the company is at a higher risk of bankruptcy in the near future. This is really bad news if you are a Fiserv investor since the Z-Score is only 1.60.

Here is Fiserv’s Altman Z-Score over time:

Everything looked good until 2019, which is when Fiserv acquired First Data. Is this a serious issue or is there some weird post-acquisition accounting going on?

Well, we need to make sure we are using the correct Z-Score. The Altman Z-Score discussed above is ideally used for public manufacturing companies. Fiserv is a software company, so the Altman Z-Score is not as relevant.

Instead, we should use the Altman Z2-Score, which can be used for any non-financial company. Fiserv has a value of 1.77, which is above the distress level of 1.10. Similar to the Altman Z-Score, the Z2-Score dropped significantly following the acquisition of First Data.

However, it has been steadily increasing after the acquisition, rising about 15% since 2019.

The Z2-Score still is not great as it is considered in the gray zone, though it is certainly better than being in the distress zone. Why did the acquisition of First Data cause the Z-Score to fall so much?

First Data had a lot more assets and debt than Fiserv with lower revenue and profits. The company was just not nearly as efficient as their purchaser. It actually had negative retained earnings when it was bought, which really hurt Fiserv’s Z-Score. Here is how First Data’s Altman Z-Score looked before being acquired:

A value just below 0.5 is extremely low, especially when any value below 1.80 is considered distressed.

Fiserv’s Z2-Score sits in that gray area, but it has been increasing since the acquisition. It will take some time to fully integrate First Data’s balance sheet and get the combined company more financially sound.

I think Fiserv is an interesting investment. Their markets have incredible growth prospects and its margin expansion has been excellent. Throw in a below-average price-earnings ratio and it appears to be a great place to build a position.

However, the Altman Z-Score is scary. I am not too concerned, however, given the Z2-Score is in the gray area and has improved over the last few years.

For investors, this is an interesting opportunity. I suggest adding a small position and keeping a very close eye on the Z2-Score. If it continues to improve, then it makes sense to slowly build into a larger position. If it reverses and starts to fall, then the company will need a further look to determine next steps.