Startups in the Ag Marketplaces & Fintech category have taken the top spot for funding in recent months, overtaking the Midstream Tech category in 2023 and bringing in $65 million, or 41% total investment on the continent so far in 2024* according to AgFunder’s recently published Africa Agrifoodtech Investment Report 2024. [Disclosure, AgFunder is the parent company of AgFunderNews.]

A few large deals helped to drive totals in the category which accounted for a smaller amount of deal activity, closing 17 deals – or 36% of the 47 African agrifoodtech deals closed so far this year. Kenya was the best-performing country both in terms of volume, with $40 million (62%), and deal count, with 8 deals (47%).

Digital platforms are playing a crucial role in the development of the agrifoodtech ecosystem in Africa, revolutionizing delivery across industries, empowering networks that connect farmers to retailers and consumers or service providers, often eliminating middlemen and cutting costs while improving efficiency. Across industries, these digital marketplaces have emerged as powerful engines of commerce, offering everything from financial services and credit assessment to personalized data analytics. Farmers can now access real-time weather updates and market prices, while consumers tap into payment systems and social networks—all through unified platform interfaces that have fundamentally transformed how services are delivered and consumed.

*Cut-off date for the AFN Africa Agrifoodtech Investment Report report data was August 16, 2024

Funding in Africa during the last 5 years for categories inside the upstream supply chain:

Ag Marketplaces & Fintech was already the top category in 2023, when it raised 27% of total funding and 17% of deals across all categories; that was despite a 60% decline in funding year-on-year. The dip needs to be put into perspective, however: the year was marked by a 62% drop in total funding across the entire continent.

Over a 10-year period — 2014 and 2023 — the category has closed the highest number of deals (198), accounting for 21% of all deals. For dollar funding, it’s the second most active with 24% of the $2.2 billion total at $544 million. Midstream Technologies has raised the most amount of funding in those 10 years with $579 million (26%).

Kenya was the top country for Ag Marketplaces & Fintech during the decade, with total funding in the category of $335 million (62%) across 74 deals (37%), followed by Nigeria with $102 million (19%) across 42 deals (21%), and Ghana with $29 million (5%) across 20 deals (10%)

Top 5 Ag Marketplaces & Fintech deal in Africa for 2024:

- Pula Advisors: $20 million Series B for the Kenyan company providing digital agricultural insurance for smallholder farmers. Investors included BlueOrchard, IFC, Bill & Melinda Gates Foundation, Hesabu Capital, and angel investors.

- Apollo Agriculture: $10 million debt deal, from Kenya again and a company founded by a gender-diverse team, offering farmers access to agricultural inputs, financing, and advice.

- Complete Farmer: $9 million Series A raised by a Ghana-based startup offering an end-to-end middlemen-bypassing digital sourcing platform for quality farm produce.

- WARC Group: $7.5 million Series B for a social enterprise with operations in Ghana and Sierra Leone, serving over 22,000 farmers with trade-hubs, consulting and other services.

- YoLa Fresh: $7 million seed round for Moroccan startup leveraging technology and data to disrupt traditional distribution models in the agricultural supply chain.

Would you like to get more insights on Africa’s evolving agrifoodtech ecosystem?

Download our Africa Agrifoodtech Investment Report 2024 for free here.

To know about future investments in the continent and remain updated on the global agrifoodtech scenario, sign up for our newsletter.

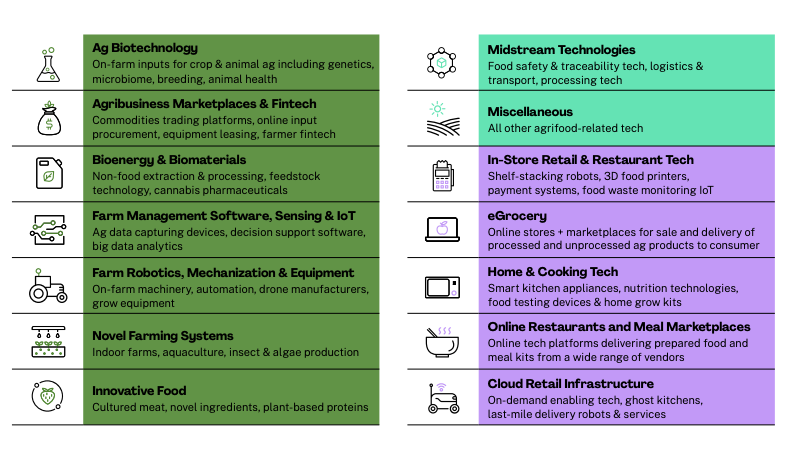

All AgFunder agrifoodtech categories: